U.S. election results are in - implications for long-term investors

The results of the U.S. presidential election have been confirmed, faster than many had expected, and former President Donald Trump has emerged victorious. He will be sworn in as the 47th president of the United States on Inauguration Day, Jan. 20, 2025.

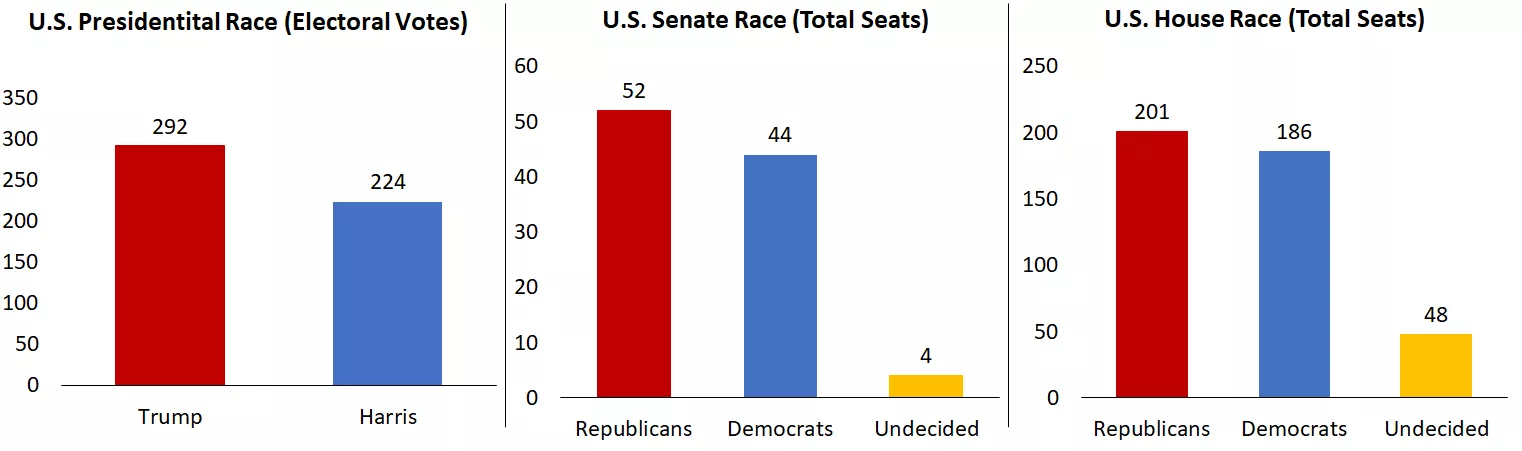

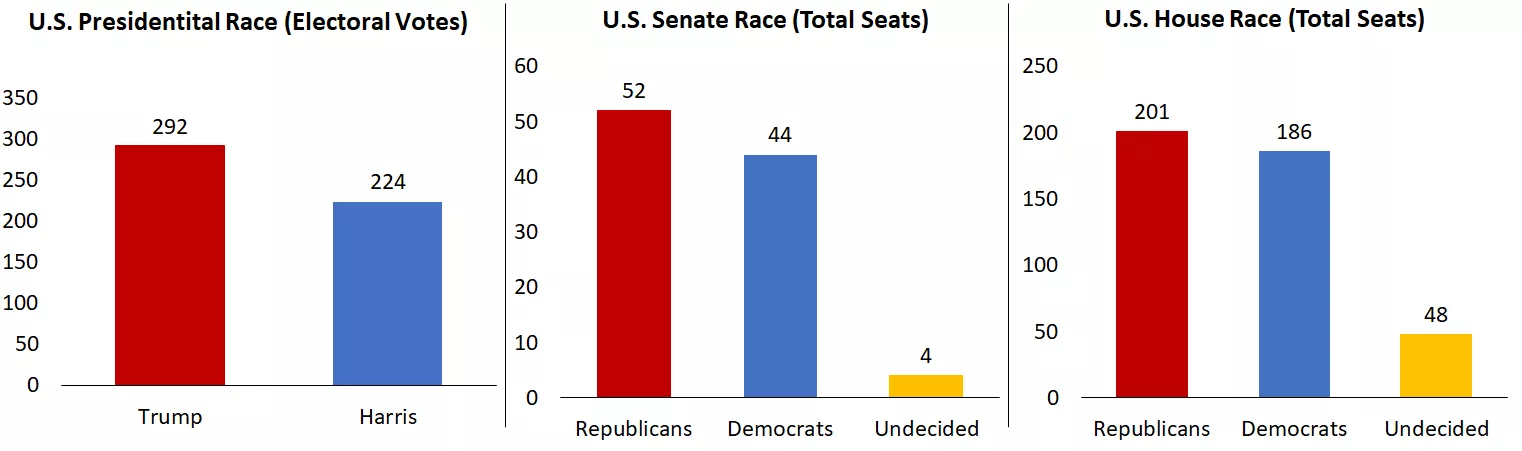

The victory was definitive, with 292 electoral votes versus 224 for Vice President Kamala Harris. And as of Wednesday afternoon, the popular vote count also favoured President Trump, with about 72 million votes versus 67.1 million for the vice president.

The focus now turns to U.S. congressional races, which remain a key component in determining the makeup and policy leanings of the next administration. In the Senate, Republicans have reclaimed the majority for the first time in four years, with the current balance 52 seats for Republicans, 44 to Democrats, and four races still to be called as of Wednesday (Nov. 6).

The outcome for the House of Representatives is less clear, but the margin of victory for either party will be tight. As of Nov. 6, Republicans have won 201 seats, Democrats have won 186, and 48 remain outstanding.

Historically, however, we have seen the House ultimately lean toward the party with the higher popular vote. This could indicate that Republicans may sweep the Presidency, Senate and House this election cycle.

This chart shows polling for U.S. presidency, Senate and House of Representatives.

This chart shows polling for U.S. presidency, Senate and House of Representatives.

Near-term implications: Stocks may benefit from pro-growth policies; bonds may remain volatile on inflation, deficit outlooks

