Three milestones on the road to financial stability

Before the days of GPS, lost travelers knew the value of asking a local for directions. A local guide could point out milestones to watch for and set them on the right path.

You may find yourself in a similar situation with your financial strategy. You know what you want to achieve, but you’re not sure how to get there.

Edward Jones recommends:

- Having three to six months’ worth of living expenses in savings to cover emergencies

- Saving enough for your unique retirement needs

- Being free of burdensome debt

Each of these may seem challenging and trying to accomplish all of them at once may have you feeling lost. This is where a map with clear milestones can help guide you.

Three milestones on the road to financial stability

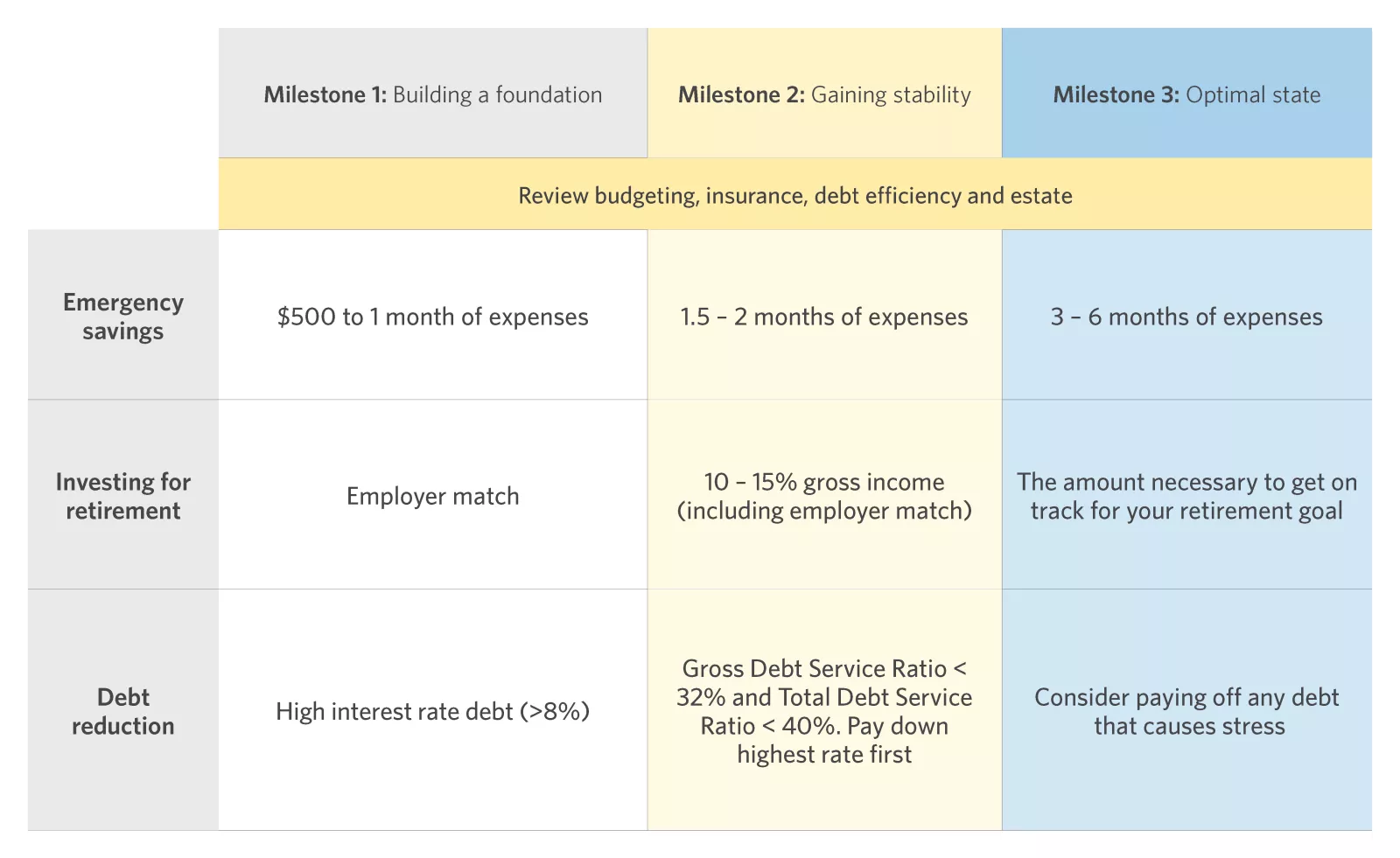

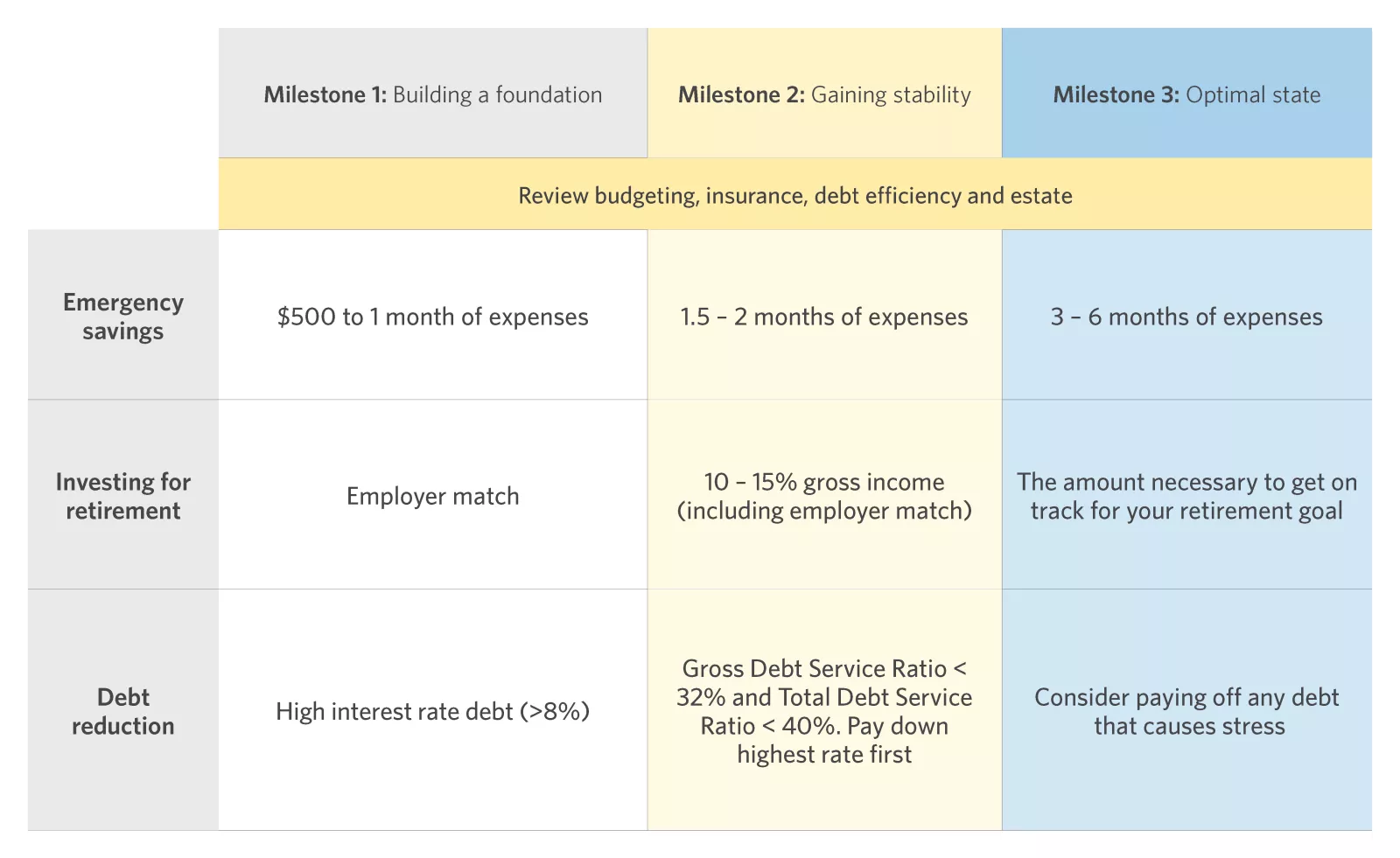

This chart shows three milestones (building a foundation, gaining stability and optimal state) across three financial goals (emergency savings, investing for retirement and debt reduction).

This chart shows three milestones (building a foundation, gaining stability and optimal state) across three financial goals (emergency savings, investing for retirement and debt reduction).

Know before you go

When preparing for a road trip, you might do a few tasks ahead of time to help ensure the trip goes smoothly. For your financial journey, the following can help make the trip a little easier:

- Enlist a trusted guide. Your financial advisor can help you define your goals (where you want to go) and how to achieve them (how to get there) based on your unique needs and circumstances.

- Build a budget to help you know how much you have available to save. Make sure you account for expenses that don’t occur on a regular basis, such as your car insurance and taxes. Also, look for opportunities to reduce or eliminate some expenses.

