Previous week's weekly market wrap

Economic growth may be shifting to a slower gear– and markets are adjusting accordingly

Key Takeaways:

- U.S. economic growth has shown signs of shifting to a slower gear. Data thus far in the first quarter points to softer consumption, with consumer sentiment surveys also indicating some weariness in confidence overall.

- A softening in growth in the first quarter of the year is not uncommon, but what is unique is that the cooling in growth comes at a time of heightened policy uncertainty, around tariffs, government funding, and cost-cutting initiatives.

- The good news is that the U.S. economy has started from a position of strength and came into the year with growth above trend. We don't yet see a recession on the horizon, and economic momentum could reemerge later in the year if tax policy or deregulation come into the forefront.

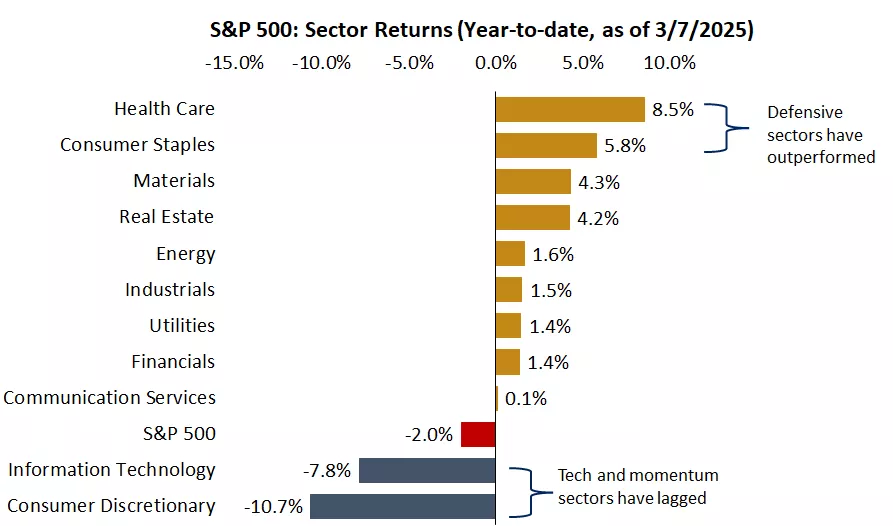

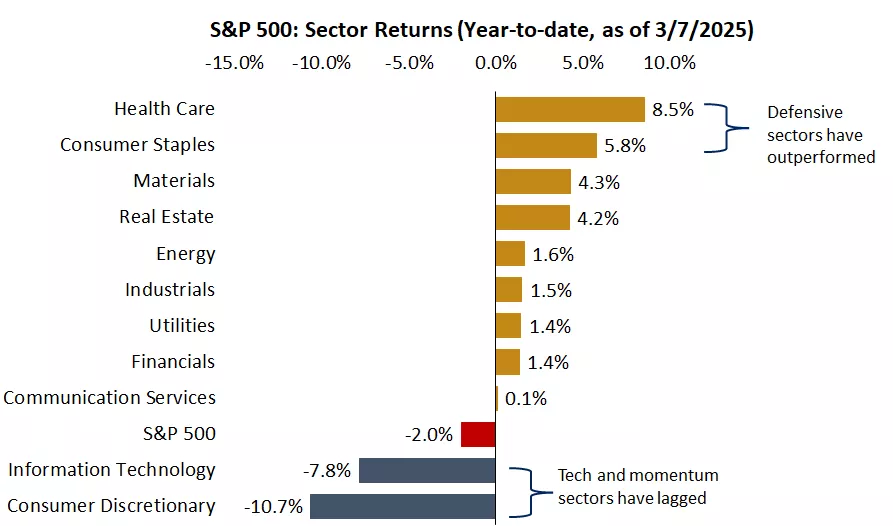

- Nonetheless, markets have taken a defensive posture in recent days. Defensive sectors, like health care and consumer staples, are leading, while momentum and technology sectors are lagging. Bond markets have provided support as well, with Treasury yields moving rapidly lower since January (although we have seen stabilization in recent days), in part because additional Fed rate cuts have now been priced in by markets.

