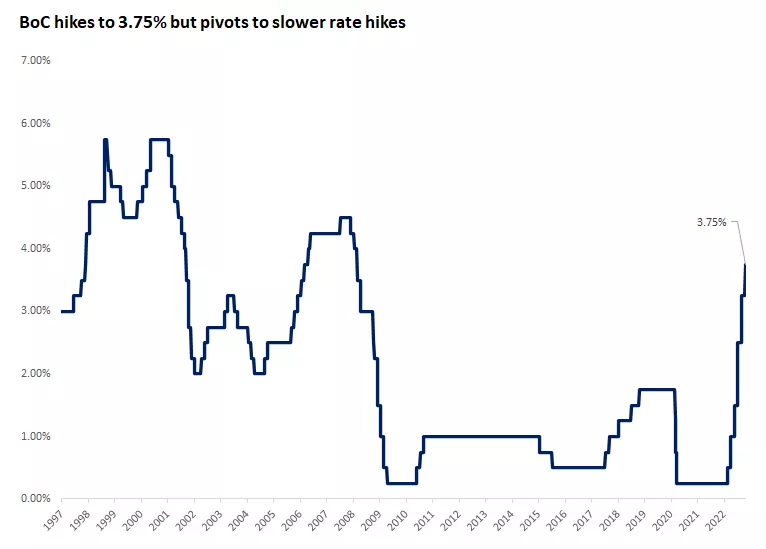

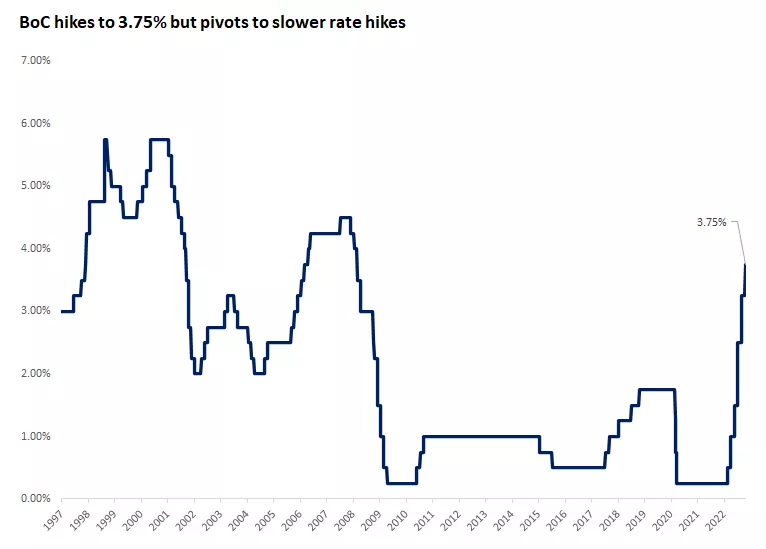

BoC slows its pace of rate hikes – End of tightening cycle now in sight

Bank of Canada (BoC) opts for a 0.5% rate hike – The BoC hiked its policy rate by 0.5% to 3.75% on Wednesday (10/26), surprising markets and most economists that were expecting a 0.75% hike. This move marks a slowdown in the pace of tightening, as it follows a 0.75% hike last month and a 1% hike in July. Because the bank did less than what markets were pricing in, bonds rallied, pushing the 2-year yield below 4% for the first time in more than two weeks, and the 10-yield down to 3.27% from 3.67% (a 12-year high)1. Equities also rose on the news, as it signals that the end of the BoC's tightening cycle is now in sight. The TSX gained 1% for the day and is up about 6% from the mid-October lows1.

Balancing high inflation with slowing growth – While the hotter-than-expected inflation data for September did not provide any evidence that price pressures are easing, policymakers are not ignoring the growing signs that the economy is starting to feel the effects of higher rates. The housing sector has already cooled in a meaningful way, the labour market remains tight but has lost some of its momentum, and spending by households and businesses is softening. Acknowledging the headwinds, the bank revised down its growth forecasts, predicting the economic expansion will stall and possibly even contract in coming months. GDP growth is projected to decelerate to 0.5% in the fourth quarter of this year and on annual basis slow from 3.3% in 2022 to 0.9% in 2023. Policymakers expect inflation to decline to around 3% in late 2023 and return to 2% by the end of 20242.

We think that the BoC projections are realistic. With both inflation and growth rolling over, and the bank having frontloaded its rate hikes, a pivot to slower increases attempts to balance the risks of under- or overtightening. One or possibly two quarter-point hikes would bring the policy rate to 4.00% - 4.25%, which would still mark the fastest and sharpest tightening cycle in decades, but likely lag what the Fed might deliver.

Investment and currency implications - While painful for asset prices, we think that the bulk of the rise in short- and long-term rates is behind us, and an upcoming pause in policy rates will be the catalyst for a rebound in both stocks and bonds. But the coast is not yet clear, as inflation remains too high for comfort, and there is a risk that if price pressures intensify, the BoC might be forced to backpedal (though not our base-case scenario, given the improvement in leading indicators of inflation). Additionally, domestic trends will be heavily influenced by not only the BoC's actions, but also Fed policy.

As the BoC pivots to slower rate hikes likely before the Fed does, the interest-rate differentials between the U.S. and Canada could weigh on the Canadian dollar. The loonie has been one of the best-performing advanced-economy currencies against the U.S. dollar this year, but it has depreciated recently1. Elevated commodity prices will likely continue to provide support for the Canadian dollar, especially against other currencies (excluding the U.S. dollar). However, the potential for a more prolonged downturn in economic activity in Canada because of vulnerabilities in the domestic housing sector suggests that there are downside risks for the loonie. This possibility of softer domestic trends highlights the importance of an appropriate allocation to international equities.

Bottom line –We expect the loonie to stay below its five-year average of around 78 cents U.S., but above the pandemic low of 70 cents1. Also, a potential reversal of this year's strength against the euro could benefit overseas developed-market returns in 2023. While we don’t think that the volatility in stocks and bonds will subside soon, we believe that this year's market downturn presents a compelling opportunity to add quality investments at attractive prices. With equity-market valuations having declined 30%, and with a sizable amount of recession fear priced in, we think the upside outweighs the downside for long-term investors.

This chart shows the recent rise in the Bank of Canada's policy rate to 3.75%.

This chart shows the recent rise in the Bank of Canada's policy rate to 3.75%.

Angelo Kourkafas, CFA

Investment Strategist

Sources: 1. Bloomberg, 2. Monetary Policy Report, October 2022

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.