Weekly market wrap

Fed meeting sets the stage for broadening market gains

Key takeaways:

- Markets reacted positively to the Fed meeting last week, less so on account of the widely expected 25 basis point (0.25%) interest-rate cut, but more around the broader messaging from the central bank on the economic and policy outlook, in our view.

- While it looks like the Fed is preparing to take a pause from its cutting cycle in January, most FOMC members are forecasting lower rates next year, and we see scope for one or two cuts, leaving the fed funds rate in the 3%-3.5% range.

- The Bank of Canada left rates unchanged last week and has most likely concluded its interest-rate-cutting cycle. Governor Macklem pushed back against building expectations that the central bank might hike toward the end of next year, and signaled that the focus remained on supporting the economy through a soft patch.

- The decline in U.S. and Canadian interest rates seen since their peak is weighing on cash returns, especially when we adjust for inflation. Investors could consider moving toward longer-maturity fixed-income investments, or increased allocations to diversified equities as we see a broadening in market leadership.

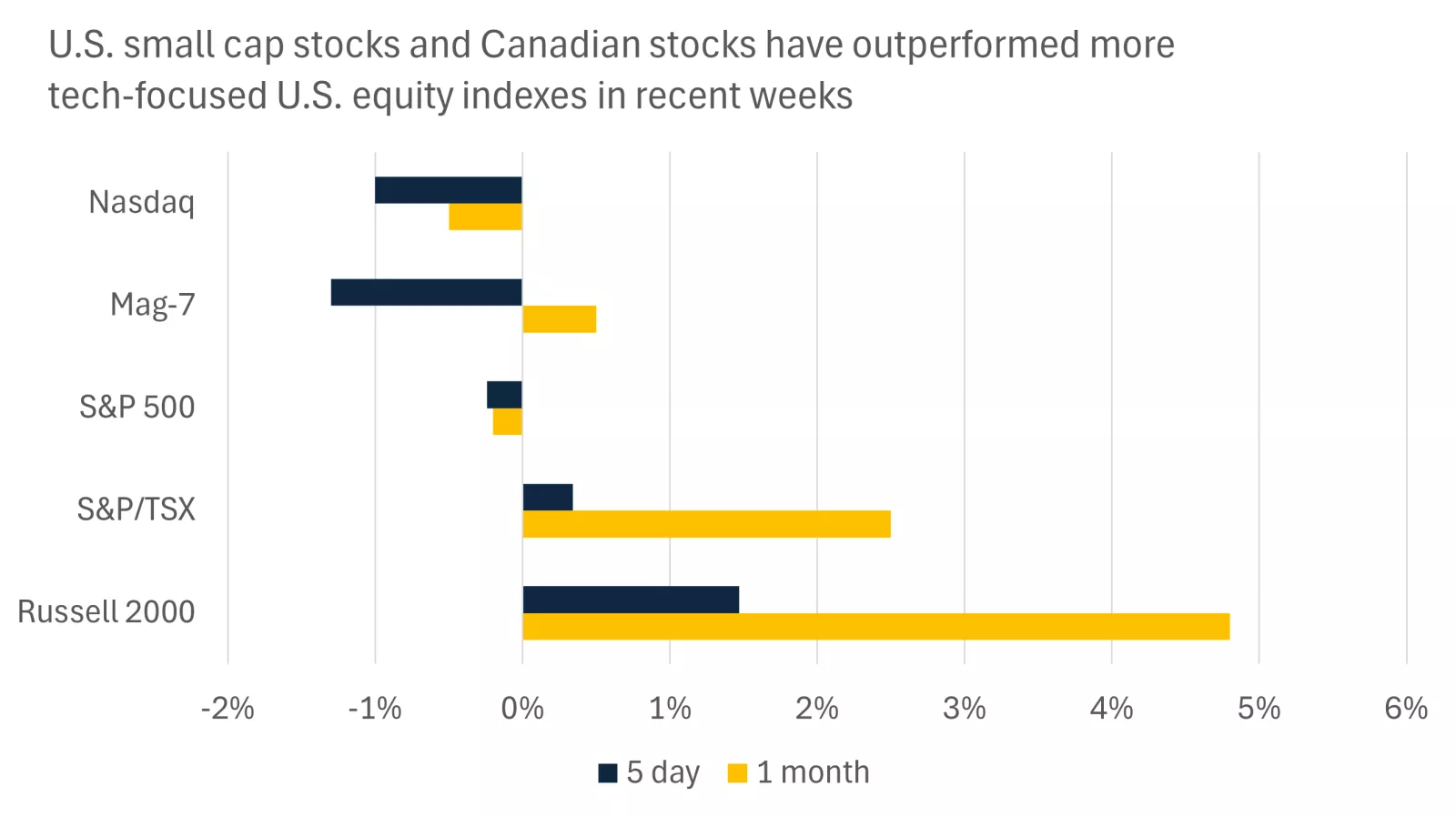

- Small-cap U.S. equities outperformed last week, as investors continue to show signs of rotating into lower-valuation stocks, which might benefit from Fed easing, with U.S. tech names appearing to take a breather after some disappointments in high-profile earnings reports.

Central banks deliver for markets

Last week saw the final Fed and Bank of Canada meetings of 2025, both of which were well received by investors*.

The Bank of Canada held interest rates steady and continued to signal that at 2.25% these remain broadly appropriate at present*. Importantly, the central bank provided some pushback on building expectations that it might hike interest rates in 2026 following more upbeat labour market and GDP data of late*.