Economic growth appears to be shifting to a slower gear – but not to a recession

After a strong end to 2024, with fourth-quarter GDP growth coming at 2.5% and consumption at a healthy 4.2% pace, there is growing evidence that the U.S. economy may be slowing as we get through the first quarter of 2025. Thus far, key economic indicators, including U.S. retail sales and personal spending, have both surprised to the downside.

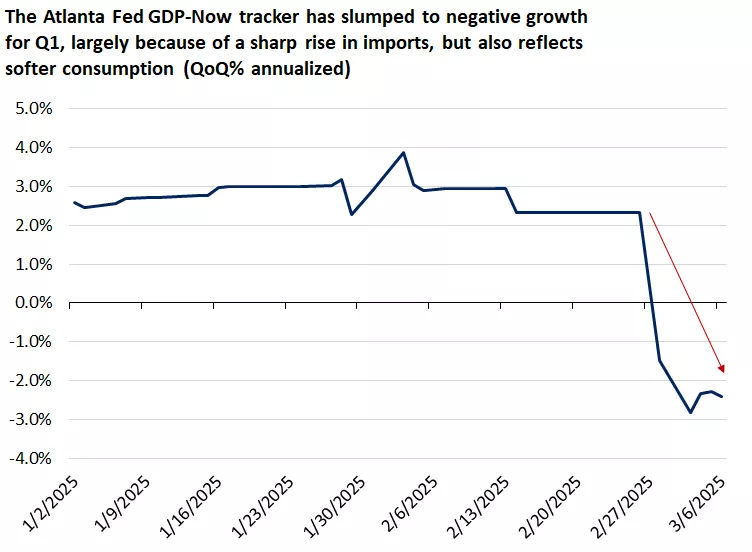

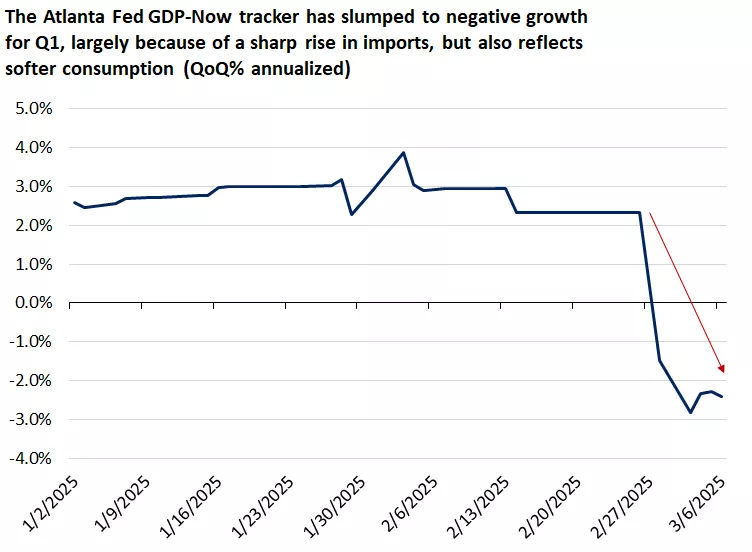

The Atlanta Fed GDP tracker is pointing to a -2.4% annualized growth rate for the first quarter, after being as high as 3.9% earlier in the year. A large part of this move lower has been driven by a sharp rise in imports, as companies look to build inventory ahead of potential tariffs. This trend is likely not sustainable in the months ahead and should stabilize and reverse. However, there was also a shift lower in consumption, which is now forecast to slow to about 0.4% in the first quarter, after being as high as 4.1%.1 We know the consumption makes up about 70% of U.S. GDP, and a slowing consumer weighs more heavily on economic growth over time.

