Weekly market wrap

Two key macroeconomic updates ahead of U.S. elections: Earnings and the labour market

Key Takeaways

- The U.S. presidential election is now just days away, on Tuesday, November 5, and the race between the two candidates remains tight. We may not know the results of the election immediately – it could take days before the counting is finalized – and this may create temporary uncertainty for investors, which could mean some form of market volatility is likely.

- However, we also know that markets are underpinned by the fundamentals, and in recent days, data was released on two key factors that are crucial to the overall economy: Corporate earnings growth and the U.S. labour market.

- The data points to an economy that may be moderating but is still squarely positive. S&P 500 earnings growth for the third quarter is on track for 5%, slightly above expectations of around 4% growth at the start of the quarter. For the full year, earnings growth is expected to be about 9%, which is well above last year's 1% growth rate. The U.S. jobs report for October came in below expectations, but these figures were skewed by last month's hurricanes and labour strikes. We believe the labour market is moderating but not showing signs of collapsing.

- Overall, the softening in the macroeconomic data also likely means that the Federal Reserve, as well as the Bank of Canada (BoC), remain on track to lower rates again this year. This combination of lower rates and an economy that remains resilient has historically been positive for stock markets broadly. In our view, investors can continue to lean into any bouts of market volatility, election-related or otherwise, to diversify or add quality investments in line with long-term strategic allocations in stocks and bonds, as we believe the economy will benefit as uncertainty from the election is lifted and growth potentially reaccelerates.

Earnings growth has been meeting expectations, but guidance has been cautious

Third-quarter earnings season for S&P 500 companies is well underway, and the results have been modestly positive thus far. The expectation heading into the quarter was that corporate earnings would grow about 4% year-over-year, below the forecast of about 7.5% at the end of June. With about 70% of S&P companies having reported already, third-quarter growth looks on pace for about 5% thus far, which is slightly above the lowered expectations.*

This past week many mega-cap technology stocks reported earnings, including Google, Microsoft, Meta, Apple and Amazon. Overall, the trends were mixed. While almost all the companies beat expectations for revenue and earnings growth, the guidance for next quarter and outlook on spending sparked volatility for some of the stocks. Companies like Microsoft and Apple offered guidance that was below analyst expectations, while others like Meta talked about increased spending on artificial intelligence (AI), which investors worried may weigh on profit margins. There is still investor scrutiny around when these companies will realize meaningful returns on AI spending, as well as when there will be wider adoption of the technology. In our view, we believe AI is still in the early innings of a multiyear growth and adoption phase, and over time should benefit sectors beyond technology, including health care, financial services, and manufacturing.

