Bond laddering

Short-term interest rates are cyclical in nature. No matter where short-term and long-term interest rates stand, bond laddering should be considered. Laddering bond maturities has shown itself to be an important component in a fixed-income investment strategy.

Consider a hypothetical example:

- Short-term rates are about 2%.

- Long-term rates are about 5%.

Let’s say you invested $10,000 in a short-term fixed-income investment at 2%. You could then roll the principal every year – as it came due – into a new one-year investment. Compare this strategy to investing $10,000 in a long-term bond. The table below assumes that the rate of a one-year (short-term) investment will increase 1% during each of the next four years, while the long-term interest rate will not change.

| Impact on income | ||

| Short-term | Long-term | |

| 1st year income | $200 | $500 |

| 2nd year income | $300 | $500 |

| 3rd year income | $400 | $500 |

| 4th year income | $500 | $500 |

| Total after four years | $1,400 | $2,000 |

| 5th year income | ? | $500 |

Source: Edward Jones. Table and example are for illustrative purposes only and do not reflect the performance of particular investments.

What does that mean? The short-term investment must earn $1,100 in the 5th year to equal the $2,500 of income produced by the long-term investment. That would be a return of 11% (10,000 x 11% = $1,100). Even with these rate increases, short-term investments still do not offer the income that long-term bonds offer.

Diversify bond maturities

Owning only short-term investments reduces the potential for price volatility in your portfolio. That’s because shorter term investments mature more frequently, and principal is returned sooner. However, they usually offer lower rates than longer-term bonds, so you may receive less income. Shorter term investments also involve more reinvestment risk because the coupon rate is locked in for a shorter period of time. So short-term investments do a good job of protecting current market price but a poor job of preserving your income.

Owning only long-term bonds usually provides more income since they typically have higher rates. However, it increases the potential price volatility of a portfolio since principal repayment is further in the future. So long-term bonds help to sustain your income but do a poor job of maintaining market price stability.

You should also consider intermediate-term bonds. Income and price volatility are less extreme, so they can help provide a solid foundation for bond ladders. They also help keep a fixed-income portfolio more interest rate neutral.

Consider laddering your bonds

Laddering is a time-tested strategy for fixed income investing that involves owning quality bonds with a variety of maturities. Bonds with different maturities react differently to interest rate changes and other market conditions. Although diversification does not guarantee a profit or protect against loss, a diversified bond portfolio can help soften the impact of these changes.

Instead of purchasing bonds based solely on the income they provide, consider how each bond will fit into your portfolio. To create a balanced fixed-income portfolio that can help your investments potentially prosper under various market conditions and interest rate changes, build your ladder with a variety of the following bonds: short-term (up to five-year maturity), intermediate-term (six- to 15-year maturity) and long-term (more than 15-year maturity).

When laddering your fixed-income portfolio, it is important to consider the call protection of your bonds. Call protection refers to the period of time prior to a specific call date when a bond cannot be redeemed by the issuer. If a bond is called prior to maturity, you may receive more or less than your original investment and may have to reinvest at a lower rate. By considering call protection and other bond features, you may be able to build a more strategic bond ladder.

If your bond is sold prior to maturity, it is possible to receive less than your initial investment amount. Bond values may decline in a rising interest rate environment.

This information is intended for informational purposes only.

You must evaluate whether a bond or CD ladder and the securities held within it are consistent with your investment objectives, risk tolerance and financial circumstances. Including callable bonds may increase the interest rate risk of a bond ladder. Bonds may be called prior to maturity, which could result in lower yields with new investments.