This chart shows that the Atlanta Fed's GDPNow tracker is forecasting first quarter real GDP growth of -2.4%.

This chart shows that the Atlanta Fed's GDPNow tracker is forecasting first quarter real GDP growth of -2.4%.

From a corporate earnings perspective, in the fourth quarter of 2024, S&P 500 earnings came in at about 18% year-over-year growth, its highest since 2021.1 However, as we look toward the first couple of quarters of 2025, there has been a notable slowdown in earnings-growth forecasts. In fact, for the first quarter, the earnings-growth expectation went from 11.5% at the start of the year to about 7.3% currently. Similarly, for the second quarter, expectations went from 11.3% to 9.7%.1 So clearly corporations and markets are lowering their outlooks for earnings in the first half of the year. Forecasts for the back half the year remain steady – for now – which still leaves S&P 500 earnings growth for the full year at about 11%.1

Silver lining: The Fed may be back in play

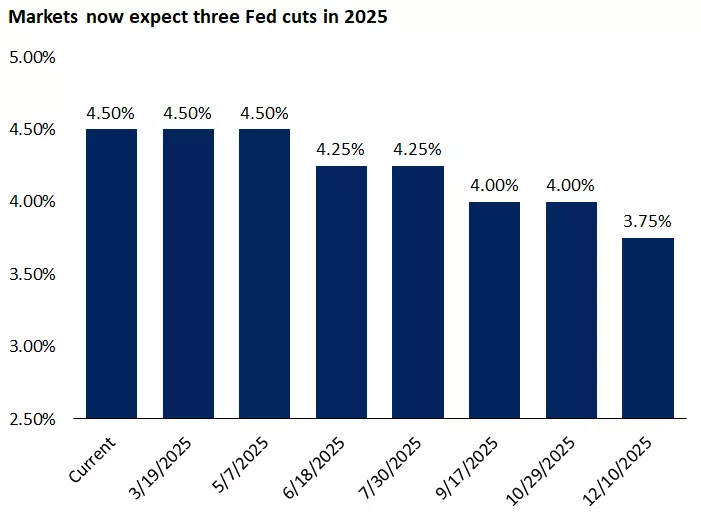

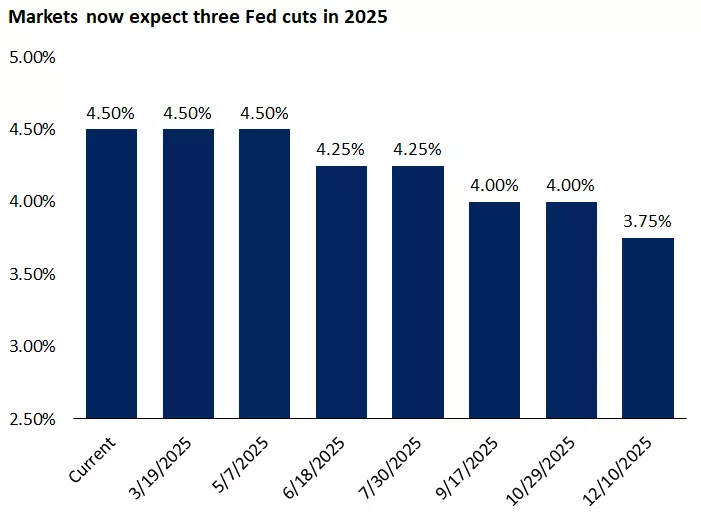

Perhaps the other offset to the cooling in economic and earnings growth is that the Federal Reserve may be more willing to provide support and lower policy rates if these trends persist. Fed Chair Powell indicated last week that the economy remains in decent shape, and even though consumer spending is moderating, and uncertainty remains elevated, he expects the Fed to remain patient on rates. However, markets have gone from pricing in no rate cuts to about three rate cuts in 2025. In our view, assuming tariffs do not create an outsized move higher in inflation, the Fed is more likely on track to cut rates two or three times this year, particularly if the labor market shows signs of weakening.

