Advice to my younger self: What every investor needs to know

After 35 years in the workforce, Nima is now ready to move onto the next chapter in her life — Retirement. Nima has several travel destinations on her retirement bucket list, she wants to learn to play the guitar, and plans to spend quality time with her children and grandchildren at the family cottage.

Like Nima, many of us dream of a long, fulfilling retirement. In a 2022 study conducted by Edward Jones and Age Wave, 54% of retirees and pre-retirees over 45 said they viewed retirement as an excited new chapter of life. However, without a sound financial strategy and adequate preparation, retirement can present significant challenges.

Canadians today are facing two significant new retirement realities. First, retirement timespans are much longer than before — 27 years on average, according to Statistics Canada. A few generations ago, working until age 65 or later, with a life expectancy of 72, was the norm. While the current average retirement age of 641 hasn’t changed much, life expectancy certainly has. In fact, life expectancy has increased by more than two decades2 in the last hundred years. Today, the joint life expectancy for a male/ female couple of average retirement age is 94.2 Stated another way, at least one spouse is, on average, expected to live in retirement for 30 years.

Second, fewer employers offer pension plans to their employees than 25 years ago.3 Many companies have shifted away from defined benefit pensions to either defined contribution plans, group RRSPs, or simply no retirement plan at all.4 In those structures, the responsibility of constructing and providing a retirement income shifts from the employer to the employee. Quite simply, we can no longer rely on the government, the union, or our employers to take care of us when our working days are done. We must take charge of our own retirement.

Unique risks threatening retirement

While there are many different investment and financial risks to guard against, a healthy retirement income can be threatened by a couple of key risks in particular: longevity risk and inflation risk.

Longevity risk is the risk of outliving your retirement savings. Although females, on average, live longer than males, the average life expectancy for males and females combined is currently about 82 years.5 However, that figure is somewhat misleading since it represents life expectancy from birth, and the life expectancy of a 64-year-old retiree is markedly different than that of a newborn. As indicated previously, the joint life expectancy of a 64-year-old male/female couple is age 94. To protect against longevity risk, we must plan for an income that sustains at least 30 years of retirement.

Inflation risk is the erosion of your purchasing power over time. As of May 2022, the inflation rate in Canada topped a 40-year high at a whopping 7.7 per cent.6 While that’s significantly higher than it has been in recent years, inflation in Canada has averaged 3.8 per cent per year since 1960.7 Although 3.8 per cent may not seem too threatening, it means the cost of living will more than triple over a 30-year retirement. To help protect against this risk, retirement income should include strategies designed to help grow with the cost of living. Yet, when approaching retirement, investors tend to become more conservative with their investment portfolios.

If I could turn back time

In 2022, Edward Jones and Age Wave conducted a study of over 9,000 people to assess retirement trends across North America. The study indicated that “retirees started saving at an average age of 37 but wish they had started saving nearly a decade earlier, at 28.”

How much difference would that make?

