Monthly portfolio brief

In rocky markets, broaden your lens

What you need to know

- Following a year of relatively smooth sailing and market-leading returns for U.S. stocks, it’s been a rocky start to 2025 as tariff- and policy-related uncertainty consumes headlines.

- A broader lens reveals the merits of diversification, given the leadership rotation toward last year’s laggards.

- Our strategic asset allocation guidance can help ensure your portfolio maintains a broad lens and a focus on your goals amid periodic volatility.

- Within our opportunistic guidance, which we've adjusted recently, we recommend overweighting U.S. stocks, offset by underweighting higher-quality bonds and large-cap stocks in non-U.S. developed markets.

- We've also recently raised the recommendation for the financial services and health care sectors to overweight.

Portfolio tip

Setting well-diversified strategic allocation targets can help keep your portfolio aligned with your financial goals during periodic market volatility.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

The pullback within U.S. stocks deepened amid high policy uncertainty. In 2024, boosted by strong economic momentum and easing monetary policy, the two U.S. stock asset classes generated solid, market-leading returns greater than 20%. Further propelled by heavy exposure to top-performing mega-cap technology stocks, U.S. large-cap stocks soared over 35% higher.

More recently, however, global trade negotiations have heated up. The U.S. announced new tariffs on certain goods and trading partners, and targeted an April 2 timeline for additional action, with varying responses from other countries. Given the uncertain impact of these policies on inflation and economic growth, the pullback within U.S. stock markets intensified. U.S. large-cap stocks hit correction territory in March after having fallen 10% from February’s all-time high.

U.S. small- and mid-cap stocks, which are generally more sensitive to changes in the economic outlook, have fallen the most this year, down nearly 8%. Higher-quality large-cap stocks within the U.S. have dropped by around 4% over the same period, giving back a smaller portion of their 2024 gains.

More broadly, a leadership rotation toward last year's laggards highlights the merits of diversification. After returning over 40% in 2024, U.S. large-cap growth stocks have fallen by about 10% this year following concerns about elevated valuations and rising competition within tech. Value-style stocks, on the other hand, have built on their 2024 gains, up by 2%. Energy, utilities and consumer staples are among the top-performing sectors, helping offset any weakness from U.S. mega-cap tech exposure in well-diversified portfolios.

Overseas developed- and emerging-market stocks were the weakest-performing equity asset classes in 2024 but have outperformed in 2025, despite the potential impact of increased barriers to trade. Up about 7% this year, developed overseas large-cap stocks have led the way, with proposed higher defense and infrastructure spending in Europe supporting the area’s economic growth prospects. Innovations within artificial intelligence have boosted Chinese tech stocks and, more broadly, emerging-market stocks, which are up 3%.

Canadian stocks have also built on their 2024 gains, but less so when compared to other non-U.S. equities. Canadian stock markets have returned around 1% so far this year.

Bonds demonstrate their stability as central banks await more clarity. In March, the Bank of Canada reduced its policy rate by 0.25% while the Fed decided to stay on the sidelines for now. Both central banks mentioned a more cautious approach until trade policies and their impacts on growth and inflation become more certain, but additional cuts remain a possibility.

These dynamics helped keep bonds relatively stable in March. Fixed-income asset classes finished last month relatively unchanged. They’ve produced positive returns over the one-year period, benefiting from their interest income and fairly contained credit spreads. This has provided stability to a well-diversified portfolio.

What do we recommend going forward?

Maintain a broad lens during volatility, with well-diversified, goal-focused strategic allocations. In our view, any singular asset class index and its volatility is too narrow of a focus for a well-diversified portfolio. They each represents only one of the 11 asset classes we recommend incorporating into a portfolio’s mix of investments and some are meaningfully concentrated, such as the S&P 500.

While periodic volatility should be expected, markets aren’t likely to move in unison, as we’ve seen so far this year. Last year’s underperformers — non-U.S. international equity, value-style stocks and higher-quality bonds — have been among this year’s leaders, helping offset weakness in U.S. stock markets. We expect diversification and broader market leadership to continue as a key theme this year, particularly amid shifting global policies.

