How much risk should I take?

What do you think of when you hear the word risk?

Are you investing too conservatively (or not at all) to try to avoid market declines? If so, we feel that's a mistake. The biggest risk you face isn't in the stock market— it's not reaching your long-term goals.

All about balance

Investing is all about balance, including balancing the return you need to reach your goals in relation to your comfort level with risk. Your Edward Jones financial advisor can not only help ensure you are not taking too much risk, but also help ensure you have the proper investments to better help reach your goals. And it's difficult to reach your long-term goals with short-term investments.

If you have some time before you plan on retiring, it's important to focus on the long term — and to consider growth investments, like stocks or stock mutual funds and exchange-traded funds (ETFs), as part of your investing strategy.

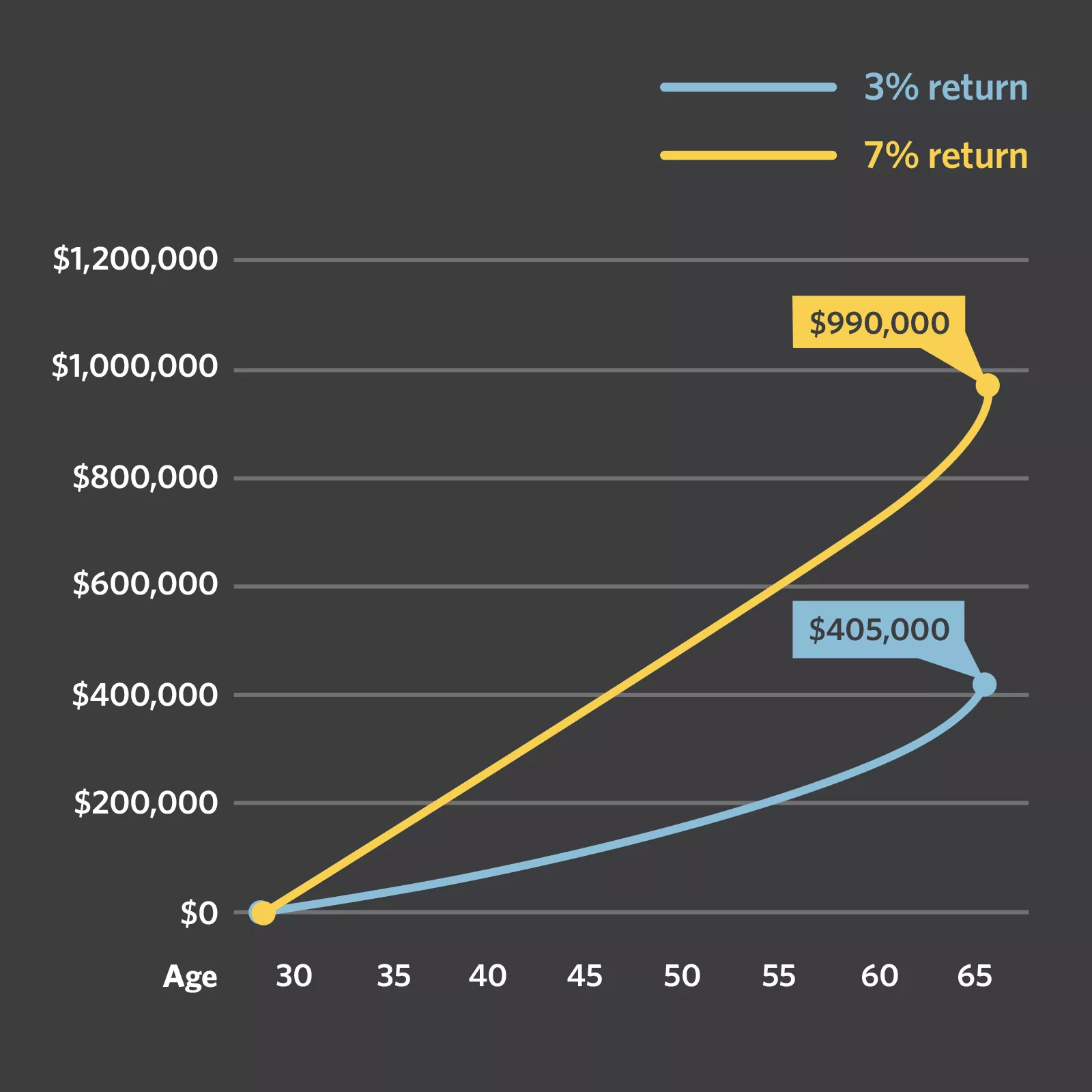

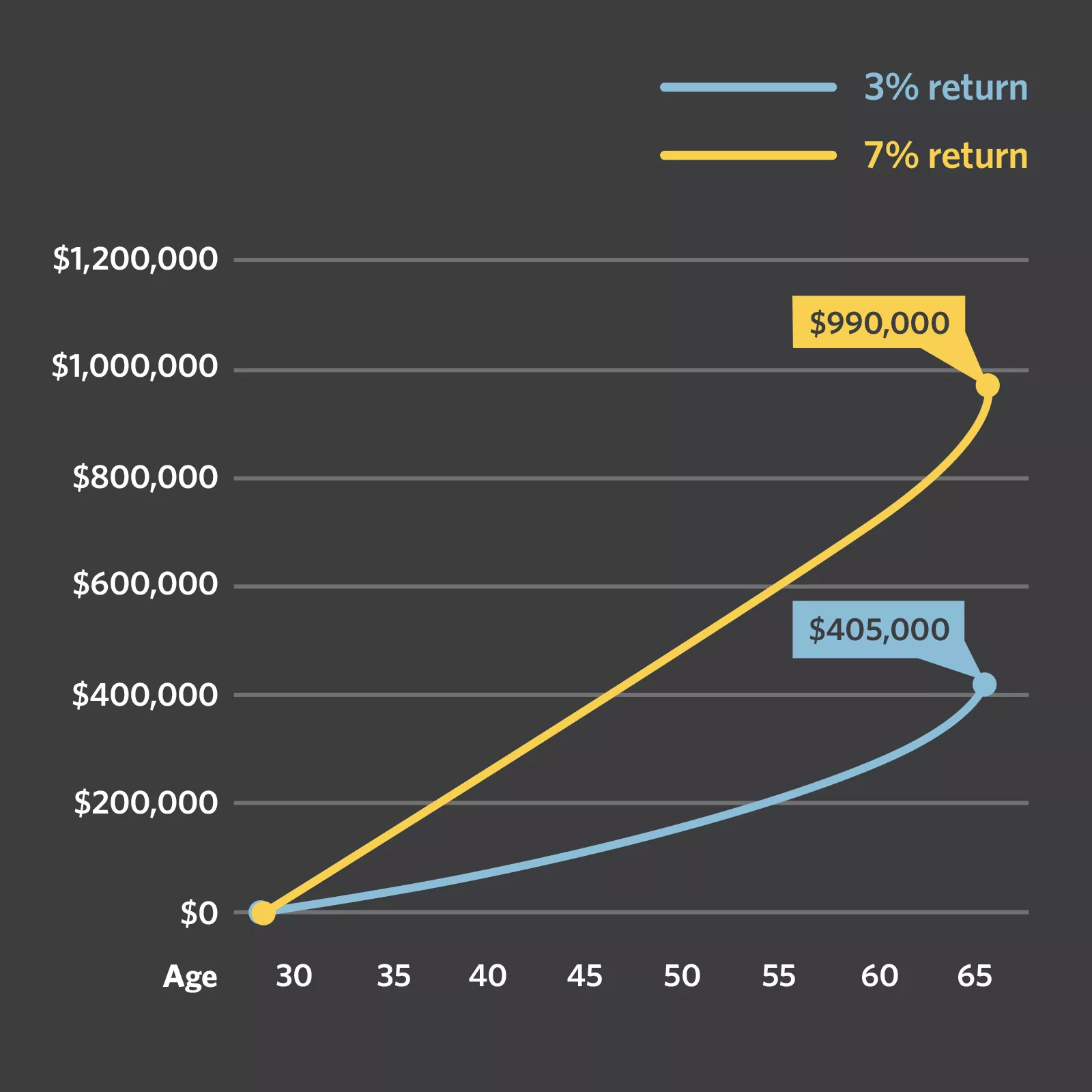

To put the importance of growth into more perspective, take a look at the graph below. The difference between a 7% return and a 3% return isn’t simply 4%: It could be nearly $600,000 for your retirement, depending on your contributions and how long you have until retirement.

By not investing, the potential size of your portfolio, and, as a result, your potential lifestyle in retirement could all be affected. So what does this mean for your investment strategy? It depends on how long you have until you plan on retiring.

If retirement is still far away

In general, if you’re many years away from retiring, more of your investments should be geared toward those that provide growth opportunities, such as stocks and/or stock ETFs and mutual funds. You generally have more time to weather short-term declines and pursue higher long-term returns. It’s still important, however, to own bonds, which can help smooth out changes in your portfolio’s value over time.

If you're closer to retiring

As you near retirement, it’s harder to weather potential larger market declines. Your portfolio should start becoming more balanced between stocks and bonds in the years before you retire. Your Edward Jones financial advisor can help you position your investments to provide for the first few years of your retirement income needs, balanced with the growth needed to provide income for your later years.

The key is finding balance – not taking on too much investment risk while ensuring you have enough growth potential to reach your long-term goals.

How we can help

Talk to your local Edward Jones financial advisor today to make sure your strategy is best positioned to help you reach your goals.