Changing of the guard: What the Prime Minister’s planned resignation and a prorogued parliament means for Canadians

On January 6, Prime Minister Justin Trudeau announced that he will resign as Prime Minister and leader of the Liberal party once a suitable replacement has been chosen to succeed him. With that announcement, he also prorogued parliament until March 24.

This move has been widely speculated since mid-December when the Minister of Finance, Chrystia Freeland resigned. It comes just weeks ahead of President-elect Donald Trump’s inauguration, and amongst threats of him using economic "warfare" against Canada and other G7 nations. It also comes at a time when previously announced legislation has not yet been passed into law, leaving many Canadians wondering how they may be impacted.

2025 is an election year

A federal election in Canada must take place by October 20, 2025, however it could be called earlier if the Liberal party loses a non-confidence vote. The Liberal government has survived three previous non-confidence votes brought forth by the Conservative party, and it is expected that they will once again call for one once Parliament returns on March 24.

Until then, the Liberal party will seek new leadership amid polling numbers that show the Conservatives with a substantial lead. We expect this situation to continue over the next few months and to dominate many news headlines.

Don't play politics with your portfolio

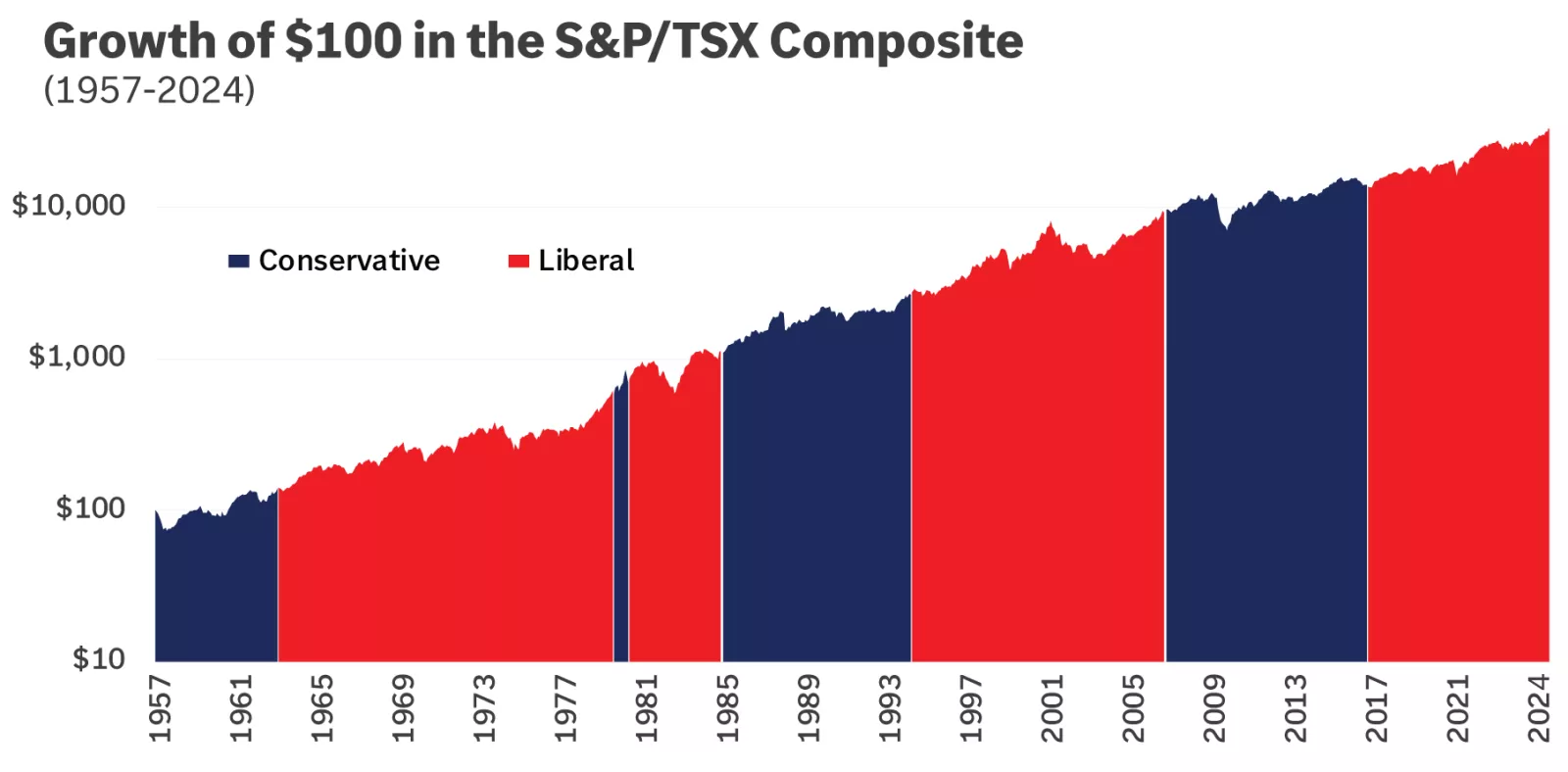

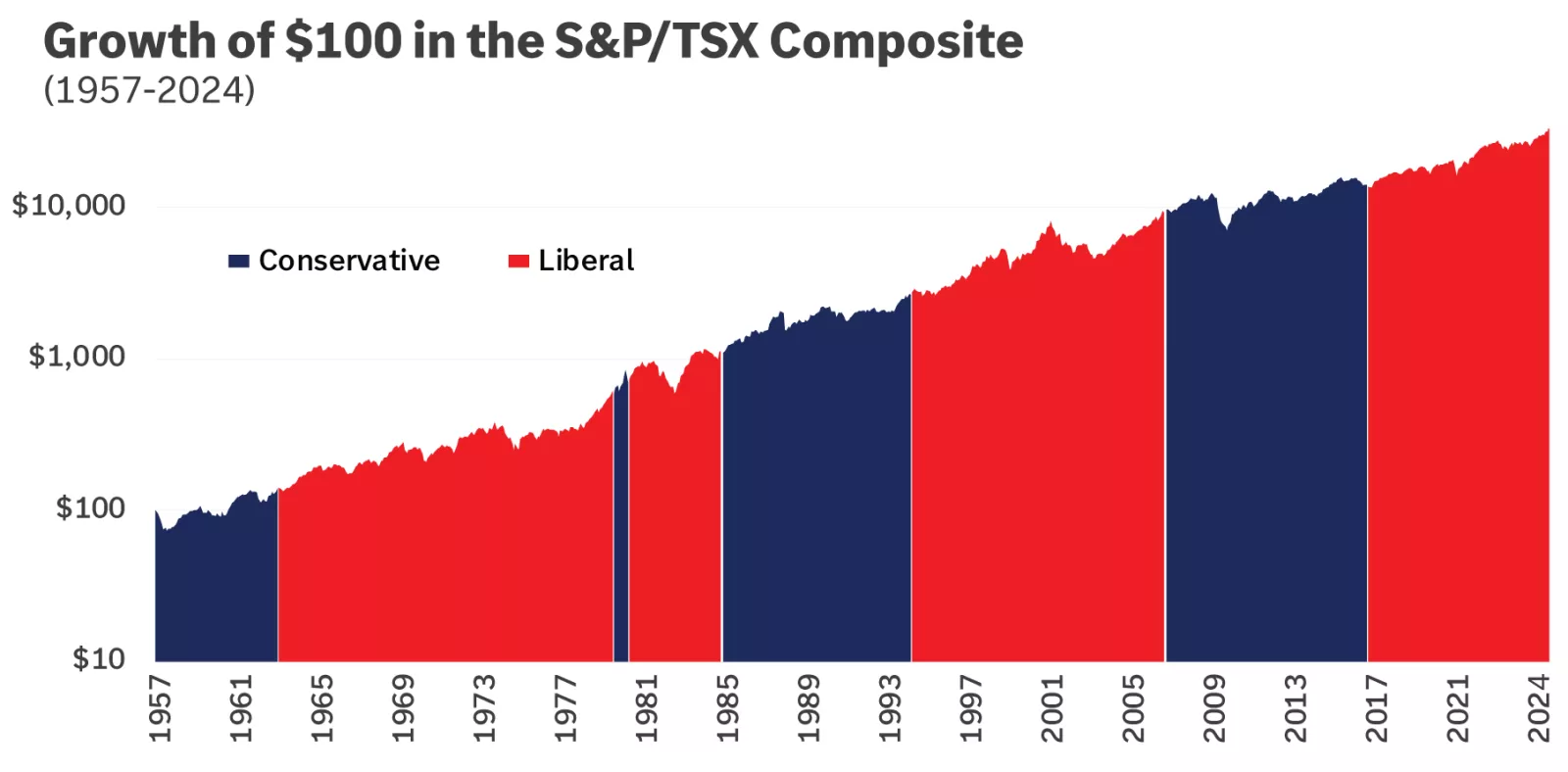

While there is considerable political uncertainty in the news today, we remind investors not to play politics with their portfolio. History has shown that market forces are more powerful than politics and that the mix of investments you own has a greater impact on your ability to meet your long-term goals than any short-term election results or political uncertainty. You can see from the following chart that regardless of which government is in place, the Canadian market tends to perform well.