To incorporate this theme into your portfolio, begin by talking with your financial advisor about your comfort with risk, time horizon and financial goals. This helps determine an appropriate mix of equity and fixed-income investments for your portfolio. From there, consider the framework outlined by our strategic asset allocation guidance to help ensure your portfolio maintains a broad lens and your focus remains on your goals.

Rebalance toward your strategic allocations, favouring U.S. stocks over large-cap stocks in non-U.S. developed markets and higher-quality bonds. Given recent market dynamics and previous years’ returns, it’s likely your portfolio has drifted from your strategic targets if it has been left unchecked. As you review your portfolio’s allocations, rebalance toward your targets to help maintain appropriate diversification as we progress through peak policy uncertainty and this period of volatility.

Using your strategic allocations as a neutral starting point, consider overweighting U.S. stocks across all market capitalizations over Canadian and developed overseas large-cap stocks and higher-quality bonds. Over the next one to three years, we expect the U.S. economy and corporate profits to maintain a position of relative strength, given the support of additional central bank rate cuts and the potential for pro-growth policies and deregulation in the quarters ahead, providing a boost to U.S. stocks.

However, we've recently reduced the magnitude of the recommended overweight to U.S. stocks and recommend reallocating back toward Canadian large-cap stocks and overseas small- and mid-cap stocks, raising the latter to neutral. While we continue to believe non-U.S. developed markets face ongoing trade uncertainties amid stagnant growth, risks and opportunities have become slightly more evenly balanced between developed-market stock asset classes, given their relative valuations.

Additionally, within fixed-income, we believe international bonds have become increasingly attractive when compared to Canadian investment-grade bonds as central banks cut rates and growth moderates, particularly given the higher yields found within U.S. bond markets. Therefore, we've recently lowered Canadian investment-grade bonds to underweight and reallocated toward international bonds. We now recommend underweighting both investment-grade bond asset classes, in favour of U.S. small- and mid-cap stocks.