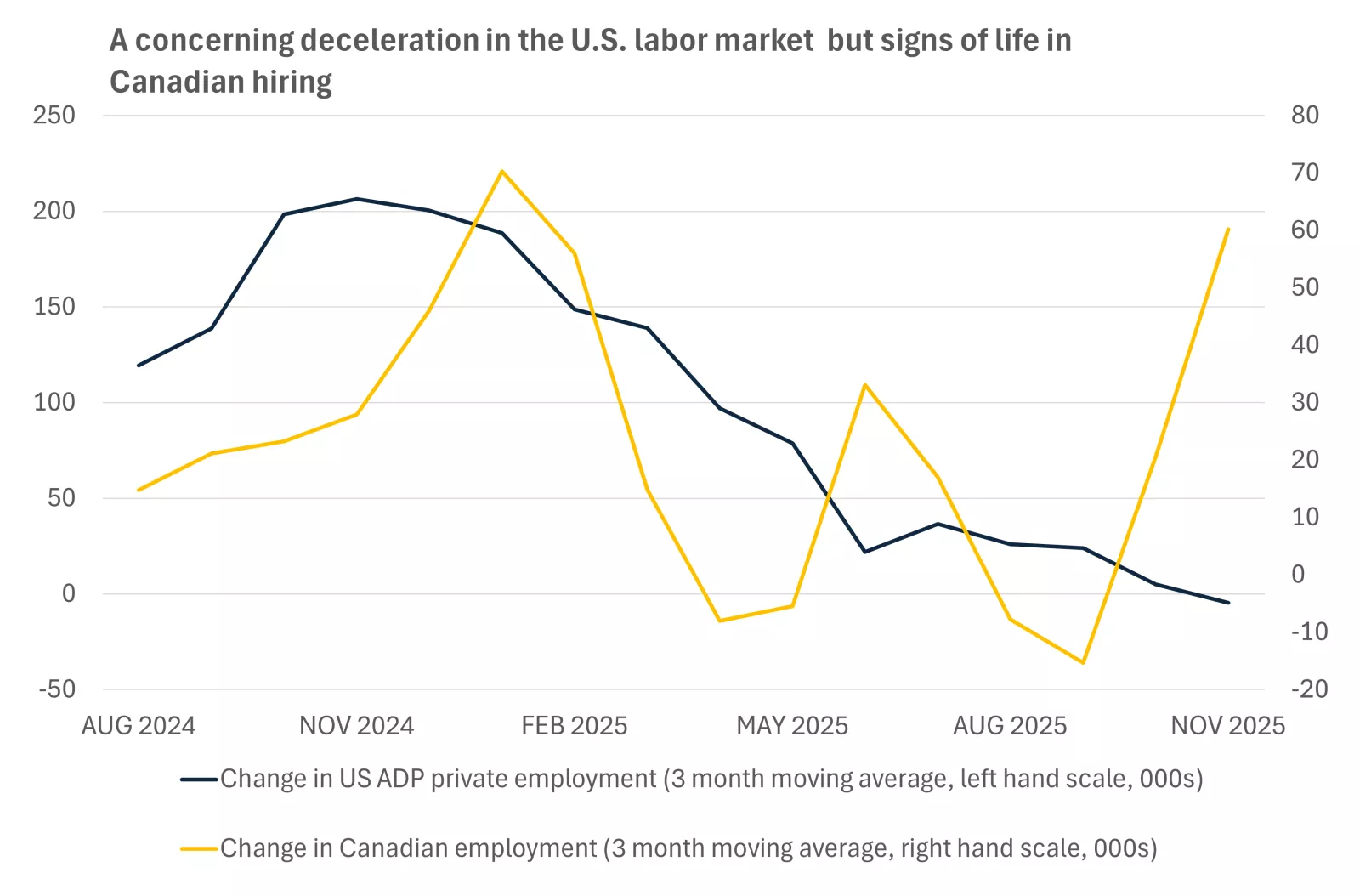

This chart shows the 3-month moving averages of U.S. ADP private employment and Canadian employment.

This chart shows the 3-month moving averages of U.S. ADP private employment and Canadian employment.

Governor Macklem acknowledged these improvements and indicated that the economy had been more resilient than feared*. However, he played down the significance of these data readings, arguing that the outlook remains challenging against the backdrop of trade-policy uncertainty*.

Moreover, with spare capacity still evident in the labour market, it would be reasonable to keep interest rates at current supportive levels, according to Macklem*. In fact, the Bank of Canada Governor signaled a willingness to provide more support to the economy if required through its 2026 adjustment*.

These 'dovish' signals helped temper market expectations for tightening in 2026, although investors are still pricing in one 25 basis point (0.25%) hike by the end of the year*. We expect interest rates to remain on hold through this period, especially given our view that inflation in Canada will moderate next year.

South of the border, the Fed cut interest rates, as widely expected, but more important for markets, in our view, were the signals around the policy outlook and news that the central bank will start buying Treasury Bills to support liquidity in short-term money markets.

The decision to cut was, as anticipated, contested. Two FOMC members, Schmid and Goolsbee, voted against the move, expressing concerns over elevated inflation*. Moreover, individual members' interest-rate forecasts show that four other policymakers were inclined to leave rates unchanged in December, with these either not scheduled to vote at this meeting, or convinced to support a cut*.

Despite objections, the majority supported a third consecutive cut on account of concerns over the labour market*. Hiring has clearly slowed in 2025, and, amid disruptions to high-quality data after the government shutdown, another rate cut was seen as a prudent step to protect against risks of a deeper deterioration*.