Strong one-day stock market returns reflect pro-growth policies

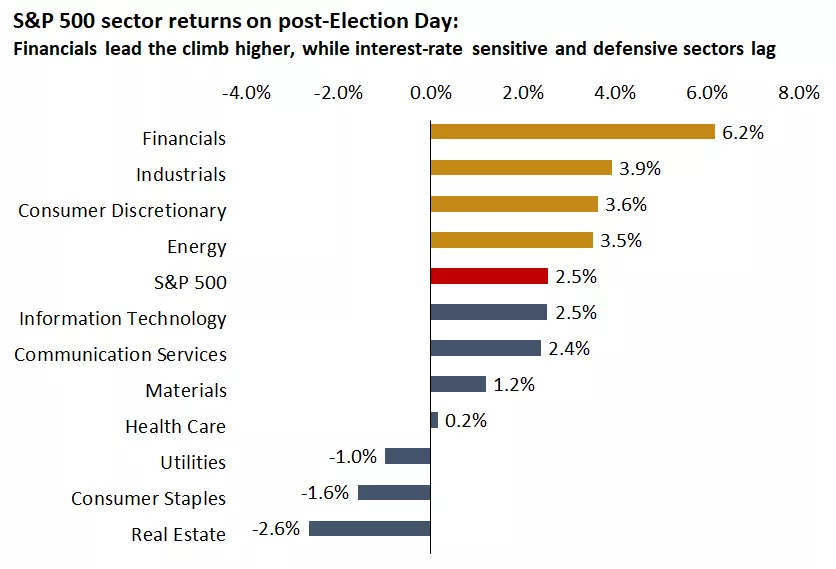

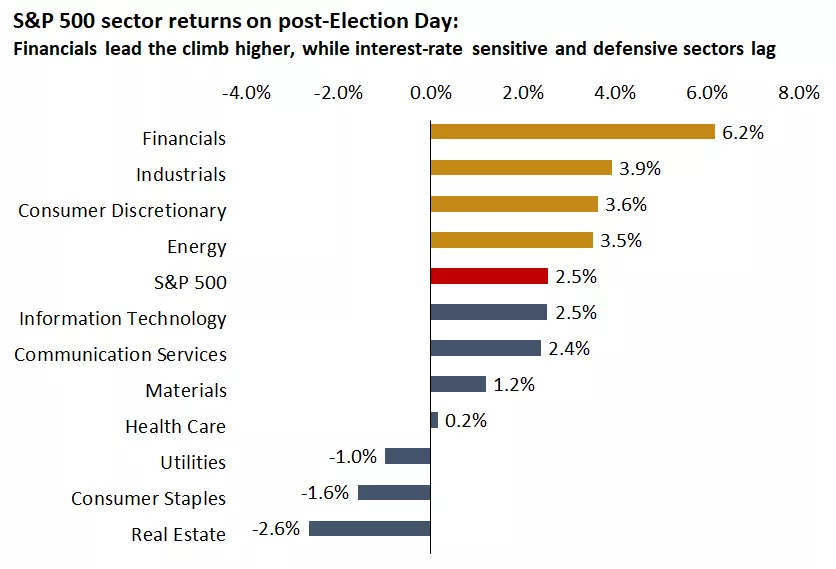

The immediate reaction in markets — particularly stock markets — has been decisively positive. Republicans have outlined a generally pro-growth set of policies, including extending the Tax Cuts and Jobs Act (TCJA), lowering corporate tax rates further, and imposing less regulation on industries such as financial services. If the Republicans gain control of the House as well, the likelihood increases that some or all of these policies could be implemented.

As a result, we have seen stock markets higher across the board since Election Day. Perhaps the biggest beneficiaries have been the cyclical parts of the market (those that do well when the economy is growing), including small- and mid-cap stocks, as well as sectors such as financial services.

This chart shows S&P 500 sector returns on 11/6/2024. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

This chart shows S&P 500 sector returns on 11/6/2024. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

Inflation, higher deficit risks reflected in bond yields

While the stock market has moved higher, the bond market has moved notably lower. This is because, in addition to growth-focused policies, there are new risks to consider to the broader economy:

- First, there is a notable risk of further increases to the U.S. deficit, which was already near all-time highs at close to 120% federal debt to GDP. Cutting taxes, for example, will ultimately decrease government revenues that fund and pay down U.S. debt, and put further pressure on deficit spending.

- Second, there is a risk of reigniting inflationary pressures, especially with potentially higher growth and tariffs, some of which may be passed to the end consumer as higher prices.

In our view, however, the appetite for inflationary and deficit-inducing policies has decreased substantially since the COVID-19 pandemic. We may see congressional members debate these more vigorously in the months ahead, across both Democrats and Republicans.

Meanwhile, we have seen Treasury yields move sharply higher and bond prices move lower after Election Day. The 10-year Treasury yield has risen by 0.18% to around 4.44% in just one day and has climbed nearly 0.82% from its September lows.* These outsized moves have been driven in part by better prospects for further economic growth, but also by the rising risk of not addressing U.S. debt levels and potentially sparking inflation.

