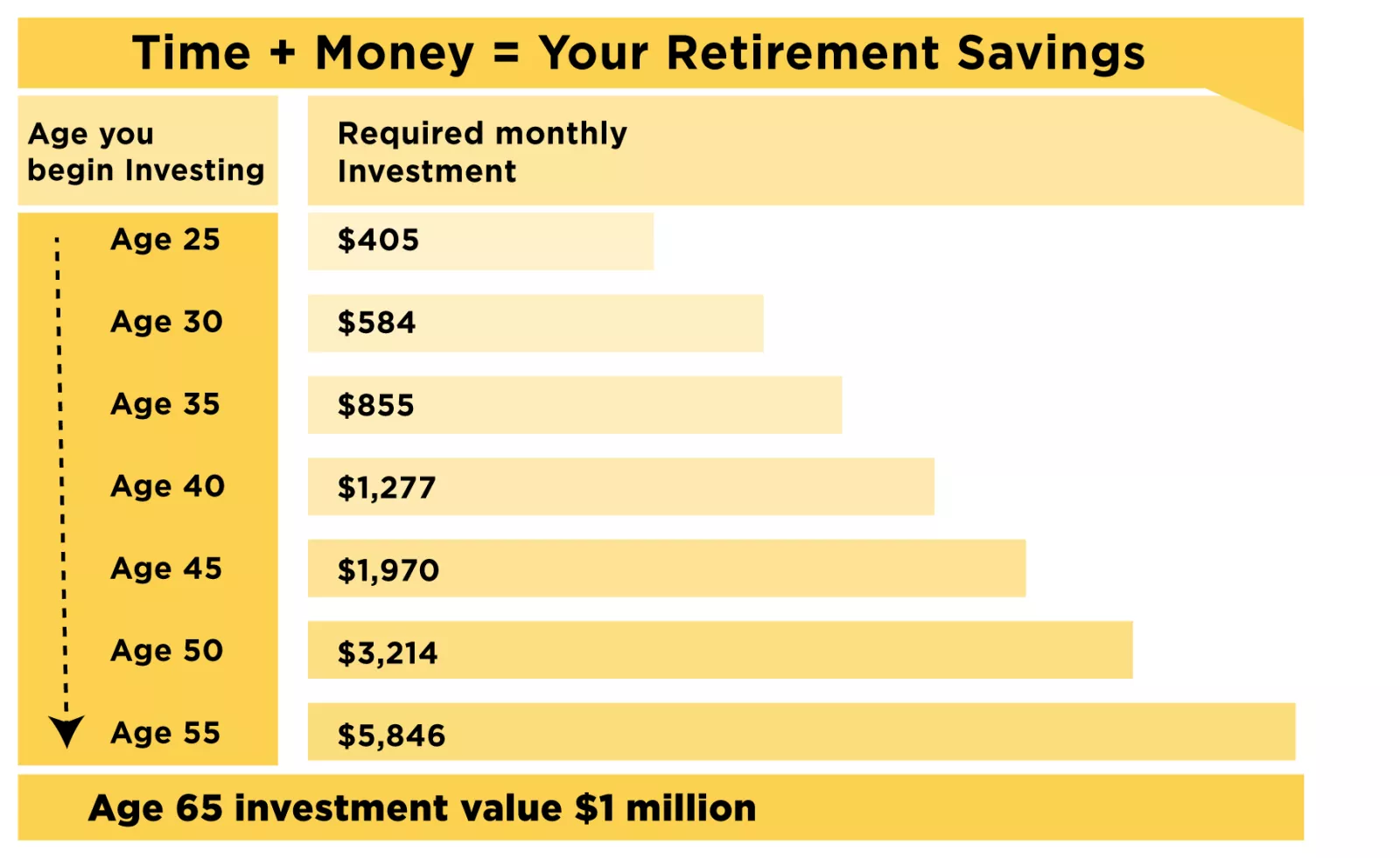

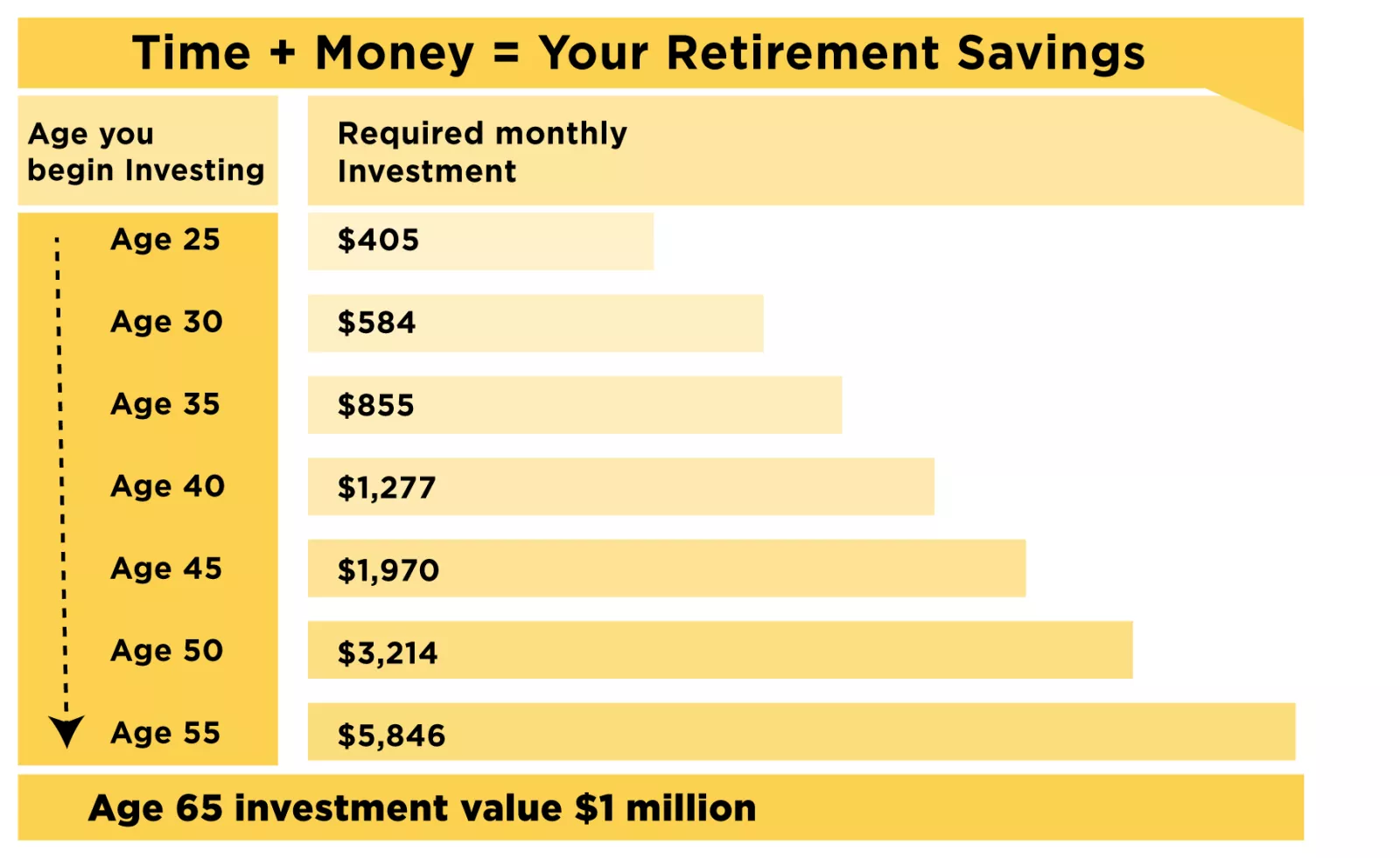

Saving for retirement: The sooner the better

When it comes to investing, good things don’t always come to those who wait. If you’re saving for retirement, you might find that the later you start, the more you’ll need to save on a monthly basis.

Take a look at this example. If your goal is to have $1 million by the time you reach age 65, you’ll need to save a certain amount each month to reach that mark. The later you start saving, though, the less time you have to work toward that goal – and the higher that monthly contribution becomes.

This chart uses a bar graph to demonstrate the efficacy of starting early to save for retirement. If you start saving at age 25 you only need to invest $400 a month to have investments valued at $1 million dollars at age 65. You'll need to invest $584 a month if you wait to start saving at age 30; $1, 377 per month if you start saving at age 40; $1,970 per month if you start saving at age 45; $3,214 per month if you start saving at age 50 and finally, you'll need to save $5,846 per month at age 55 if you want to have investments valued at $1 million dollars by age 65. This chart assumes a 7% hypothetical rate of return. Rates of return are calculated on a monthly basis and for illustrative purposes only. They do not represent an actual investment. Figures do not include taxes, fees, commissions or expenses, which would have a negative impact on investment results. There is no guarantee that you will be able to achieve a consistent rate of return.