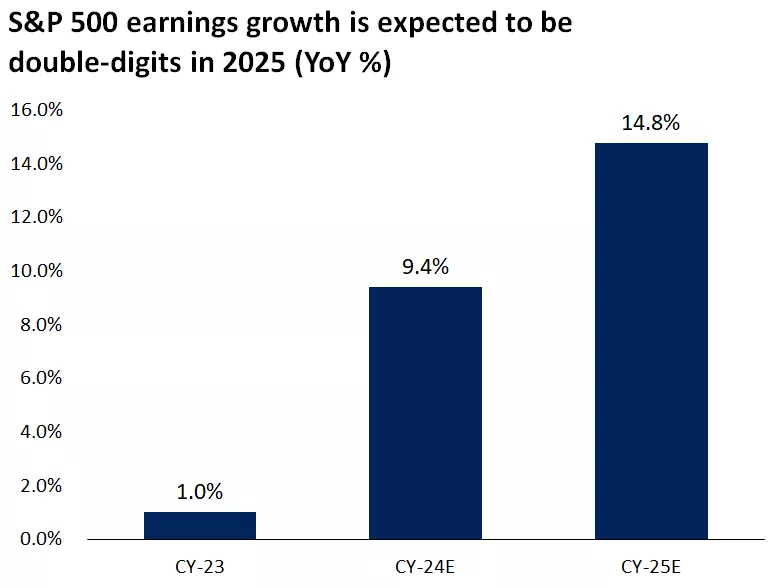

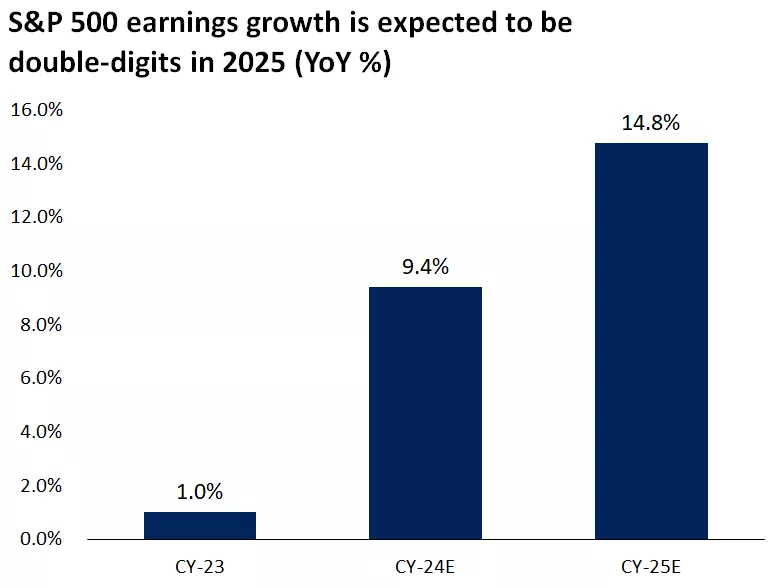

More broadly, we believe earnings growth should be positive and a driver of returns both this year and through 2025. S&P 500 earnings growth for this year is on track for about 9% annually, well above last year's 1% growth rate.* For 2025, we see the potential for double-digit earnings growth, especially as interest rates moderate and inflation remains in the 2% range, both of which should support household consumption and corporate spending.

This chart shows S&P 500 earnings growth in 2023 and estimates for 2024 and 2025. Expectations are for earnings to grow 9.4% in 2024 and nearly 15% in 2025. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

This chart shows S&P 500 earnings growth in 2023 and estimates for 2024 and 2025. Expectations are for earnings to grow 9.4% in 2024 and nearly 15% in 2025. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