- Make your debt as efficient as possible. Start by understanding how much and what kinds of debt you have. Consider ways to lower your interest rate, such as refinancing. Be cautious when trading unsecured debt (credit cards) for secured debt (a home equity loan) because if you’re unable to pay in the future, you may be jeopardizing your home. Prioritize making all minimum payments, and account for them in your budget. Late fees and penalties can be costly hurdles to overcome.

- Maintain basic forms of insurance such as health, home, auto, disability and life.1 Term life insurance can help insure your future income and provide resources to pay off debts should something happen to you. This could be especially important if you are the primary income earner or have dependents. Periodically review your coverage, especially after a life event such as a new home or the birth of a child.

- Understand your employer benefits. These can be instrumental in helping you achieve your goals.

- Begin planning for your estate by outlining key priorities and objectives, such as asset transfer, incapacity protection and guardianship for minor children and dependents.

Milestone 1: Building a base

Now that your bags are packed, you’ll want to build a foundation in each of the three goals. While we recommend prioritizing each goal in the order shown below, you can tackle them one at time, save for them equally or put more money toward the one that most appeals to you.

To make it easier, automate as much as you can. For example, you can divert part of your pay directly into an emergency savings account or retirement account and set up automatic payments for any debt.

- Prioritize $500 to a month’s worth of expenses in emergency savings. Unexpected expenses and dips in income are common, and small disruptions can happen frequently. This amount can help you cover minor repairs or a few days of missed work without taking on new debt. Consider keeping your emergency savings in an account separate from your everyday spending, so you know what is set aside for emergencies.

- Take advantage of any employer matches in employer sponsored savings plans. Many employers offer matching contributions to Defined Contribution Pension Plans, Group RRSPs, Employee Stock Purchase Plans, and in some cases TFSAs. Review all savings benefits offered by your employer; if they match an amount that you contribute to a savings plan, contribute the full amount required to maximize the match benefit. Since an employer match is such a powerful tool for saving, and you can’t recoup lost years, prioritize this opportunity.

- Pay down high-interest, non-deductible debt. If you have loan balances, or carry balances on your credit card, come up with a strategy for paying them off. You may be tempted to invest extra funds to earn returns. However high-interest, non-deductible debt, such as a credit card balance, is likely to cost you more in interest than you can expect to earn on your investments. Paying down debt is also guaranteed to save you interest, and interest saved is tax-free, whereas returns you would otherwise earn in non-registered plans are not. To save on interest and pay your debt off sooner, commit any extra cash to paying off debt with the highest interest rate first.

Benefits of extra payments on a $5,000 credit card balance

| Years to pay off | Interest cost | Total cost | |

|---|---|---|---|

| Making minimum payments | 15.25 | $5,595 | $10,595 |

| Pay $100 extra per month | 3.17 | $1,489 | $6,489 |

Source: Government of Canada Credit Card Payment Calculator. Minimum payment assumed to be greater of $25 and 3% of balance. Interest rate of 19.99% based on standard credit card interest rate for purchases.

Milestone 2: Gaining stability

Now you’re building on the momentum you gained in Milestone 1. Again, prioritize each goal in order, and automate where you can. While you should continually manage your budget, keep your debt as efficient as possible and ensure you have adequate insurance.1 Milestone 2 provides a good opportunity to reflect on these.

- Save 1½ to two months’ worth of expenses in emergency savings. Not only will this help you cover larger, unexpected expenses or longer periods of lost income, it can also help you weather multiple events. Given the security this amount of emergency savings can provide, you may be tempted to prioritize it over an employer match or paying down high-interest debt. But don’t forget what you’d be giving up by skipping the steps in Milestone 1.

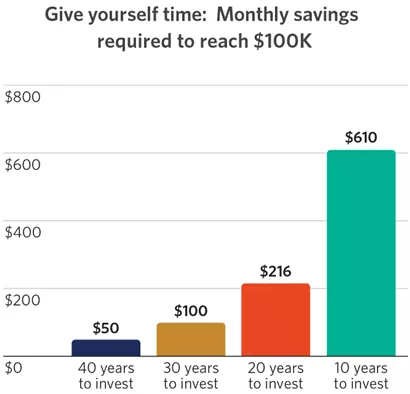

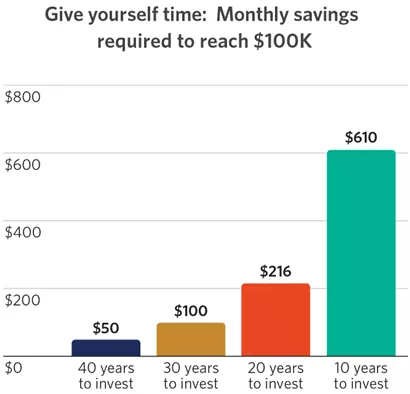

- Save 10% to 15% of your gross income (including any employer match) in retirement accounts. You’re already receiving your employer match, but what if you could add to that total? When it comes to retirement savings, time is your ally. Saving even smaller amounts can provide big benefits over time. Start with what you can, and pledge a portion of any future raises toward your retirement savings. Bonuses and tax returns can also help boost your retirement savings.