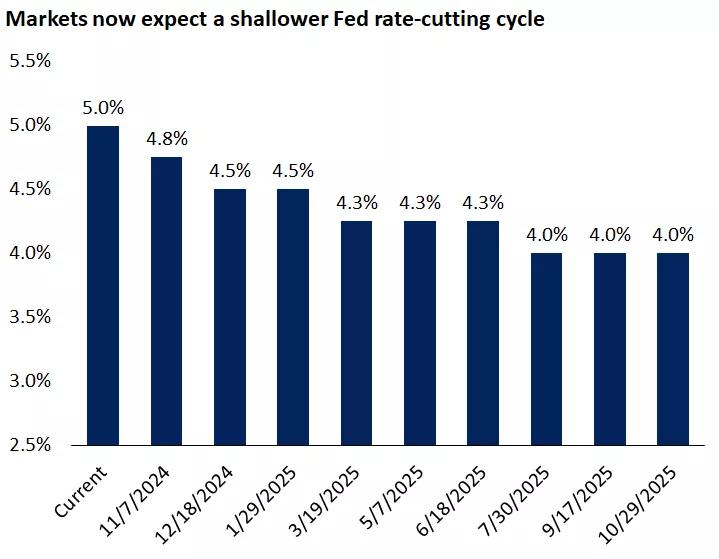

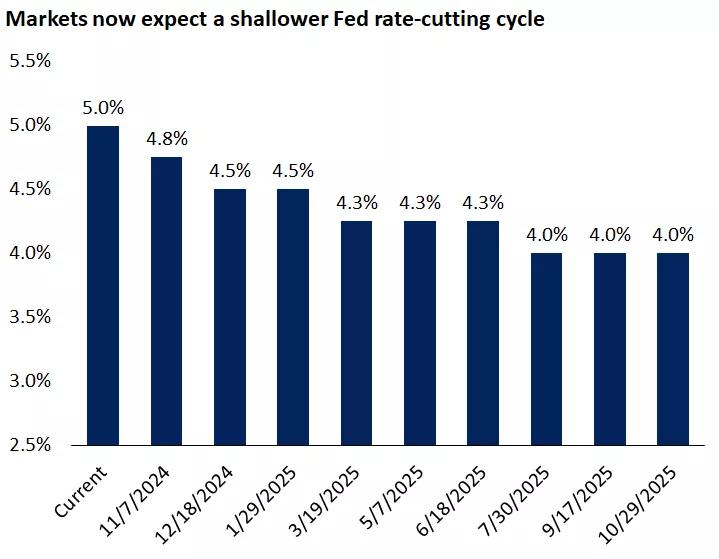

In addition, the outlook for Federal Reserve interest rate cuts has shifted since Election Day. According to the CME FedWatch tool, markets are now expecting the Fed to lower its policy rate from the current 5% to about 4% next year. This is higher than earlier expectations for the Fed to cut rates to about 3.5%.

Thus, the outlook for the economy, deficits and inflation has also weighed on the outlook for the Fed, which is now expected to implement a relatively shallow rate-cutting cycle.

This chart shows the implied Fed policy rate over the next year based on futures market pricing.

This chart shows the implied Fed policy rate over the next year based on futures market pricing.

Action for investors: Fundamentals remain intact; stay aligned with long-term financial strategies

While the U.S. election certainly has been a driver of markets and sentiment in the near term, keep in mind that over the long term, markets tend not to be heavily influenced by political events. Instead, markets are underpinned by fundamentals, including innovation, productivity and economic and earnings growth.

In our view, the fundamentals remain well supported as we emerge from election season:

- The Fed is continuing its rate-cutting cycle, albeit perhaps a shallower one.

- Inflation has been moving largely in the right direction, with PCE (personal consumption expenditure) inflation now around 2.1% annually, and expected to remain in this range near term.*

- Perhaps most importantly, the economy is holding up well, with economic growth expected to be above 2% once again in the fourth quarter.