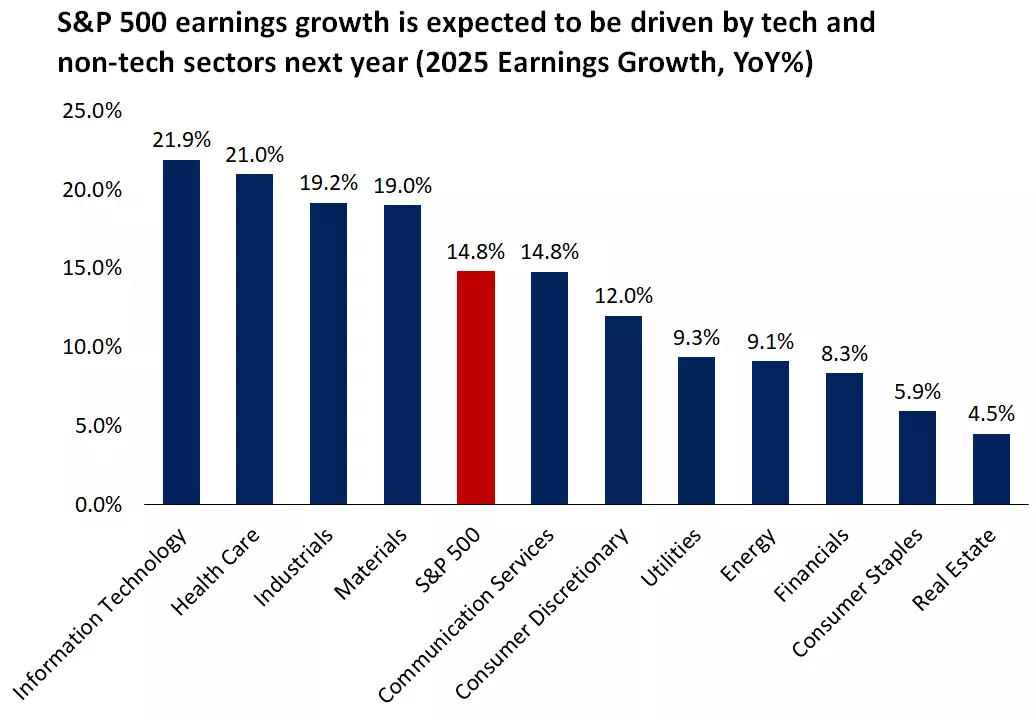

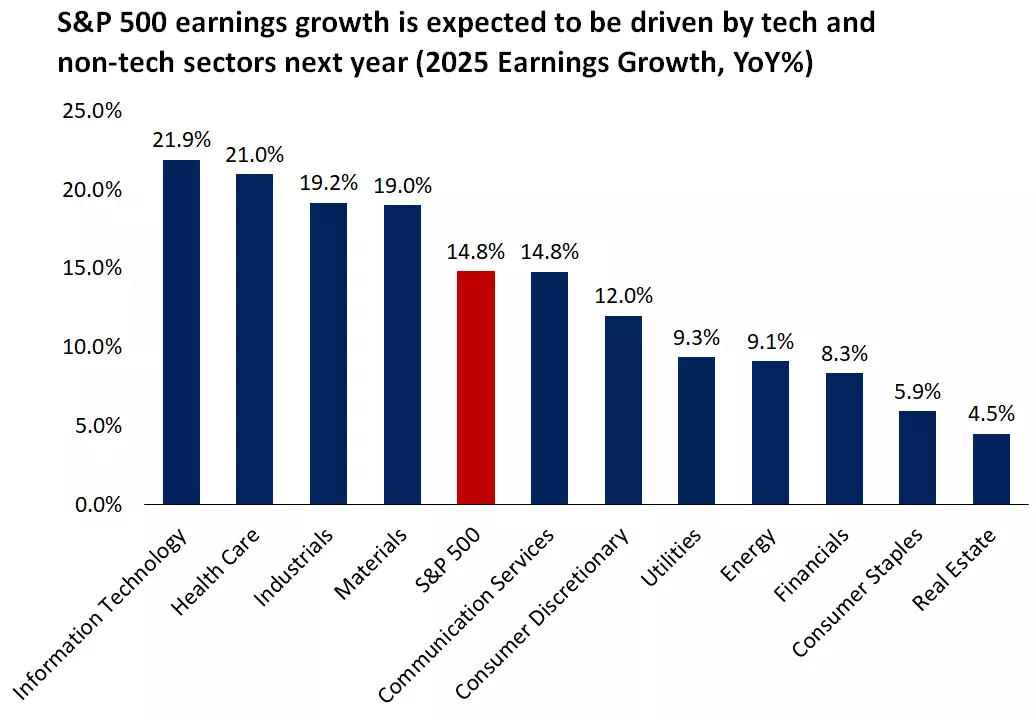

Keep in mind that stock-market returns are typically a combination of two factors – valuation expansion and earnings growth. The scope for valuation expansion remains more limited, especially in parts of the technology sector that have already experienced a meaningful rise in valuation. Thus, earnings growth will likely be the key driver when it comes to market returns. And we believe that earnings growth is poised to expand, supported by both tech and nontech parts of the market in the quarter ahead.

This chart shows earnings growth expectations for S&P 500 sectors in 2025. All eleven sectors are expected to see positive earnings growth led by tech and health care. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

This chart shows earnings growth expectations for S&P 500 sectors in 2025. All eleven sectors are expected to see positive earnings growth led by tech and health care. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

The labour market returned to a softening trend, but natural disasters and strikes skewed the picture