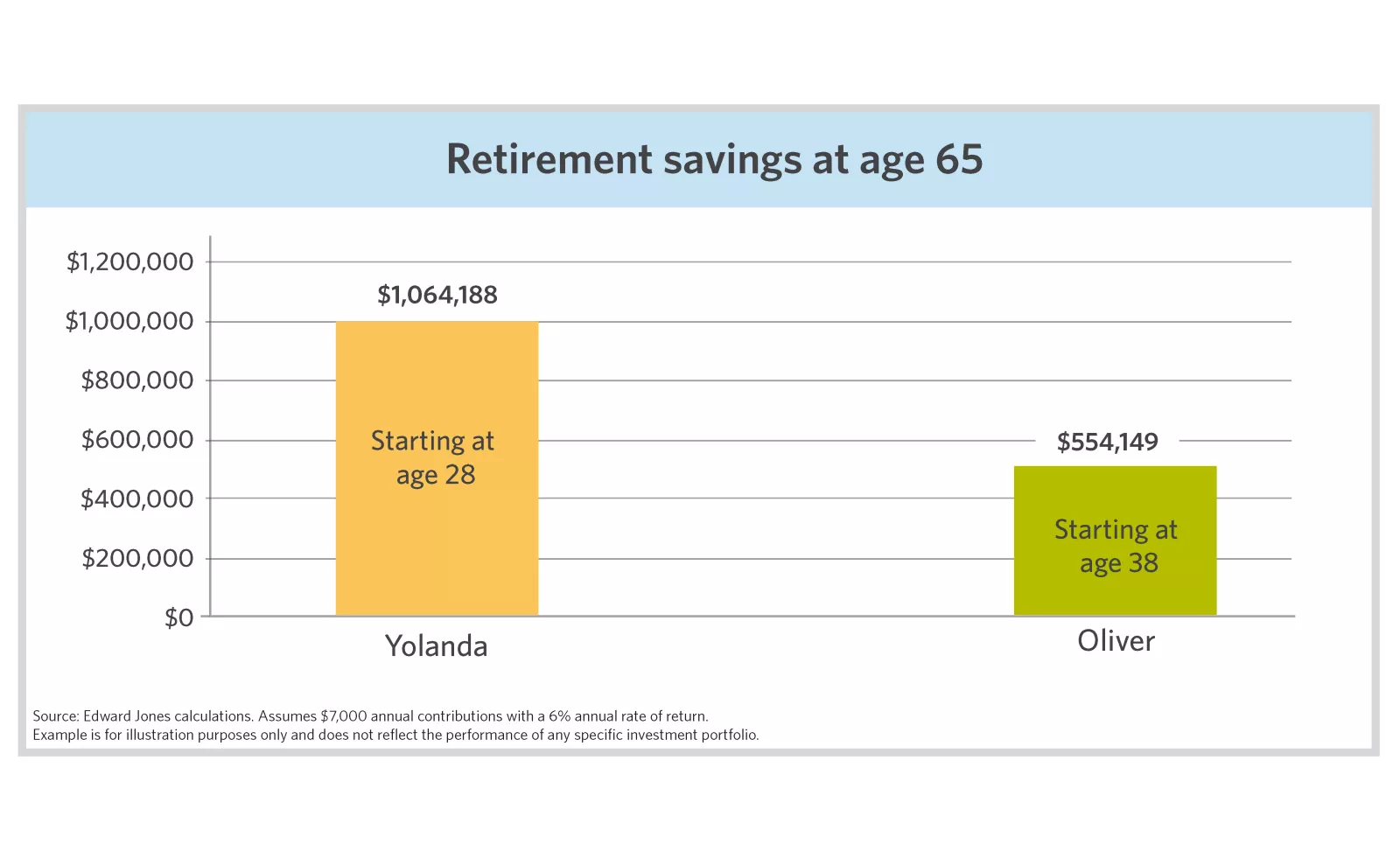

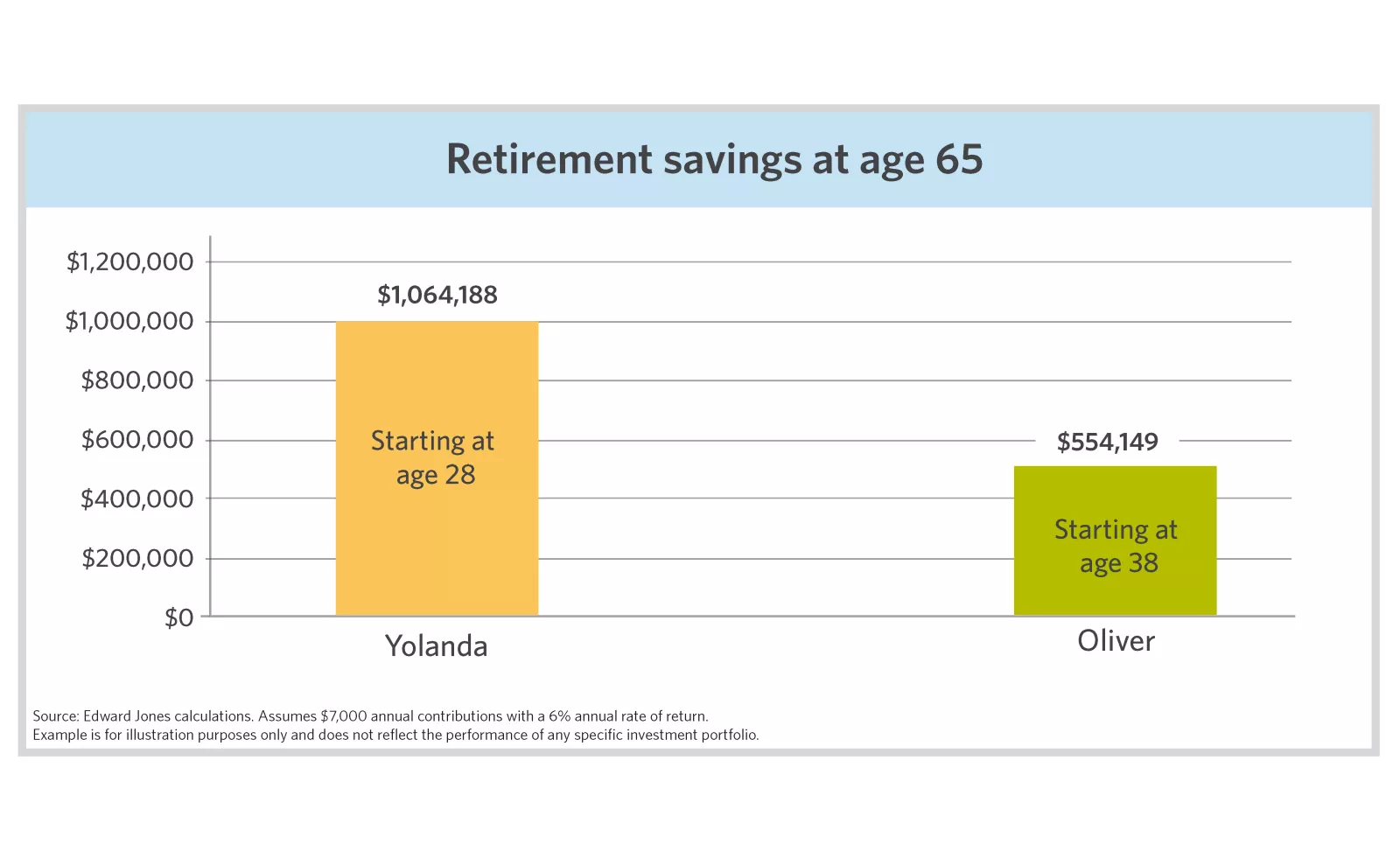

Yolanda Young and her partner Oliver Olde have both just turned age 65. Yolanda started investing for retirement at age 28, whereas Oliver waited until age 37. They each contributed $7,000 to their RRSP accounts on the first of each year, and earned an average 6% rate of return per year. How much do they have today?

At age 65, Yolanda has $1,064,188. Yet Oliver, with $554,149, has only about half as much at Yolanda. Note that Yolanda contributed for only nine years more than Oliver. That is, with a contribution of $7,000 per year, she contributed just $63,000 more than Oliver. Yet, she ended up with over $500,000 more than Oliver. How did this happen?

This is the power of compound growth over time. In this simple example, a difference of nine years in start dates resulted in a difference of over half a million dollars at age 65. This example is for illustrative purposes only and does not reflect performance of any specific investment.

Bottom line

When it comes to saving for retirement, it’s never too late to start, and no amount is too small. But the math shows — the sooner the better. Your Edward Jones advisor can help you consider your retirement objectives at retirement, determine the financial requirements to meet those objectives and develop and implement a strategy to help achieve your retirement goals. To find out more, contact your Edward Jones advisor today.

Important information :

1. Statistics Canada, Retirement age by class of worker

2. Statistics Canada, Life expectancy, 1920-1922 to 2009-2011

3. National Association of Federal Retirees

4. The Institut québécois de planification financière (IQPF), Life expectancy calculator

5. Statistics Canada, Life expectancy and other elements of the life table, Canada and provinces

6. Statistics Canada, Consumer Price Index

7. WordData.info, Development of inflation rates in Canada