This chart shows that futures markets are now pricing in three quarter-point Fed rate cuts in 2025.

This chart shows that futures markets are now pricing in three quarter-point Fed rate cuts in 2025.

Tariffs and policy uncertainty are an overhang

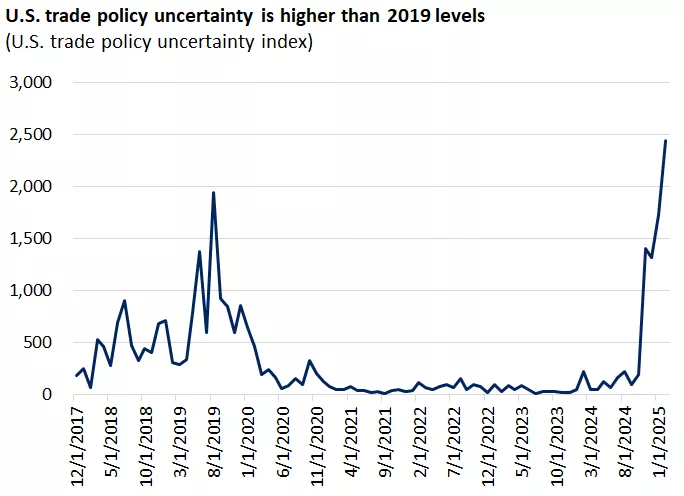

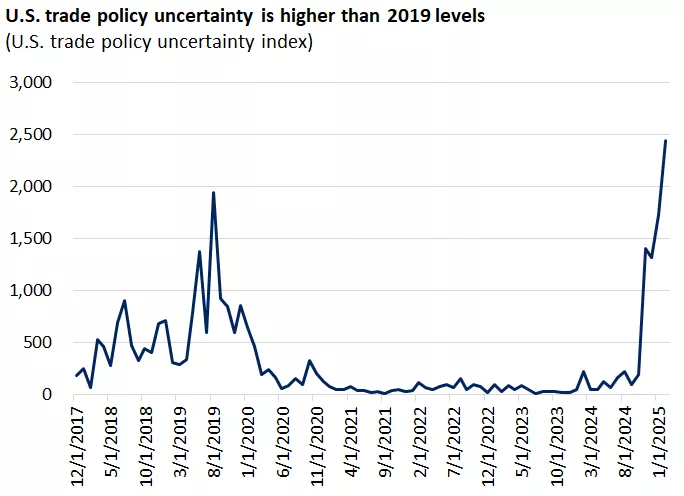

Overall, a slowing in the economy during the first quarter is not uncommon, but what is unique is the rising uncertainty in areas like tariffs, government funding, and cost-cutting policy. These continue to remain an overhang on markets and may be weighing on consumer spending and corporate activity.

This chart shows the U.S. trade policy uncertainty index which has risen above 2019 levels.

This chart shows the U.S. trade policy uncertainty index which has risen above 2019 levels.

This past week, the administration again imposed 25% tariffs on Mexico and Canada, only to postpone them for one month until April 2. Nonetheless, markets continued to fall, and sentiment did not seem bolstered by this postponement, as the threat of tariffs now looms large for April, across not only Canada and Mexico, but other economies like the European Union, which may be subject to reciprocal tariffs. Many economies, including Canada and the European Union, have vowed to implement retaliatory tariffs if the U.S. raises its tariff rates, which could lead to higher prices across goods and services for consumers and corporations.