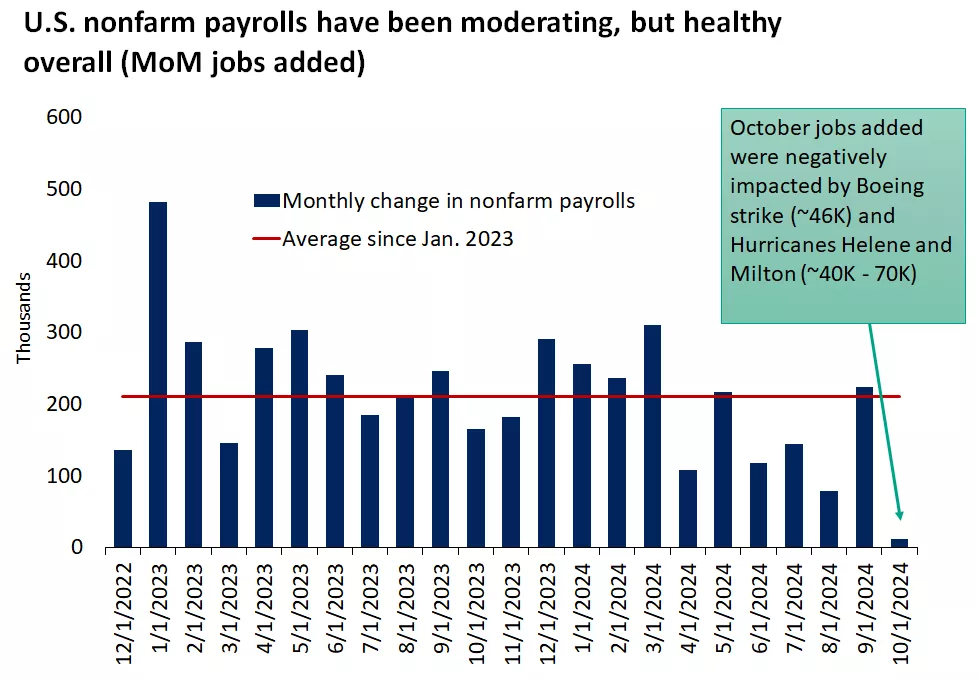

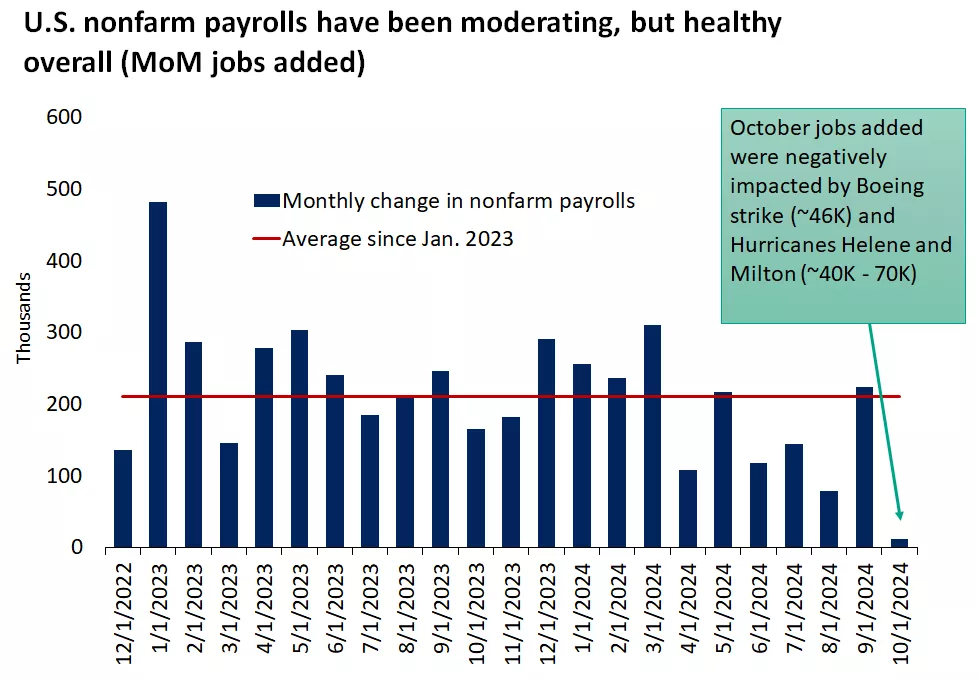

The other major datapoint released last week was the U.S. nonfarm-jobs report for the month of October. The total new jobs came in well below expectations, with 12,000 jobs added versus forecasts of 100,000.* The last two months were also revised lower by 112,000, although they were still relatively healthy at 78,000 and 223,000. The average monthly jobs added this year are now at about 170,000, below last year's average of 250,000 but still above the long-term average of 148,000.

The weakness in last month's jobs, however, was largely due to two factors: labour strikes at Boeing and impacts from Hurricanes Helene and Milton. The Bureau of Labor Statistics (BLS) estimates that the Boeing strike may have reduced jobs by around 46,000, while the two hurricanes are estimated to have had a negative impact of between 40,000 and 70,000 jobs. Adding these back to last month's jobs report would have likely yielded a figure in line with estimates but still below the average pace of gains this year.

This chart shows that nonfarm payrolls declined in October to a 12,000 gain. The decline was likely driven by weather related disruptions and striking workers at Boeing.

This chart shows that nonfarm payrolls declined in October to a 12,000 gain. The decline was likely driven by weather related disruptions and striking workers at Boeing.

More broadly, we believe the jobs data in both the U.S. and Canada continue to point to labour markets that appear to be cooling after a period of outsized strength in the post-pandemic period. However, these job markets don't appear to be imminently collapsing, and the U.S. unemployment rate of 4.1% still points to a healthy supply and demand balance. In Canada, employment data next week is likely to show that the unemployment rate ticked higher, from 6.5% to 6.6%, approaching the highs for the year.