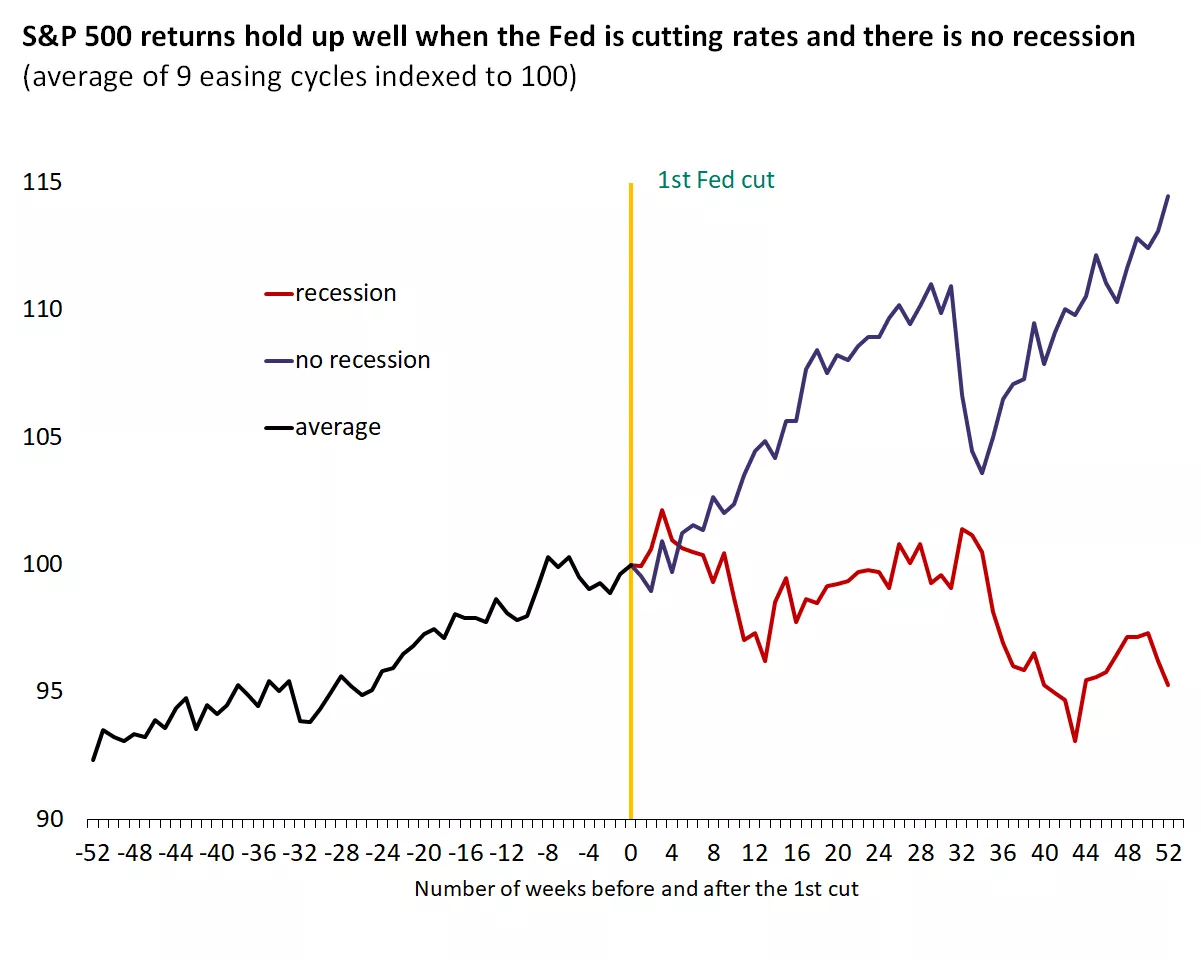

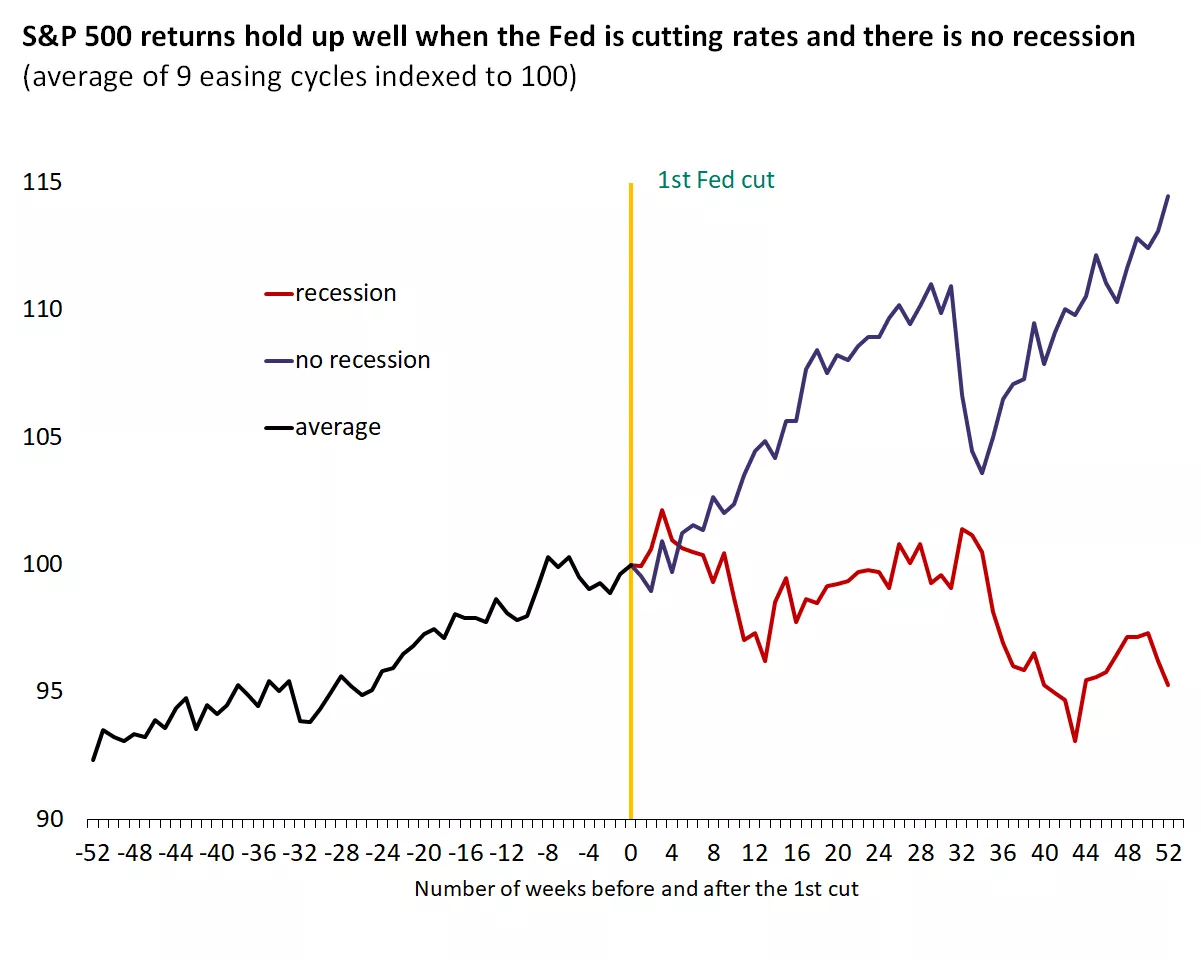

Historically, when the Fed or Bank of Canada is cutting rates — and the economy is not entering an imminent recession — this has been a positive backdrop for financial markets.

The graph shows the path of the S&P 500 after the first rate cut of the past nine easing cycles which tends to diverge based on whether the economy is in a recession or not. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

The graph shows the path of the S&P 500 after the first rate cut of the past nine easing cycles which tends to diverge based on whether the economy is in a recession or not. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

Some of these positive returns, however, have been realized over the last couple of years, including in the last couple of days. We have now experienced two strong back-to-back years in the market, with the S&P 500 up 24% last year and another 24% this year (as of Nov. 6). Similarly, the Canadian TSX has also been higher over the last two years, up about 8% last year and up over 17% this year thus far. The pace of gains may moderate going forward, but we still expect positive returns and would use pullbacks as opportunities for long-term investors.

Portfolio opportunities in both stocks and bonds

In stocks, we continue to favour U.S. large- and mid-cap stocks across both growth and value sectors. We recently upgraded the financial sector to neutral and remain overweight in the industrials sector. Both moves reflect our view that the recent broadening of market leadership may have legs, especially in a more pro-growth policy backdrop. We would use these cyclical sectors to complement investments in technology and artificial intelligence (AI), which we continue to believe are in the early innings of a long-term secular growth phase.

And in bonds, we would look for opportunities to extend duration in U.S. investment-grade bond portfolios. Especially for those investors with outsized exposure to cash-like investments, including GICs and money market funds, we would recommend gradually repositioning these into investment-grade bonds in the seven- to 10-year maturity range. Given the recent rise in yields, investors may have the opportunity once again to lock in these higher yields for longer and realize price appreciation as the Fed cuts rates over time.