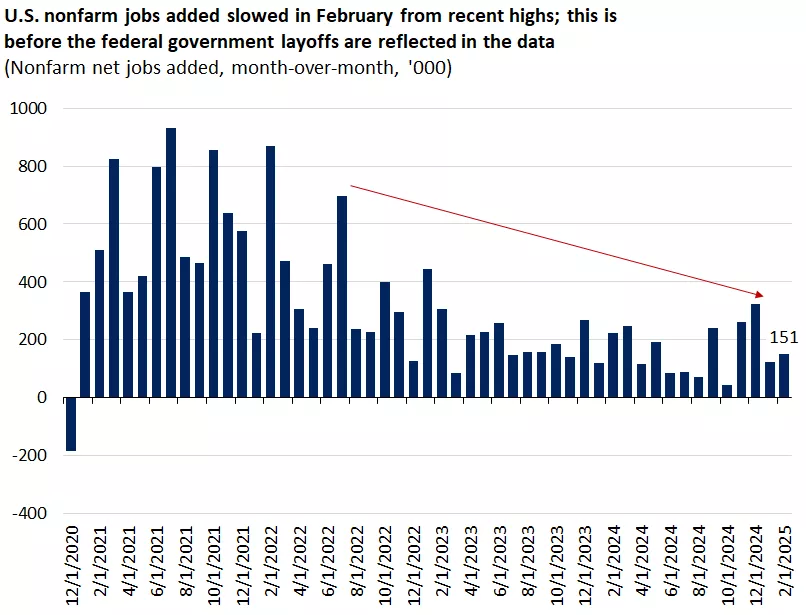

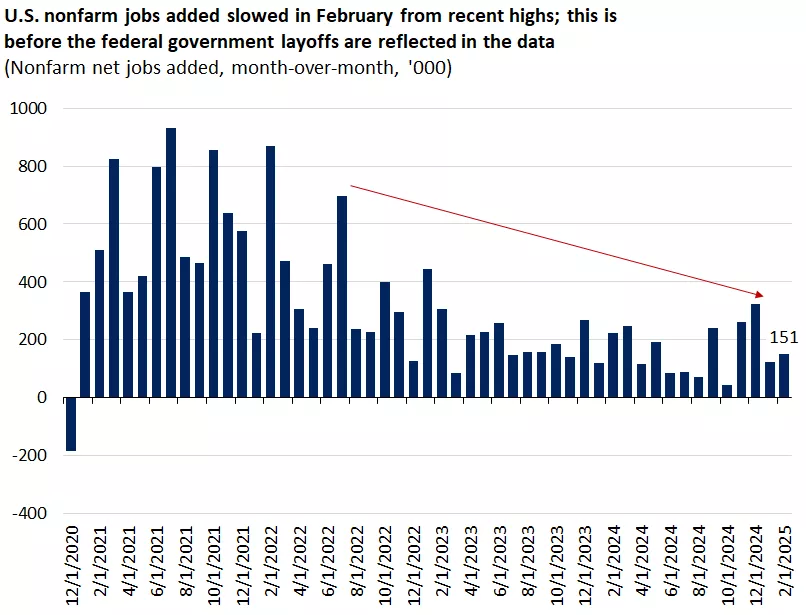

In addition to tariff uncertainty, government cost-cutting initiatives have pressured sentiment. While the U.S. jobs report for February was in line with expectations, with 151,000 jobs added and the unemployment rate ticking up only slightly to 4.1%, these figures do not yet reflect the federal government layoffs, which will likely dampen new job growth and increase unemployment. This comes at a time where new jobs added were already slowing, and corporations may be reconsidering hiring efforts in the face of tariffs and a potentially cooling economy.

This chart shows that U.S. nonfarm payroll growth has slowed in the first two months of 2025.

This chart shows that U.S. nonfarm payroll growth has slowed in the first two months of 2025.

The uncertainty around tariffs and government policy broadly could cause both consumers and corporations to hold off on spending and major investments, or delay capital markets activity like acquisitions and IPOs. In recent weeks, we have also heard from big retailers like Target and Walmart that have lowered their forecasts, driven by expectations of softer consumer spending, and have also indicated that tariffs could spark higher prices in the months ahead.