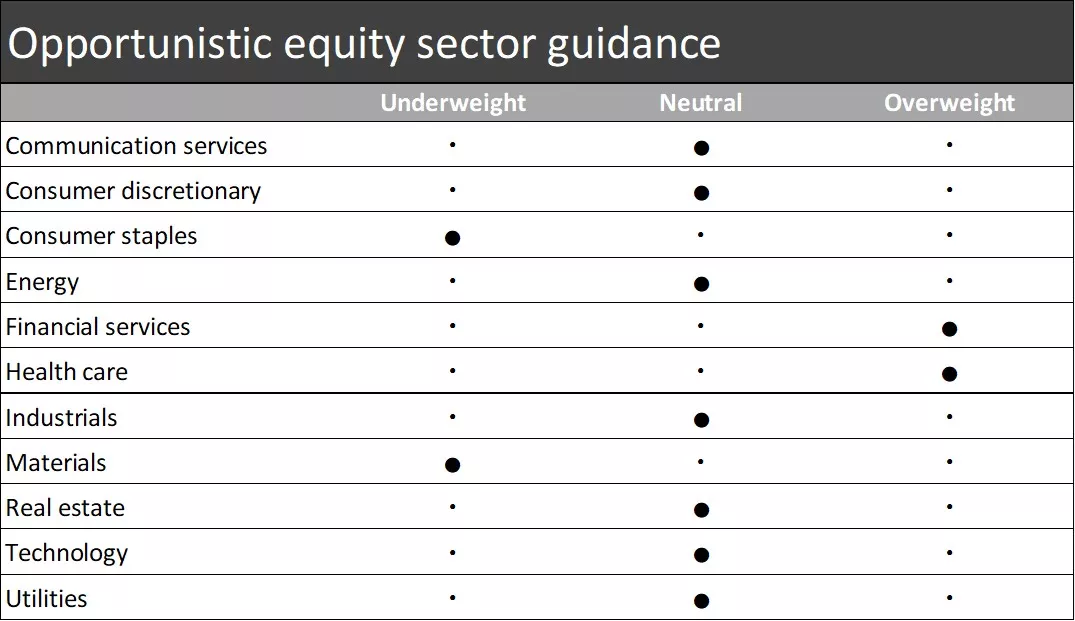

We've recently adjusted our opportunistic sector guidance, raising the financial services and health care sectors to overweight. These adjustments reflect our expectation for broadening market leadership beyond mega-cap tech. Financial services appear less exposed to tariff uncertainty and may benefit from deregulation in the U.S. Higher health care exposure may help protect against economic softness and offers catch-up potential, given valuations within the sector. We offset these overweight recommendations with underweights to the materials sector, given tariff and inflation uncertainty, and consumer staples, due in part to the potential impact of still-elevated inflation on consumers.

We’re here for you

When markets get rocky, it can be difficult to navigate the noise. And while higher policy uncertainty will likely linger, it comes down to how these risks are managed within your portfolio. When planning for your goals, we recommend a broad lens and a diversified approach.

Talk with your financial advisor about how our strategic asset allocation guidance can help you navigate periodic market volatility, and how our opportunistic guidance can help you incorporate timely positioning when rebalancing your portfolio in this environment.

If you don’t have a financial advisor, we invite you to meet with an Edward Jones financial advisor to uncover the merits of diversification and discuss how to direct the lens of your portfolio toward your comfort with risk, time horizon and financial goals.