Perhaps the positives here are that a softening labour market should keep the Federal Reserve and BoC on track for continued rate cuts in the meetings ahead, and we should see an easing in wage growth over time, which would support lower services inflation as well.

The Federal Reserve is poised to continue its rate-cutting cycle

In addition to U.S. elections next week, the November Federal Reserve meeting is also on deck for Wednesday and Thursday. Given the weaker-than-expected jobs report and downward revisions, we believe the Fed is squarely on track to cut rates next week by 0.25%. In fact, markets are now pricing in higher probabilities of rate cuts at both the November and December Fed meetings.

Beyond the 2024 meetings, we would expect the Fed to continue to bring rates toward a more neutral level, although perhaps at a more measured pace, given that it will be mindful of not stoking inflation along the way. In our view, the terminal rate, or ending policy rate, will likely be around 3.5%, which implies about six rate cuts total from the current 5.0% fed funds rate.

In Canada, the BoC has already cut rates four times, bringing its policy rate to about 3.75%. We would expect the BoC to cut rates again at its December meeting, and perhaps enact up to four rate cuts total. This would bring terminal rates in Canada closer to 2.75%, below the Fed's potential 3.5% ending rate. In our view, given that the Canadian economy has slowed more than the U.S., while inflation is closer to 2.0%, the Canadian central bank is more likely move rates lower to support household and corporate consumption.

Historically, if central banks are cutting rates for the right reasons -- i.e., inflation has moderated and they want to gradually move rates to less restrictive territory -- this is a good backdrop for financial markets. In our view, there is opportunity both for equity and bond investors, especially if the economy holds up and corporate default rates remain low.

The underpinnings of the bull market remain intact

Despite the uncertainty around the outcome of next week's U.S. presidential elections, economic fundamentals remain solid, which should continue to support the ongoing bull market. After a rally of about 60% in the S&P 500 since October 2022, the pace of gains in stocks may moderate, but markets will likely be paying most attention to the economic data, including corporate earnings growth on pace for 9% this year and a labour market that is cooling but not collapsing.