Given splits on the FOMC and elevated inflation, the market had been expecting last week's move to be accompanied by 'hawkish' messages that might indicate less chance of future interest-rate cuts*.

There were nods in this direction. Subtle changes to the FOMC press statement suggest the central bank is preparing to pause its easing cycle, similar to the message in December 2024 before an extended pause*. Moreover, Chair Powell indicated that following 175 basis points (1.75%) of rate cuts since September 2024, it may be appropriate to wait and see how the economy evolves before moving again*.

However, while these comments seemingly set up a pause in near-term policy easing, they were perhaps not as hawkish as feared.

First, Chair Powell struck a cautious tone on the job market, calling this extremely weak, and warning that negative nonfarm-payroll readings are possible*. This caution suggests the FOMC will likely remain highly sensitive to further disappointments in the labour market.

Second, FOMC members lowered their inflation forecasts this year and next, despite becoming more optimistic on growth*. This indicates greater confidence that upward pressures on inflation due to tariffs will likely be temporary, and that the economy can rebound in 2026 without maintaining inflationary pressures.

Finally, 12 out of 17 members continue to expect lower interest rates, with the median forecast pointing to one cut in 2026 and one more in 2027*. Chair Powell was tight-lipped when asked about the Fed's next step but did indicate that it was unlikely this would be a hike, maintaining a bias for further rate easing*.

Markets liked what they heard

Equity markets responded well to the Bank of Canada and Fed messages last week*. Canadian equities hit new record highs, while in the U.S. we saw the interest-rate-sensitive small-cap sector again outperform big U.S. tech names over the week*. This rotation was amplified by a stumble across the Magnificent 7, after Oracle and Broadcom results that raised concerns over AI investment and short-term revenues*.