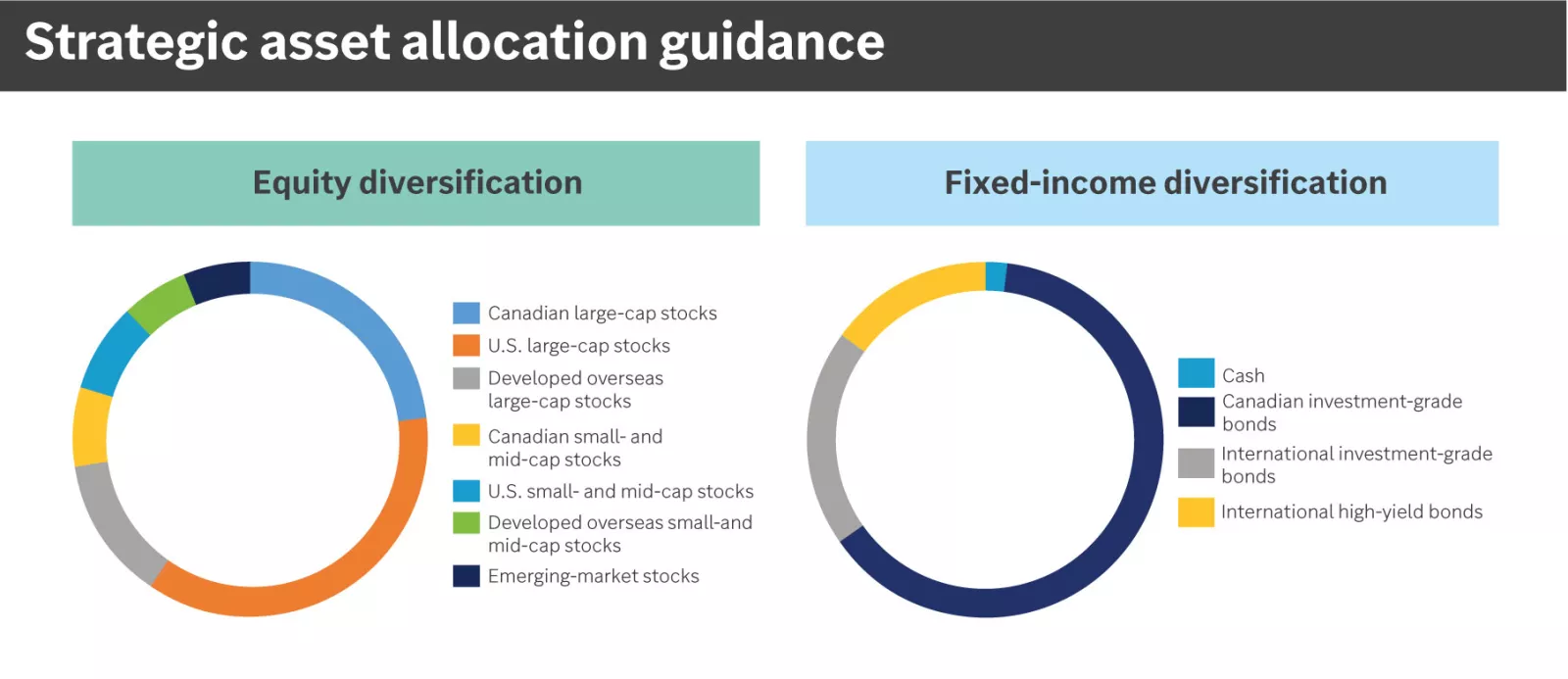

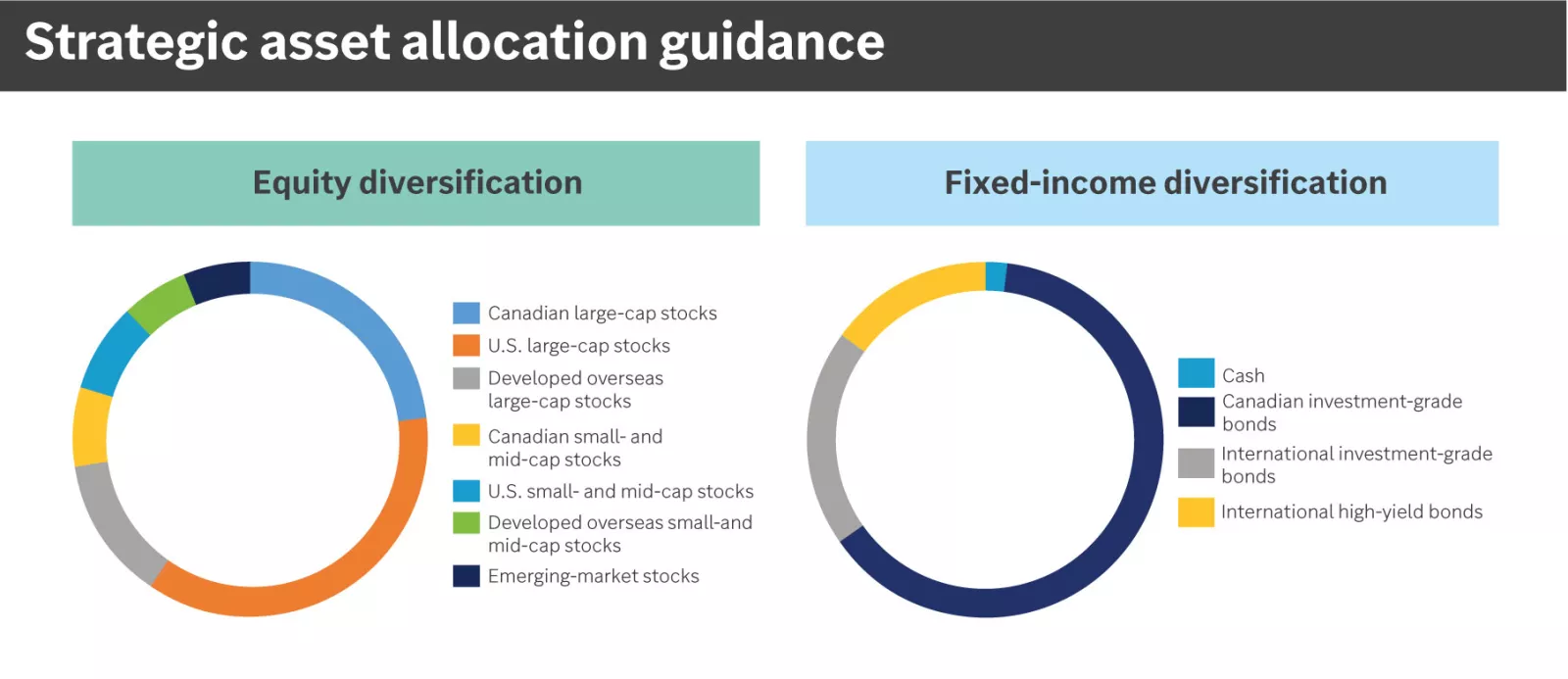

Strategic portfolio guidance

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian small- and mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: Canadian large-cap stocks, U.S. large-cap stocks, developed overseas large-cap stocks, Canadian small- and mid-cap stocks, U.S. small- and mid-cap stocks, developed overseas small- and mid-cap stocks, emerging-market stocks.

Fixed-income diversification: Canadian investment-grade bonds, international bonds, international high-yield bonds, cash.