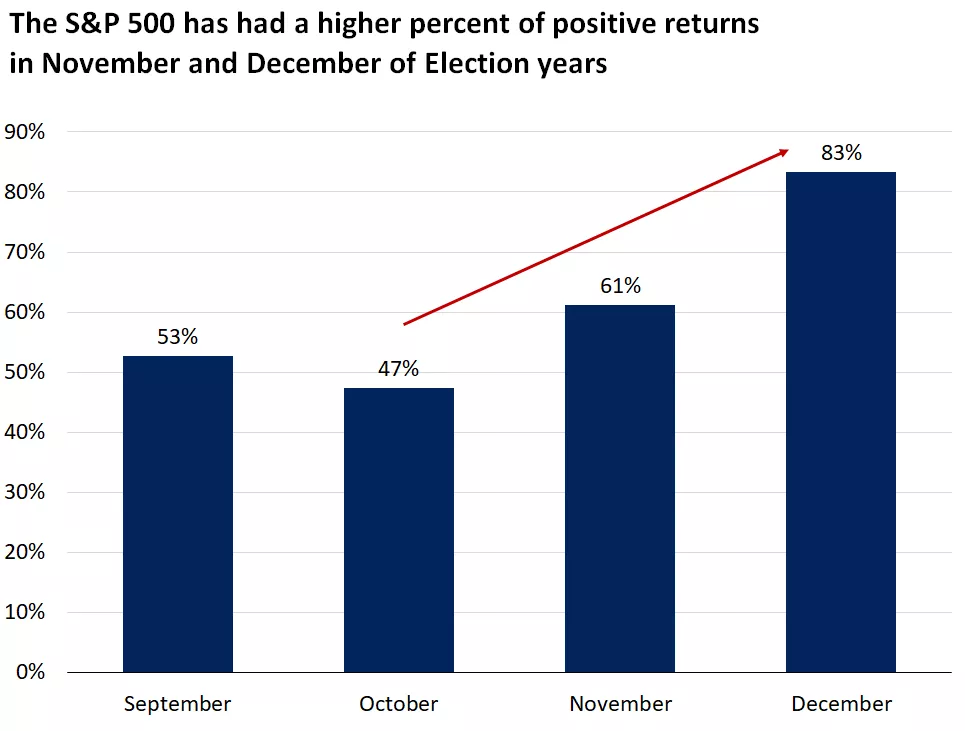

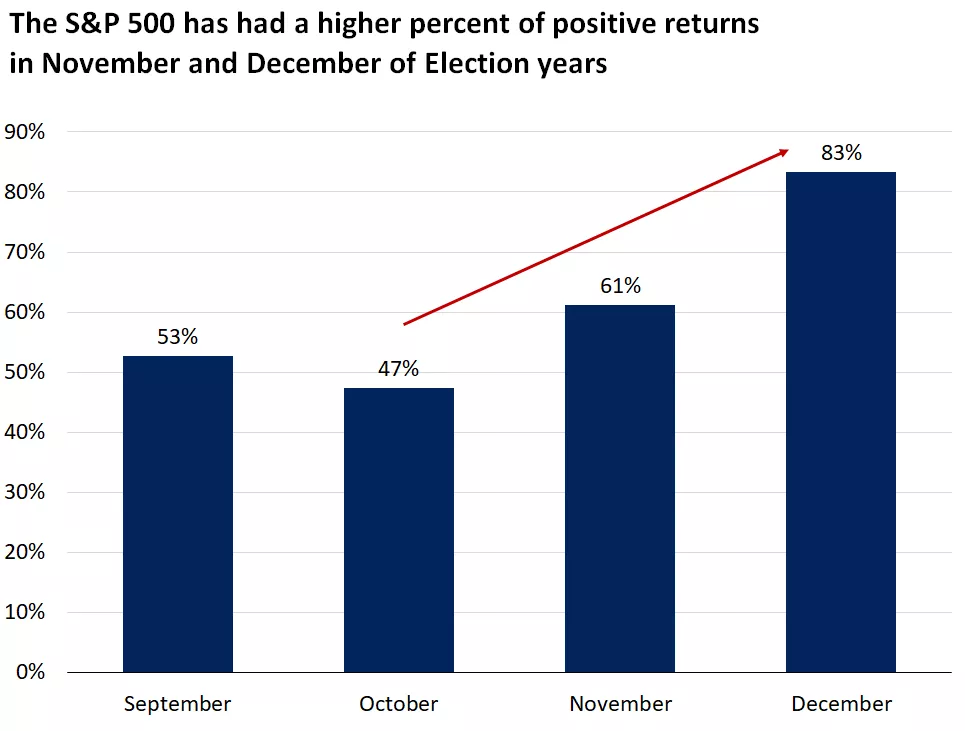

History also tells us that election-related market volatility has often been a buying opportunity in portfolios. In particular, November and December in election years have tended to be positive months for U.S. markets. For long-term investors, we would continue to lean into market volatility as an opportunity, to diversify portfolios or add quality investments at potentially better prices.

We favour U.S. large-cap and mid-cap stocks, and diversification across growth and value sectors, as earnings growth continues to expand. In fixed income, we believe investors should remain cautious of being too overweight cash-like instruments, like GICs and money-market funds, and should consider gradually extending duration in the investment-grade bond space, especially as we believe the Fed and BoC remain poised to continue their rate-cutting cycles.

This chart shows that S&P 500 returns have been positive 61% of the time in November of election years and 83% of the time in December of election years. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

This chart shows that S&P 500 returns have been positive 61% of the time in November of election years and 83% of the time in December of election years. Past performance does not guarantee future results. An index is unmanaged, not available for direct investment and is not meant to depict an actual investment.

Mona Mahajan

Investment Strategist

Source: FactSet

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| TSX | 24,255 | -0.9% | 15.7% |

| S&P 500 Index | 5,729 | -1.4% | 20.1% |

| MSCI EAFE * | 2,336.19 | -1.1% | 4.5% |

| Canada Investment Grade Bonds * | 0.2% | 2.6% | |

| 10-yr GoC Yield | 3.29% | 0.1% | 0.2% |

| Oil ($/bbl) | $69.54 | -3.1% | -2.9% |

| Canadian/USD Exchange | $0.72 | -0.4% | -5.3 |

Source: FactSet, 11/01/2024. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. *Source: Morningstar, 11/03/2024.

The Week Ahead

Important events this week include the domestic labour force survey and the U.S. presidential election.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macro-economic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC, Bloomberg TV, The Wall Street Journal and Barron's.

Mona has an MBA from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.