This chart shows the percentage change in major U.S. and Canadian equity indexes over the past five days and month, with the small-cap Russell 2000 index and Canadian S&P/TSX index outperforming more tech-focused U.S. benchmarks. Past performance doesn't guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the percentage change in major U.S. and Canadian equity indexes over the past five days and month, with the small-cap Russell 2000 index and Canadian S&P/TSX index outperforming more tech-focused U.S. benchmarks. Past performance doesn't guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

U.S. market moves might have also been amplified by news that the Fed will buy $40 billion in Treasury bills each month until April to support liquidity in money markets*. This reflects a technical adjustment to how the Fed sets interest rates, in our view, as opposed to any shift in policy, such as Quantitative Easing, whereby the central bank buys longer-maturity securities to lower longer-term interest rates and stimulate the economy. However, some investors see a less clear distinction between these policies, interpreting purchases as a form of policy easing*.

The beginning of the end of Fed easing

Looking ahead to 2026, while we think we are approaching the end of the Fed easing cycle, there still looks to be room for one or two cuts, leaving interest rates between 3%-3.5%.

A weak labour market, particularly around the start of 2026, should make a case for lower rates, in our view. We get the delayed November nonfarm-payrolls data on Tuesday, with forecasters expecting a modest 50,000 gain in jobs over the month*. Further sluggish increases as we move into 2026 would argue for additional easing, in our view, especially given the sensitivity at the Fed to these downside risks. We will also be watching consumer spending closely for signs that a cooling labour market is starting to weigh on spending. Tuesday's October retail-sales data will be an important waymark on this front.

However, we would need to see a sharp deterioration in the economic outlook to justify more aggressive easing. With inflation still running well above its 2% target*, and expected to do so through 2026, we think the Fed needs to be mindful that too much policy loosening could exacerbate price pressures.

Implications for investors

There are a few important takeaways from last week's central bank meetings.