This chart uses a bar graph to demonstrate the efficacy of starting early to save for retirement. If you start saving at age 25 you only need to invest $400 a month to have investments valued at $1 million dollars at age 65. You'll need to invest $584 a month if you wait to start saving at age 30; $1, 377 per month if you start saving at age 40; $1,970 per month if you start saving at age 45; $3,214 per month if you start saving at age 50 and finally, you'll need to save $5,846 per month at age 55 if you want to have investments valued at $1 million dollars by age 65. This chart assumes a 7% hypothetical rate of return. Rates of return are calculated on a monthly basis and for illustrative purposes only. They do not represent an actual investment. Figures do not include taxes, fees, commissions or expenses, which would have a negative impact on investment results. There is no guarantee that you will be able to achieve a consistent rate of return.

What’s your number?

Everyone’s priorities are different. Whether you're looking to retire at 55 or 65, a successful financial strategy depends on a strong relationship with a trusted financial professional, who is committed to working with you to help you achieve your goals.

The value of your Edward Jones financial advisor

Following a disciplined approach and using sophisticated tools, your financial advisor develops a customized strategy for you. This includes an appropriate investment portfolio tailored to where you are today and where you'd like to be. Once your strategy is in place, your advisor will continue to work with you to review it on a regular basis and help you stay on track.