This chart shows the growth of $100 invested in the S&P/TSX Composite from 1957 to 2024.

This chart shows the growth of $100 invested in the S&P/TSX Composite from 1957 to 2024.

Previously announced legislation

The 2024 Federal Budget outlined significant changes to Canadian tax policy however, because these have not yet received parliamentary approval, and have not become law, Canadians are left wondering if they will be enforced.

Two of the most impactful proposals include:

- An increase to the capital gains inclusion rate and;

- An extension to the 2024 charitable donation deadline

Proposed increase to capital gains inclusion rate

When the Prime Minister announced the prorogation of parliament it effectively terminated any outstanding bills that have not yet become law. This included the proposed increase to the capital gains inclusion rate which means that the proposal will need to be reintroduced and approved after Parliament returns on March 24 for it to become law. There is a chance that this may happen, however it would be speculation to say one way or another.

What we do know is that the Canada Revenue Agency (CRA) has made their position clear: They will enforce the proposed capital gains inclusion rate change.

"Although these proposed changes are subject to parliamentary approval, consistent with standard practice, the CRA is administering the changes to the capital gains inclusion rate effective June 25, 2024, based on the proposals included in the Notice of Ways and Means Motion tabled September 23, 2024.” – CRA Newsroom, January 8, 2025

The legislation proposed an increase to the inclusion rate on realized capital gains from 50% to 66.67% on all gains realized by a corporation and most trusts and for gains realized by individuals over $250,000 in a calendar year. For 2024, this would impact all transactions that took place after June 24, 2024. Gains on qualifying principal residences remain exempt.

Clients who may be impacted by the proposals should contact their tax or legal professional for guidance and advice as it pertains to their unique tax and financial situation.

Extending the charitable donation deadline

On December 30, 2024, the department of Finance announced that due to the Canada Post labour disruption, an extension to the deadline for making charitable donations for the 2024 tax year would be provided to Canadians. The extension deadline is until February 28, 2025. This change was to be introduced to parliament after the winter holidays, however, it did not happen prior to Trudeaus announcement.

With the government being prorogued until after the new deadline of February 28 and with the 2024 tax filing date of April 30th fast approaching, it is unclear if this proposed legislation will be introduced and passed once parliament resumes on March 24.

Seek the advice of a tax professional

While we have highlighted two previously announced legislative changes that lack approval, there are many others that are still awaiting clarification. If you think your situation may be impacted by these or other proposed changes, we recommend you speak with your tax or legal professional for additional guidance. Edward Jones and its employees do not provide tax or legal advice.

Important information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.