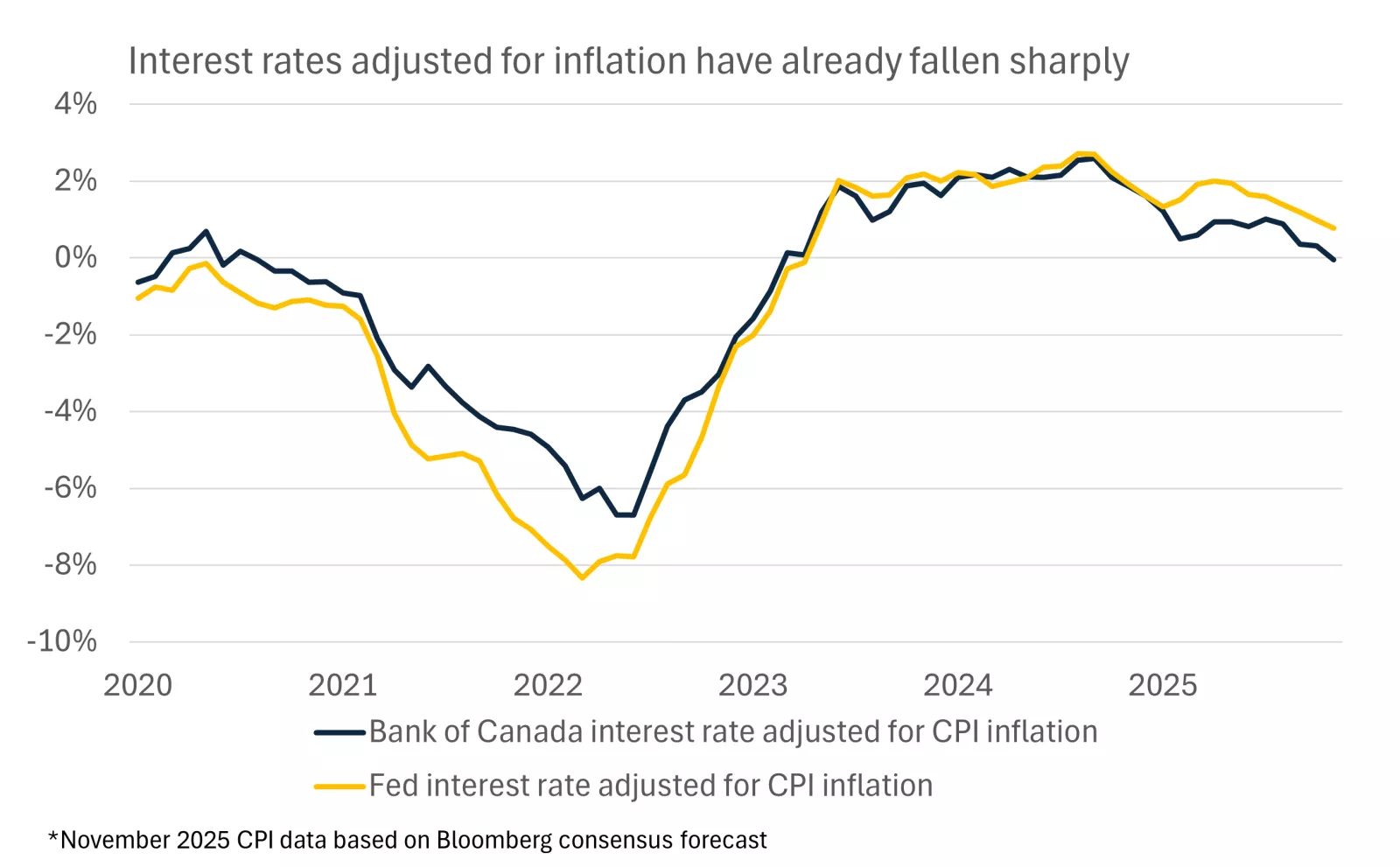

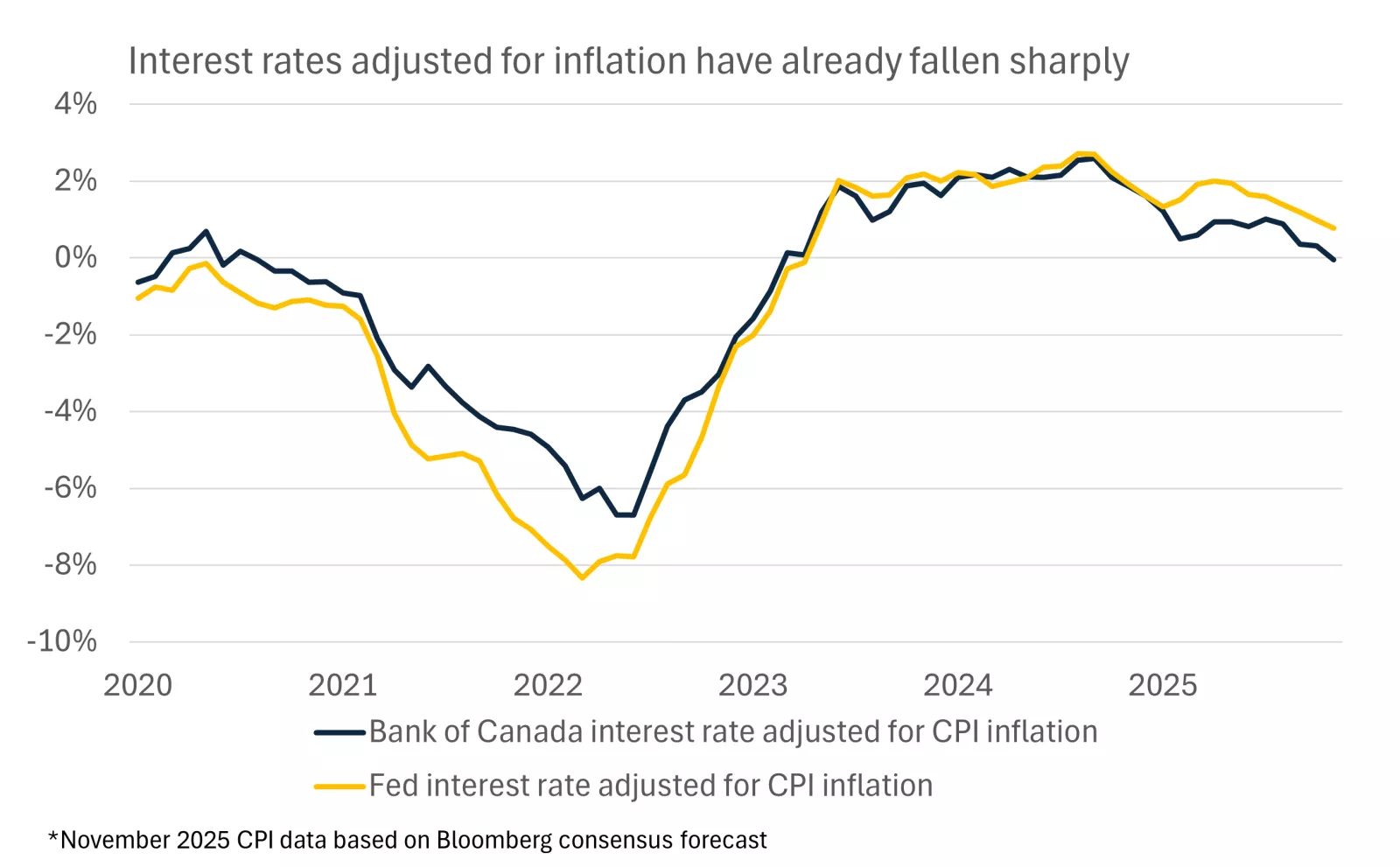

First, returns on cash, or very short-term investments like money-market funds, CDs and Treasury bills, have already fallen sharply in Canda and the U.S.*, and we believe yields will likely continue to move lower in the year ahead in the latter market if we are right that the Fed will cut rates further. We think this squeeze is especially pressing in economies where inflation remains somewhat elevated, implying a real return on cash-like investments close to zero.

This chart shows the inflation-adjusted Bank of Canada policy rate and fed funds rate.

This chart shows the inflation-adjusted Bank of Canada policy rate and fed funds rate.

Investors might consider moving up the curve to take advantage of somewhat higher returns.

In Canada we have seen the 10-year Government bond yield jump in recent weeks as investors have considered the possibility of future rate cuts*. At a touch above 3.4%, this appears to be providing some more uplift over cash. In the U.S, the 10-year U.S. Treasury yield has also increased from its 2025 low of 4% to around 4.2% at present*.

However, we don't see significant scope for government bonds to rally much from here. Instead, the 10-year Treasury yield should remain rangebound, between 4%-4.5%, in our view, while we see the Canadian equivalent stuck between 3%-3.5%. With central banks near or at the end of easing cycles, inflation still firm, and in the U.S. some lingering concerns over the federal debt outlook, there looks to be few triggers for yields to move materially lower.

For those investors with more risk tolerance and longer time horizons, we suggest increasing allocations to equities, as opposed to bonds. At present we believe targeting diversified portfolios of domestic and international stocks is most appropriate.

