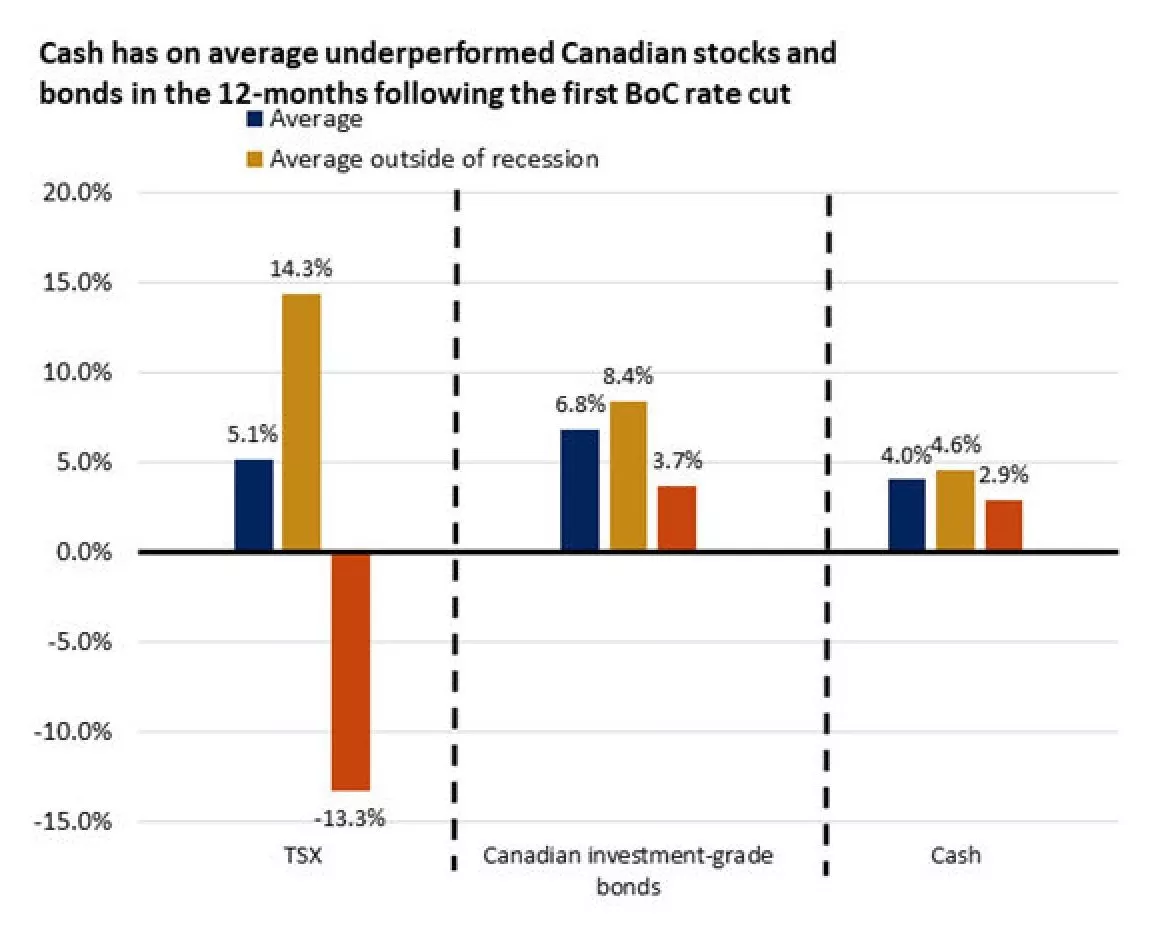

A lower expected return due to a higher allocation to cash can open the door to not meeting your financial goals.

While a Bank of Canada rate decrease is signal that the economy needs support, financial markets are forward-looking and tend to react positively in this environment.

What interest rate decreases mean for debt reduction

For individuals with variable-rate debt like a line of credit, a central bank rate cut is generally good news. Variable rate debt is tied to a bank’s prime lending rate, which is adjusted accordingly when central banks change the policy interest rate. An interest rate cut may or may not impact your payment, but it should impact how much of your payment goes towards the principal balance, which could result in you paying off your outstanding debt sooner.

For those who are looking to renew or finance a new mortgage, a Bank of Canada rate cut can also be beneficial. Mortgage rates are positively correlated to Government of Canada bond yields. When interest rates are going down, bonds yields tend to fall and so do mortgage rates.

How we can help

With cash and cash equivalents earning less interest, and borrowing rates coming down, an Edward Jones advisor can help you weigh the benefits of holding excess cash versus investing or reducing debt. We recommend you review your portfolio at least annually to ensure you're on track to meet your goals.