- Check your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios. When considering a mortgage application, lending institutions in Canada consider, among other things, two ratios that compare your ability to make your debt payments to your overall income. The Gross Debt Service Ratio considers how much of your income is used towards housing costs (mortgage principal and interest, property taxes, heating costs, and 50% of condo fees if applicable). The Total Debt Service Ratio also includes housing costs, but adds the cost of servicing any additional debt (credit card interest, vehicle loan payments, etc) as well. The general rule of thumb is that your GDS ratio should not exceed 32%, and your TDS ratio should not exceed 40%. The Canada Mortgage and Housing Corporation (CMHC), which insures mortgages for Canadians with less than a 20% down payment, restricts borrowing once GDS exceeds 39% and or TDS exceeds 44%. To reduce your TDS, pay off debt starting with the highest interest rate debt first.

This chart shows that the more time you have to invest, the more modest your monthly savings need to be to reach $100,000.

This chart shows that the more time you have to invest, the more modest your monthly savings need to be to reach $100,000.

Milestone 3: Optimal state

With Milestone 2 in the rearview mirror, you’re now in the home stretch. But just as a road trip can have a detour, life can be full of the unexpected. You may find yourself back in an earlier milestone for one or more goals, and that’s OK. You can spend from your emergency savings with confidence knowing it’s there for exactly that purpose. If an unexpected expense moves you back to an earlier milestone, you can go forward knowing you’ve navigated these roads before.

- Save three to six months’ worth of expenses in emergency savings. This amount can help you withstand longer periods of unemployment or multiple larger expenses without having to dip into your retirement savings or take on new debt. It can also provide flexibility to do the things you want to do, such as taking a sabbatical, switching careers or taking time off to care for a loved one.

- Stay on track for your retirement goal. Your vision of retirement is unique, and so is your path to get there. In this milestone, the focus is on ensuring you’re saving enough to realize your retirement goal. Your financial advisor can help you adjust as necessary.

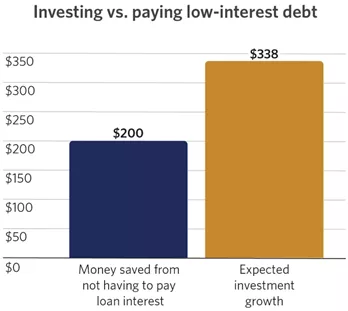

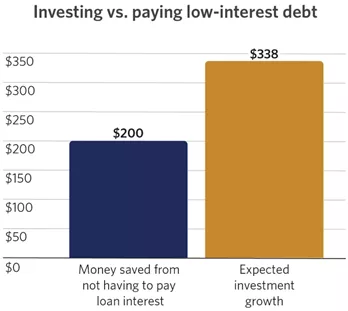

- Think about your attitude toward debt. After completing Milestone 2, your debt should be at a more manageable level. If your balances still cause you stress, you could consider paying them down. Paying off your loans will save you in interest charges – but you may need to do so at the expense of investing for your future. As this chart shows, it’s possible the expected return on your investments could outpace what you owe in interest. While you’ll want to be comfortable with your amount of debt, this may come at the expense of achieving other goals.

This chart shows the potential interest savings of paying off a loan versus investing the same amount of money.

This chart shows the potential interest savings of paying off a loan versus investing the same amount of money.

The road ahead

At the end of the trip, there’s a moment when your destination appears on the horizon and excitement sets in. Take time to look around and be proud of how far you’ve come in your journey. Not only have you built financial stability, but you’re also achieving financial flexibility to do the things you want to do, such as paying for a child’s or grandchild’s education, contributing to a cause you’re passionate about or saving for a major purchase. Whichever road you choose next, your financial advisor will be there to help you at every turn.

Important information :

1. Insurance and annuities are offered by Edward Jones Insurance Agency (except in Québec). In Québec, insurance and annuities are offered by Edward Jones Insurance Agency (Québec) Inc.