The life of a bond

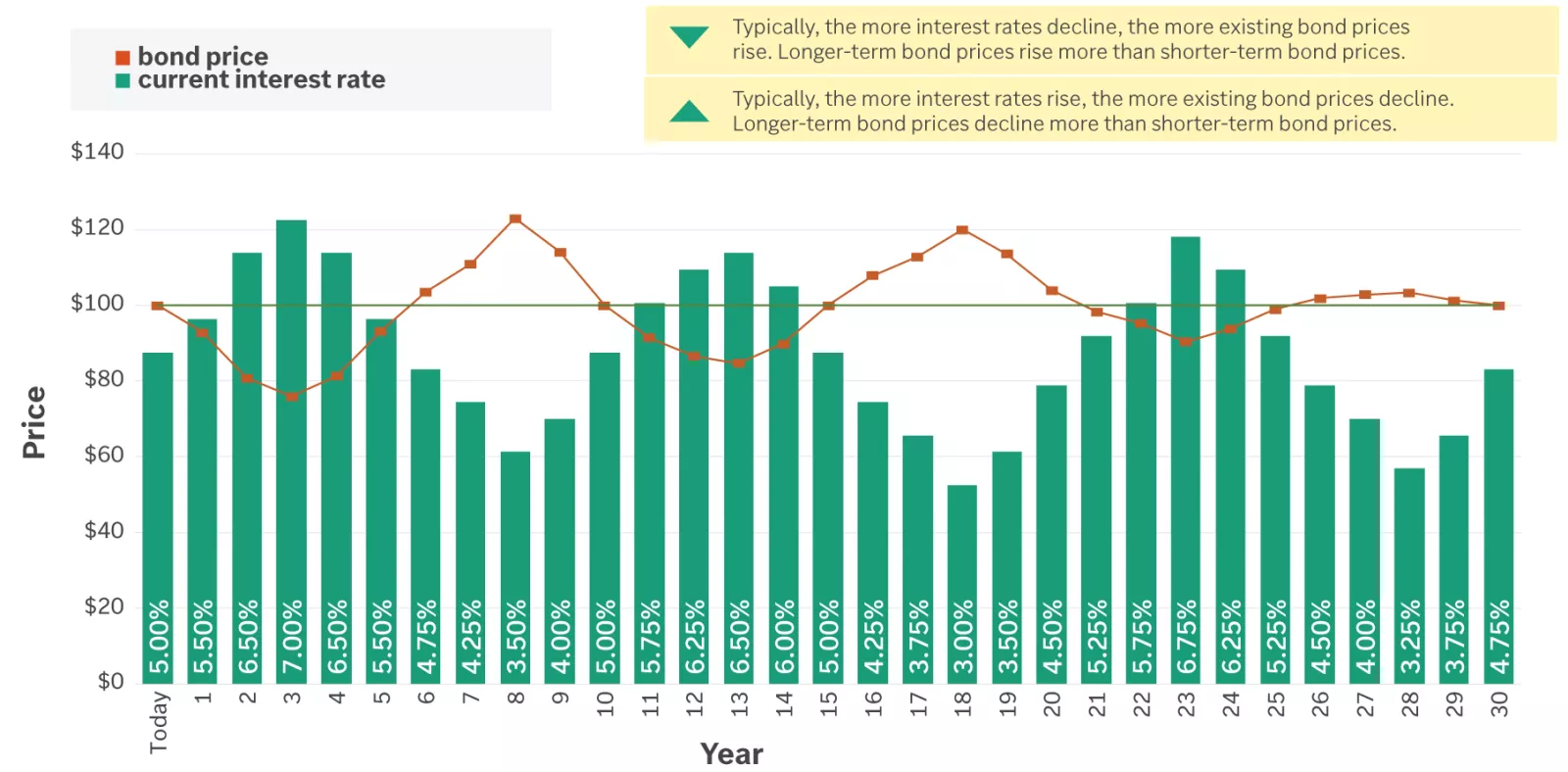

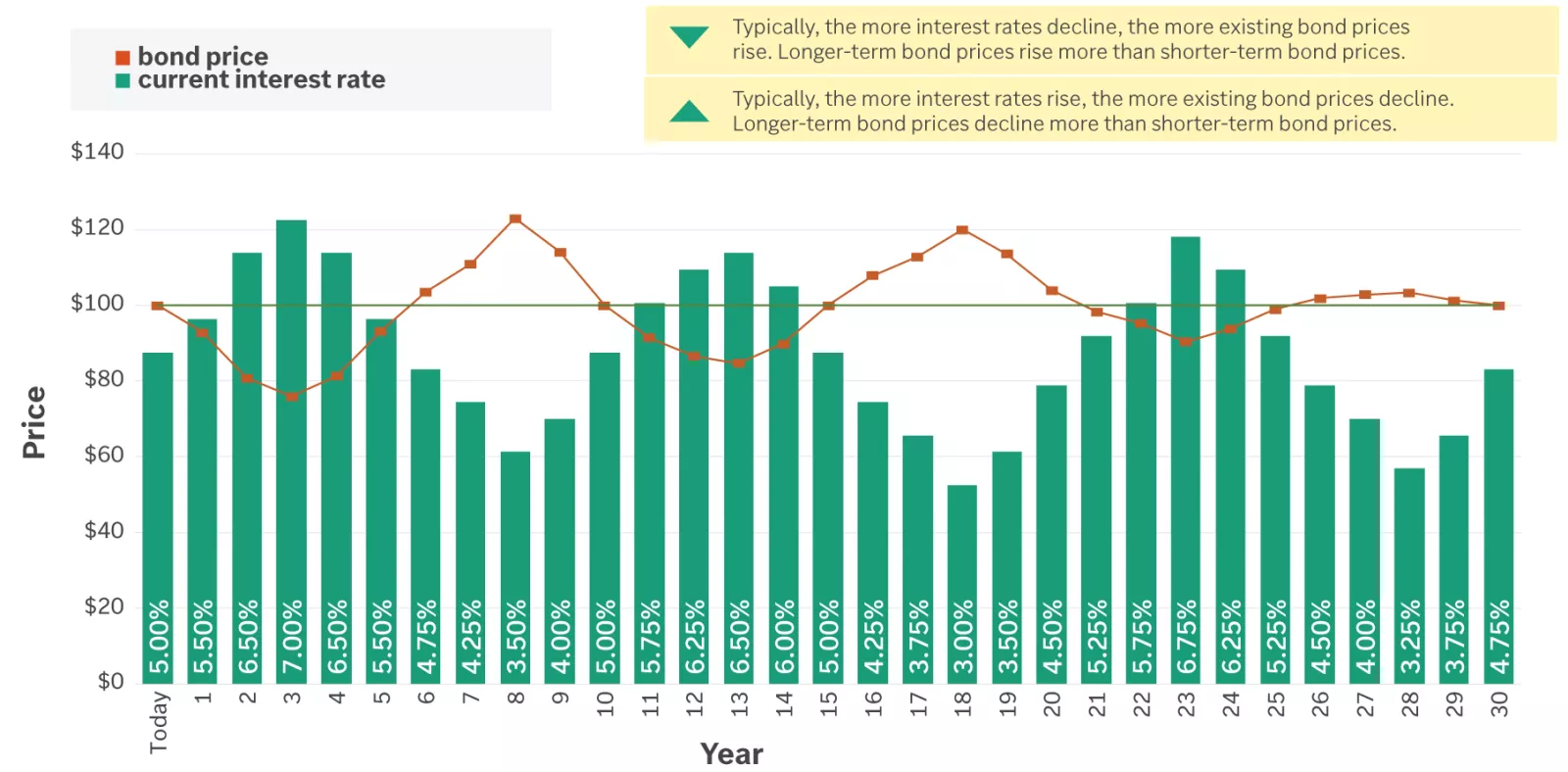

While changes in interest rates do not impact a bond’s regular interest payments or the repayment of its principal at maturity, interest rate changes do impact the existing bond price. The chart below illustrates how the price of a long-term bond could fluctuate over time. *

A noncallable bond is used in this illustration. Be aware that if a bond did have a call feature, its value would not rise much above $1,000 per bond. In fact, it would likely be called (or redeemed) by the issuer during a lower interest rate period and thus not experience the price peaks illustrated in this example.

The graph shows how the price of a long-term bond could fluctuate over time. It is based on a hypothetical 5% bond with an initial 30-year maturity that is noncallable.

The graph shows how the price of a long-term bond could fluctuate over time. It is based on a hypothetical 5% bond with an initial 30-year maturity that is noncallable.

We can help

If you think a fixed-income investment strategy is right for you, talk to an Edward Jones advisor to help ensure you own quality bonds with a variety of maturities, a time-tested strategy that can help reduce the impact of fluctuating interest rate changes and other market conditions over time.

Important information:

* Based on a hypothetical 5% bond with an initial 30-year maturity that is noncallable. Example assumes an investment-grade bond with no change to the credit quality of the bond. Past performance is not a guarantee of future results. Diversification does not guarantee a profit or protect against loss. The value and price of a bond can fall as well as rise, so you may get back less than you invested if you sell prior to maturity.