In the U.S., we like large-cap equities to help maintain exposure to the ongoing AI investment cycle. However, the recent rotation away from mega-cap tech companies into other sectors and cap sizes highlights the benefits of diversification and potential for a broadening market leadership, in our view. We think small and mid-cap stocks offer a way to benefit from the steady growth and lower interest rates we anticipate next year.

Similarly, we think portfolio resilience can be enhanced by geographical diversification too, with international equities and emerging-market equities both attractive at present given solid earnings prospects and lower valuations compared with U.S. large-cap stocks *.

Speak to your financial advisor to consider your portfolio allocations as we move into the new year.

James McCann

Investment Strategy

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| TSX | 31,527 | 0.7% | 27.5% |

| S&P 500 Index | 6,827 | -0.6% | 16.1% |

| MSCI EAFE * | 2,810.47 | 3.2% | 26.3% |

| Canada Investment Grade Bonds | 0.1% | 1.9% | |

| 10-yr GoC Yield | 3.42% | 0.0% | 0.2% |

| Oil ($/bbl) | $57.49 | -4.3% | -19.8% |

| Canadian/USD Exchange | $0.73 | 0.5% | 4.4% |

Source: *Bloomberg

Source: FactSet, 12/12/2025. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. *Morningstar Direct, 12/14/2025.

The week ahead

Important economic data and events for the week ahead include CPI inflation, retail sales and housing starts and, in the U.S., labour, inflation, PMI, housing and retail sales.

James McCann

Senior Economist

Thought Leader In:

- Economic issues impacting the lives of everyday Americans.

- The effects of government spending, taxes and regulation changes on our clients.

- Building diversified portfolios to help investors reach their long-term financial goals.

“The economic, political and policy landscape is shifting dramatically, making it ever more challenging for our clients to navigate their personal finances. In this environment, it's our deep, research-driven insights that can help clients stay on track to reach their financial goals."

James McCann

Senior Economist

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.