Growth concerns overshadow fundamentals – for now

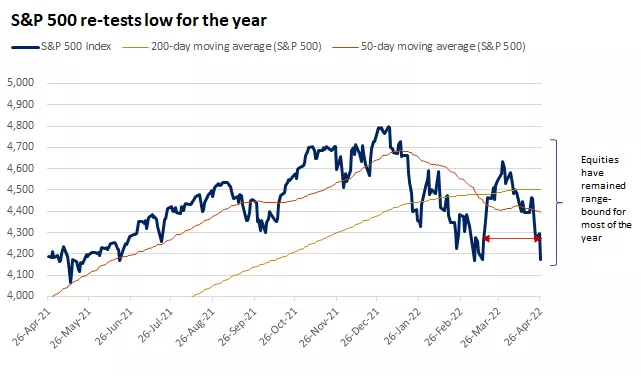

Equity markets retest lows as growth concerns rise: U.S. markets were down sharply earlier this week, as a risk-off sentiment gripped most major indexes, adding to losses for the year. The S&P 500 is now down over 11% for the year. From a technical perspective, the S&P 500 is well below its 200-day moving average (often an indicator of downward momentum) and briefly retested the lows from mid-March.

Source: FactSet, the S&P 500 is an unmanaged index and cannot be invested in directly. Past performance does not guarantee future results.

This chart shows that equities have been mostly lower this year with periods of volatility as multiple compression takes place.

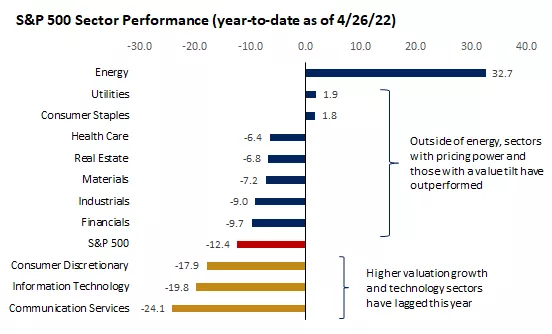

Meanwhile, the technology-heavy Nasdaq notched a new low for the year, now down about 20%, hitting bear-market territory. The higher-valuation growth and technology parts of the market have been hit particularly hard, as the Federal Reserve begins its tightening cycle and as yields have risen.

This week, however, we saw a decline in yields, as investor concerns around the growth outlook pushed rates lower. The 10-year yield fell to under 2.75%, after reaching nearly 3.0% just last week. Investors did find some comfort in the bond market this week, with both investment-grade and high-yield returns higher.

What caused the weakness in equity markets? While there was no single catalyst for this week's volatility, there has been incrementally negative news flow globally, in addition to the existing worries around inflation and aggressive Fed tightening. The geopolitical crisis in Ukraine seems to be ongoing, with little sign of de-escalation, exacerbated by Russia's recent talk of nuclear weapons. In China, we see more lockdowns in major cities like Shanghai, as the Chinese government navigates its zero-COVID-19 policy. These global issues can also put upward pressure on commodity prices and exacerbate already strained supply chains.

Earnings have held up but have not provided support: Meanwhile, first-quarter earnings season is in full swing, and despite some high-profile misses, the overall results have been sound. Nearly one-third of S&P 500 companies having reported, with about 80% of these reporting an upside surprise on earnings. Growth is on track for about 6.5% this quarter (above earlier expectations of 4.7%). Large-cap tech is in focus this week, with tech giants like Microsoft and Google reporting already with mixed results (although both indicated that consumer demand remained resilient, and that their corporate cloud businesses were exceeding expectations).

While investors were hopeful that reasonably solid earnings would provide support to the market, thus far we have not seen much support from earnings season, with markets more focused on the Fed and rising interest rates, and the valuation compression that typically comes with these.

Near-term, the Fed meeting may be a catalyst: Overall, while risks are rising, we continue to see signs that the U.S. economy and consumer have been relatively resilient. Earnings growth is on track for mid- to high-single digits this year, the labor market remains tight, and consumption has yet to show meaningful cracks. The next inflation reading on May 11 could also show early signs of moving gradually lower, at least on a headline basis.

Nonetheless, markets have been grappling with fears around economic growth, and now may look toward next Wednesday's Federal Reserve meeting for direction. In our view, the Fed will deliver a 0.50% rate hike next week, as well as announce a bond-tapering program at a pace of $95 billion per month – both of which have been endorsed by various Fed officials, including Fed Chair Jerome Powell. If the Fed meeting doesn't offer any major negative surprises, it is possible markets will find some relief in the near term.

Range-bound for now, but look for opportunities: More broadly, we believe markets may trade within a range until we see inflationary pressures come down more meaningfully, perhaps in the back half of the year. While economic growth is expected to slow, our base case remains that the U.S. will not enter a recession this year, supported by a healthy consumer and positive earnings growth. If inflation can moderate – driven by better supply-and-demand dynamics – this may take some pressure off the Fed-hiking cycle, which would also support market sentiment.

In our view, investors can use the recent market volatility to rebalance and diversify portfolios as needed, and ultimately add investments at more attractive prices. We favor quality and defensive parts of the market here, including large-cap equities with a value tilt and sectors with pricing power, like consumer staples and health care. While markets can and often do overshoot to the upside and downside, over time fundamentals tend to guide the direction of travel, and, in our view, the fundamental backdrop remains solid.

Source: FactSet, the S&P 500 is an unmanaged index and cannot be invested in directly. Past performance does not guarantee future results.

This chart shows that Energy, Utilities, and Consumer Staples are the only sectors in the green this year while other sectors have negative returns.

Important Information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.