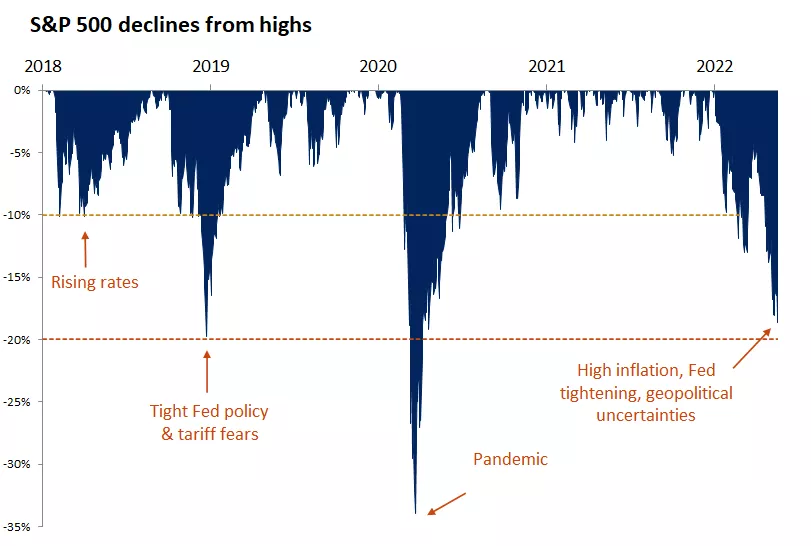

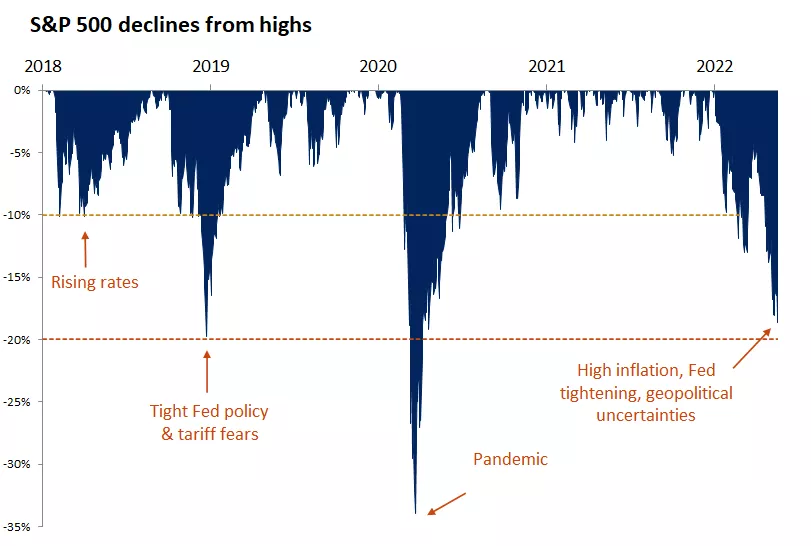

Stocks edge near bear market: Mapping the path for a durable rebound

Inflation and Fed-policy uncertainty keep markets under pressure – The S&P 500 dropped to a 14-month low on Thursday (5/19/22) and is now down 18.7% from the record high it set early in the year1. With stocks just shy of the 20% threshold that defines a bear market, concerns are mounting over potential economic and earnings-growth disappointments. At the core of this year's pullback are the heightened inflation pressures that are forcing the Federal Reserve (Fed) to hike rates at the fastest pace in two decades. Against a backdrop of ongoing price shocks, slowing growth and tightening monetary policy, valuations have adjusted lower, with the speculative areas of the market and high-valuation investments getting hit the worst. Amplifying the challenges to balanced portfolios, bonds have also been under pressure amid higher yields this year. However, since the beginning of May, yields have followed equity markets lower, and as a result bonds have helped stabilize portfolios.

Four conditions for a durable rebound – We don't think that a recession is inevitable, but because credible threats to the expansion exist, volatility is unlikely to end soon. Here is a list of fundamental and market conditions that are likely required to gain confidence that equity markets can find their footing and mount a more durable rebound.

Evidence that inflation is past its peak and on a path of moderation: Even with the annual pace of inflation ticking down in April from March, the price increases are too hot, forcing the Fed to hike at a fast pace. Policymakers aim to raise borrowing costs enough to slow growth and tame inflation, but not so much as to push the economy into recession. The market will likely want to see several months of moderating inflation before it is convinced that there is no need for monetary policy to become overly restrictive. If the market sees such a stretch of moderating inflation, it can be a key catalyst for bond yields to stabilize and equities to rally.

Economic and earnings resiliency: With the S&P 500 on the edge of a bear market, the current decline implies a high probability of a recession. If economic data holds up in the coming months, consistent with a slowing but still growing economy, attention will likely shift back to focusing on opportunities instead of risks.

Valuation stability as excesses unwind: As the Fed has signaled an aggressive tightening cycle ahead, and as the 10-year yield topped 3%, valuations have now returned to their 30-year average1. Many high-growth tech companies have given back all of their pandemic outperformance, and the price-to-earnings ratio of the S&P 500 has declined about 30% from last year's peak. While valuations could decline further if the economy slips into recession, that is not our base-case scenario, and at this point we believe that a lot of speculation has already come out of the market.

Widespread pessimism that resets expectations: Investor sentiment tends to be a good contrarian indicator, and as such, complacency tends to signal market peaks, while panic and pessimism are consistent with market bottoms. Currently, investors appear overly pessimistic, as the AAII survey shows that bearish sentiment has surged to its highest since the Global Financial Crisis.

The underpinnings of the economy are reasonably sound – We believe that there is enough underlying strength that the economy can withstand the upcoming Fed tightening that is currently priced in by the markets. Incomes are supported by a tight labor market, household savings remain elevated, and debt is low, all pointing to resilient consumer demand despite the surging inflation. On the business side, inventories will need to be rebuilt as supply chains normalize, and the recent strong growth in industrial production supports a positive outlook for capital investment. Also, credit markets are not signaling the stress that would be consistent with a more sustained economic downturn. Therefore, in the absence of any major economic imbalances, there is a solid foundation for an eventual rebound, in our view. But it might not be as swift as in recent years because of the lingering uncertainties.

How to navigate pullbacks successfully

Consider rebalancing strategies and dollar-cost averaging (systematic investing) to take advantage of the wide price swings and the likely gradual process of finding a durable bottom.

A focus on balance and diversification can potentially better help weather short-term dips, which over the long term are nearly impossible to avoid.

Elevated volatility has not historically lasted for a very long time and has been followed by strong returns, especially when a high degree of pessimism is already in the market. Periods of indiscriminate selling in the market can help to create long-term opportunities to add quality equity and fixed-income investments at potentially attractive prices.

Source: 1. Bloomberg

Stocks flirt with a bear market as inflation and Fed tightening concerns take over

Source: FactSet, Edward Jones calculations. Past performance does not guarantee future results. Market indexes are unmanaged and cannot be invested into directly.

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.