Time in the market pays off more than trying to time the market

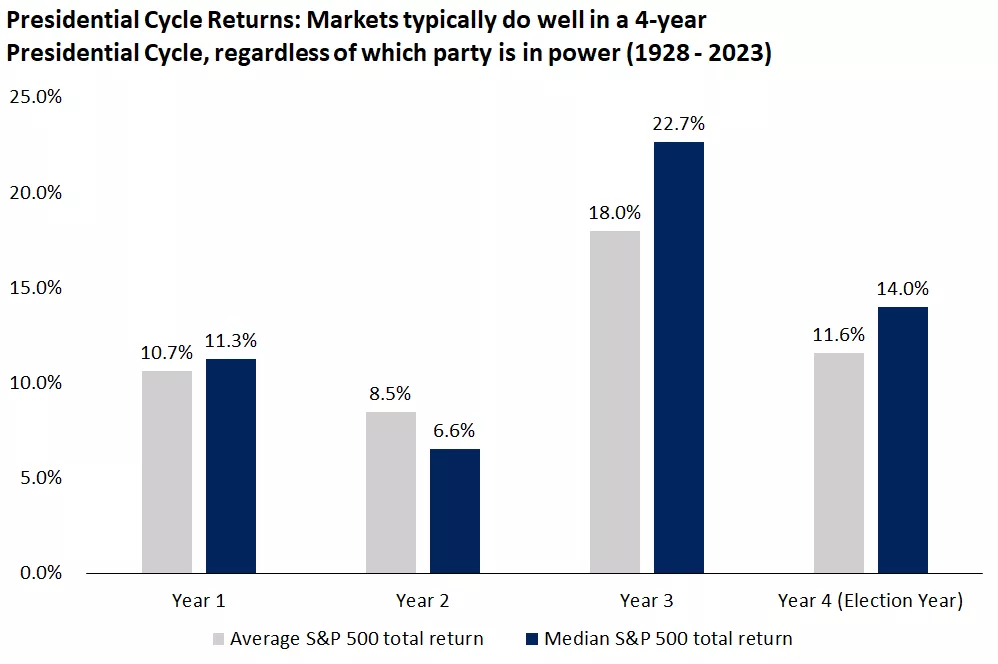

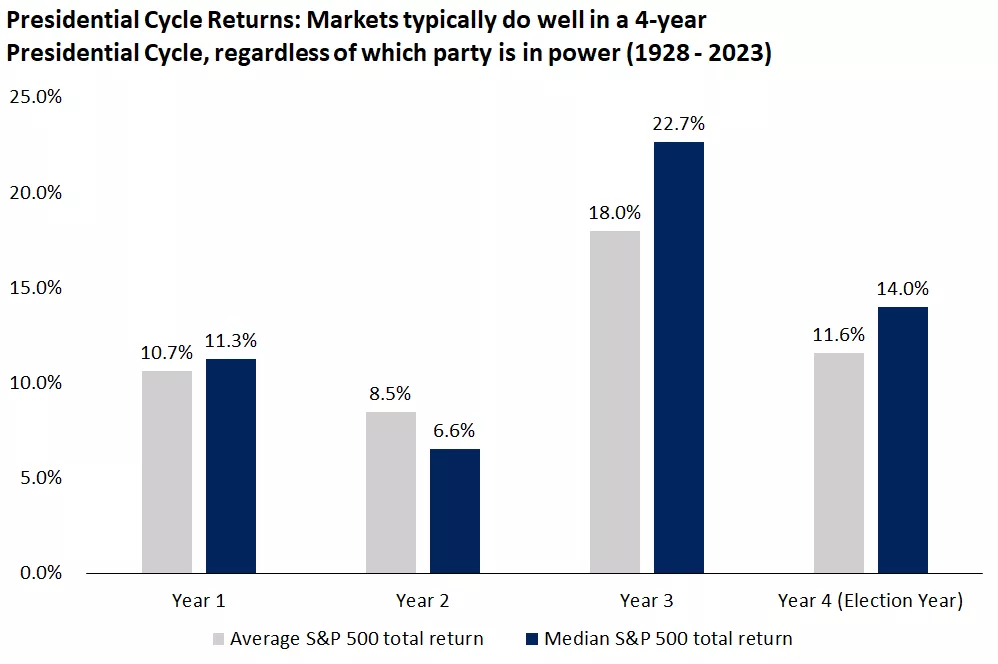

Overall, the results of the U.S. presidential election are now finalized, which eliminates one uncertainty for investors. While there remains a wide array of potential policy outcomes ahead, we believe investors should remain steadfast with their long-term financial strategies, as history has consistently shown that time in the market yields far better outcomes than investors trying to time themselves into and out of the market.

We recommend working with your financial advisor to help ensure your investments are aligned with your personalized financial goals, including owning the appropriate investments in both stocks and bonds. This, more than anything, will help ensure a secure long-term financial future, regardless of the makeup of the White House and Congress.

This chart shows S&P 500 performance across each year of U.S. presidential cycles since 1928. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

This chart shows S&P 500 performance across each year of U.S. presidential cycles since 1928. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

Mona Mahajan

Investment Strategist

Source: *FactSet

Important information:

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.