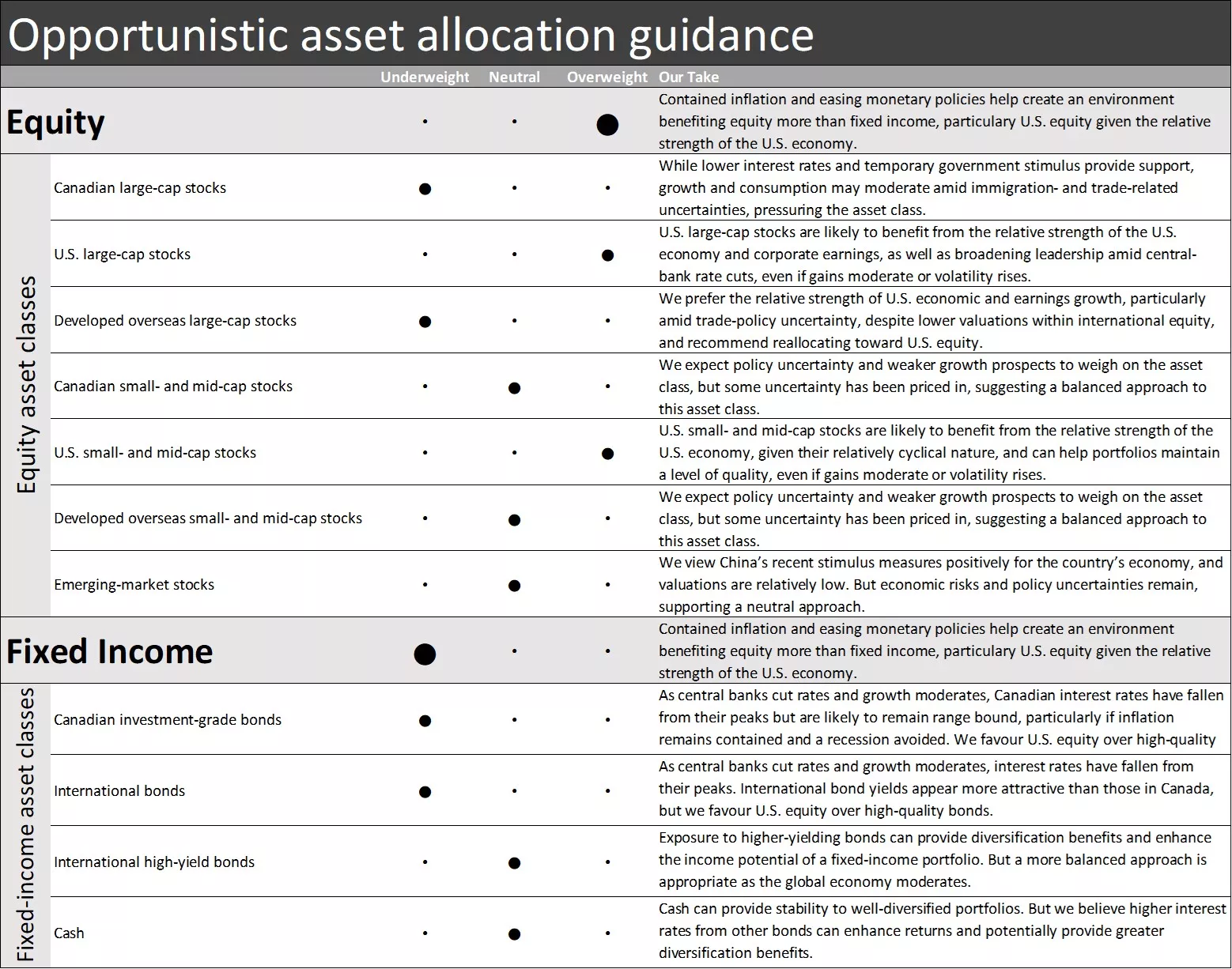

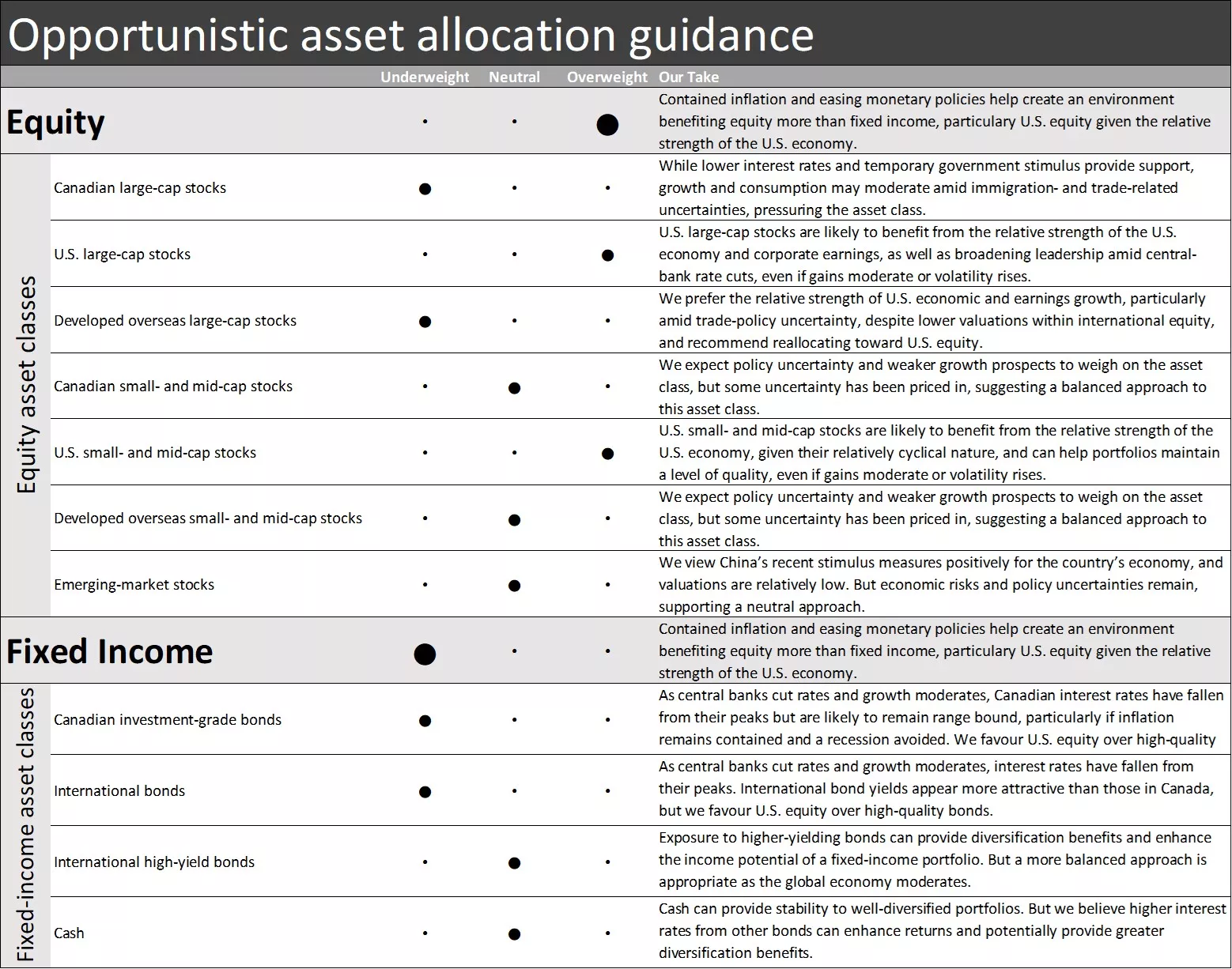

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping to keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity sector and Canadian investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Canadian large-cap stocks and developed overseas large-cap stocks; neutral — Canadian small- and mid-cap stocks, developed overseas small- and mid-cap stocks, and emerging-market stocks; overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income —underweight overall; neutral — International high-yield bonds and cash; underweight – Canadian investment-grade bonds and international bonds.

Our opportunistic asset allocation guidance is as follows:

Equity —overweight overall; underweight — Canadian large-cap stocks and developed overseas large-cap stocks; neutral — Canadian small- and mid-cap stocks, developed overseas small- and mid-cap stocks, and emerging-market stocks; overweight — U.S. large-cap stocks and U.S. small- and mid-cap stocks.