Silver lining: Pro-growth policies may be on the agenda next

As we look ahead on government policy initiatives, perhaps the good news is that while the administration is focused on tariffs and government layoffs now, it should start shifting its focus in the weeks ahead to more market-friendly policies, including tax cuts and deregulation. Although there may still be uncertainty on the outcomes of these policies, we believe markets will welcome a renewed focus on keeping corporate tax rates low and cutting regulation across sectors. Over time, we may also see the administration focusing less on tariff policies, perhaps after April, particularly if there are clear signs of more inflation and lower growth because of these actions.

Markets are taking on a defensive posture

Given the potential slowing economy and rising policy uncertainty, markets are understandably reacting with caution. The S&P 500 is now down about 2% for the year, while the technology-heavy Nasdaq is down about 6%.1 After two years of 20%+ returns in the S&P 500, though, some period of consolidation and pullback was probably warranted, and thus far markets are acting orderly.

Perhaps what is most notable are the rotations in the market happening underneath the surface. We are clearly seeing investors take more defensive posturing across asset classes. In stocks, we are seeing defensive, or "recession-proof," sectors showing leadership, including health care and consumer staples. The lagging sectors are those that have had the strongest momentum and rise in valuations, including technology (whose highest weights are in Apple, Microsoft, and NVIDIA) and consumer discretionary (whose highest weights are in Amazon and Tesla).

This chart shows the year-to-date performance of the GICS sectors of the S&P 500. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the year-to-date performance of the GICS sectors of the S&P 500. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

We are also seeing some investors move from U.S. equities to international equities, especially European and Chinese technology stocks. This comes as the economic growth in the U.S. cools, tariff and policy uncertainty rises, and investors seek better valuations and access to growth and value stocks abroad.

Finally, in bonds, we have seen some flight to safety in U.S. Treasury bonds as stock market volatility rises. The 10-year Treasury yield, for example, was as high as nearly 4.8% in mid-January, but tumbled to about 4.15%, as concerns about economic growth and policy uncertainty came to the forefront. More recently, we have seen some stabilization, with 10-year yields back around 4.3%, but bonds could continue to play a stabilizing role in portfolios this year, especially as Fed rate cuts are also back on the table.

Silver lining: Market corrections are normal and historically have led to opportunities

Overall, investors are understandably nervous – the economy seems to be softening as tariffs and government policy uncertainty remain elevated. But keep in mind that in any given year, one to three pullbacks are normal, in the 5% to 15% range, and historically these have led to buying opportunities. Especially because we don't yet see a recession, the likelihood of a deep or prolonged bear market is not as high.

Also remember that, historically, time in the market has been the better strategy than trying to time yourself in and out of the market. For long-term investors, this approach has led to meeting – and in some cases exceeding – financial goals. We recommend using periods of volatility to consider rebalancing your portfolios or diversifying across stocks and bonds, or simply starting a list of potential investments to buy if we do get better prices ahead. If needed, reach out to a financial advisor who can help you ensure that your investments are aligned with your personal long-term financial goals and can help you navigate portfolios through bouts of market volatility.

Mona Mahajan

Investment Strategy

Source: 1. Bloomberg

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| Dow Jones Industrial Average | 42,802 | -2.4% | 0.6% |

| S&P 500 Index | 5,770 | -3.1% | -1.9% |

| NASDAQ | 18,196 | -3.5% | -5.8% |

| MSCI EAFE* | 2,495.73 | 3.0% | 10.3% |

| 10-yr Treasury Yield | 4.30% | 0.1% | 0.4% |

| Oil ($/bbl) | $67.05 | -3.9% | -6.5% |

| Bonds | $98.35 | -0.9% | 2.3% |

Source: FactSet, 3/7/2025. Bonds represented by the iShares Core U.S. Aggregate Bond ETF. Past performance does not guarantee future results. *Morningstar Direct 3/9/2025.

The week ahead

Important economic releases this week include CPI inflation and a read on consumer sentiment.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important Information:

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.