Fixed income —underweight overall; neutral — International high-yield bonds and cash; underweight – Canadian investment-grade bonds and international bonds.

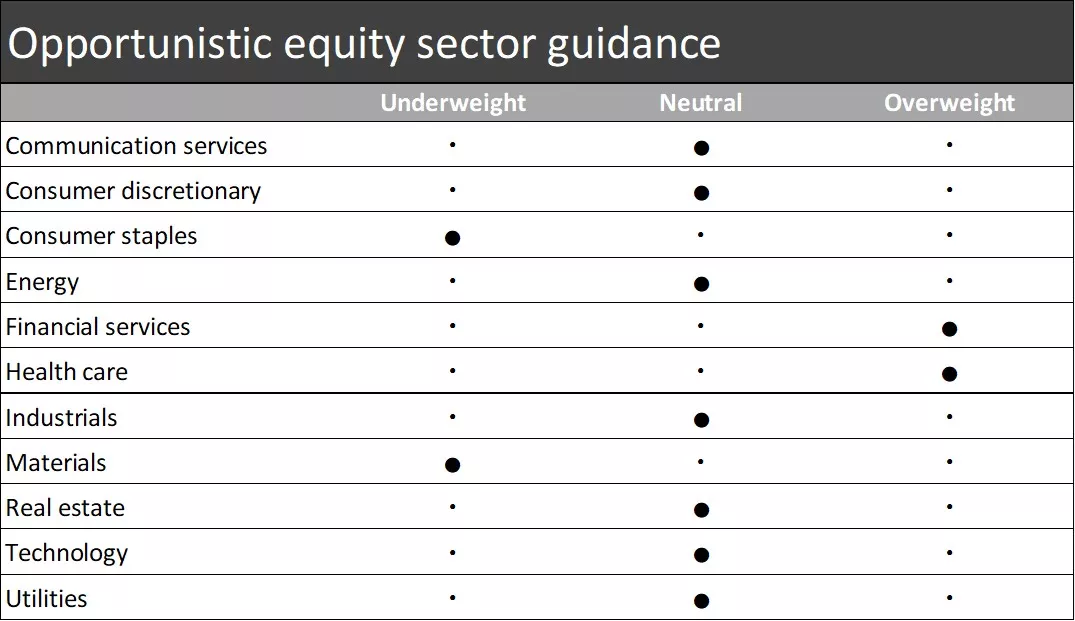

Our opportunistic equity sector guidance follows:

Overweight for financial services and health care

Neutral for communication services, consumer discretionary, energy, industrials, real estate, technology and utilities

Underweight for consumer staples and materials

Our opportunistic equity sector guidance follows:

Overweight for financial services and health care

Neutral for communication services, consumer discretionary, energy, industrials, real estate, technology and utilities

Underweight for consumer staples and materials

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Our opportunistic Canadian investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charter holder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Diversification does not ensure a profit or protect against loss in a declining market.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

The opinions stated are for general information purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.