Should I pay down debt or invest?

A question we are often asked is, "Should I pay down debt or invest in the market?"

The decision to pay down debt or invest is more about you as an individual than it is about the math. Your decision may depend on multiple factors including:

- Your relationship with risk;

- The type of debt you have, and;

- The amount of debt you have relative to your income.

Let’s examine each point, look at two examples that compare paying down debt versus investing and review the pros and cons so that you can determine which strategy may be best for you.

How your relationship with risk impacts your decision to pay down debt or invest

The more risk you are able and willing to tolerate in your investment portfolio, the higher your expected returns are likely to be over the long term. In the short term, however, markets can be volatile and this may cause you to fall short of your long-term return expectations. It's important to understand your risk tolerance, risk capacity and time horizon to help aid you in your decision.

What is your risk tolerance?

Risk Tolerance is a measurement of your willingness and ability to withstand volatility in your investment portfolio. It is typically assessed with a risk tolerance questionnaire and can help you determine the right asset allocation for your goal. Your asset allocation helps determine your expected return.

Everyone's comfort with risk is different. Some people can tolerate high volatility in their investment returns while others get anxious at the thought that their investments could lose value. If the thought of owing money keeps you up at night and is impacting your day-to-day decisions and overall happiness, you may have a low risk tolerance.

What is your risk capacity?

Risk capacity can be thought of as how much could your investments lose in value before it has a negative impact on your life. An individual who is on a fixed income and depends on their investment portfolio to provide them income would likely have a lower risk capacity than someone with a well-paying job, little debt and saves 20% of their income.

Your capacity to assume risk is an integral part of your decision to pay down debt or invest. An individual with a stable income and little to no debt may have the capacity to increase their risk, but not the willingness. Whereas someone whose income is variable (say 100% commission) with some debt may be willing to assume more risk but may not have the capacity to do so.

What is your investment time horizon?

Time horizon refers to how long you intend to invest your money before withdrawing. Generally, the shorter the time horizon, the less risk you should assume on the investment. Therefore, if you intend to invest for 15 or more years, you may be able to achieve an after-tax rate of return that can justify investing versus paying off low-interest debt.

Different types of debt

What are the different types of debt?

Debt can come in many different forms including:

- Credit card;

- Personal or auto loans;

- Buy now / pay later;

- Mortgage;

- Student loans

- Line of credit, and;

- Margin

This list is by no means exhaustive and when used responsibly, debt can help individuals reach many of life's milestones such as owning a home and attaining an education.

Good debt versus bad debt

Not all debt is created equally. There is such a thing as good debt. But there is also bad debt.

| Good debt | Bad debt |

| It has a low interest rate, and it’s a bonus if the interest is tax deductible. | It has a high interest rate. |

| It’s used to buy something that has value, may increase in value, or will help generate income. | It’s used for something that doesn’t have future value. |

| It doesn’t increase your total debt service ratio (TDSR) above 40%. | It increases your total debt service ratio (TDSR) above 40%. |

Examples of good debt include mortgages on a principal residence that provides you with a place to live and builds equity in your home. Another example is an investment loan that is tax-deductible or a Registered Retirement Savings Plan (RRSP) loan, where suitable.

On the other hand, bad debt includes consumer debt that has a high-interest rate and that does not provide an investment return. If you currently have bad debt, such as credit card debt, you would almost certainly be better off paying it off before you invest.

How much debt is too much for you?

Too much debt is debt that you cannot maintain based on your income. It varies from person to person, as everyone’s situation is different. For instance, two individuals with the same income could have different thresholds for what is considered too much debt based on their budget and required spending. Two key measures used to determine debt affordability include the gross debt service ratio (GDSR) and total debt service ratio (TDSR) calculated as:

- GDSR1 = [Annual mortgage payment (principal + interest) + Annual property taxes + (50% of condo fees) + Annual heating costs] / Gross annual income

- TDSR1 = [Annual mortgage payment (principal + interest) + Annual property taxes + (50% of condo fees) + Annual heating costs + Other annual debt obligations] / Gross annual income

Edward Jones generally recommends that your GDSR remain under 32% and your TDSR remain under 40% to comfortably manage your debt payments and maintain any property that you may have.

If you determine that you have too much debt and you want to reduce it, review 3 strategies to help pay down debt and work with your financial advisor to put a plan in place to achieve your goal.

How to calculate the value of investing versus paying off debt

Generally, if the after-tax return provided by your investment is higher than the interest rate you pay on your debt, it is better to invest. But be careful when you're comparing your investment returns to the cost of your debt. It's often not as simple as comparing a statement return to the interest rate on your debt. Investment returns and the cost of debt need to be examined after-tax.

Returns on investments in a registered account like a Registered Retirement Savings Accounts (RRSP) or a Tax-Free Savings Account (TFSA) can be thought of on an after-tax basis, so your statement return does not need to be adjusted when comparing it to the interest rate on your debt. Alternatively, investments in a taxable account are generally subject to tax in the year that interest or dividends are received, or capital gains are realized.

Assume you hold a dividend paying stock in a taxable account. Your investment value is $10,000, and you receive $500 in eligible dividends. An eligible dividend is one from a corporation that was previously taxed on the income before the money was paid to you. Let's also assume you are at a 30% marginal tax rate.

This chart shows a hypothetical calculation of after-tax investment returns.

This chart shows a hypothetical calculation of after-tax investment returns.

In this scenario, the $500 earned as a dividend will be "grossed up" by 38% and be reported as $690.2 To calculate the taxable portion of the eligible dividend, you would multiply your marginal tax rate by the gross up amount to get $207.3 Next, the federal dividend tax credit rate is 15.0198% for eligible dividends. Multiplying the gross up amount by the federal dividend tax credit rate gives us $103.64.4 Finally, calculate the difference between your taxable portion of eligible dividends and the federal dividend tax credit amount to see the amount owed to tax. In this example, $103.365 is the tax owed on the $500 dividend. This would result in your after-tax return being reduced from 5.00% pre-tax, to 3.97% after-tax. Therefore, if you are holding debt with an after-tax rate above 3.97%6, you may be better off financially to pay all or a portion with money from your taxable account.

As you can see from this example, the math can be complex, and it can become even more complicated as interest and capital gains income are added to the equation. And your return would be further reduced if you were in a higher marginal tax bracket. For those with debt that is not tax-deductible, you could consider the rate of interest you pay to be equivalent to a guaranteed rate of return. For instance, if you have a line of credit with an interest rate of 7%, by reducing the debt, you're essentially 'earning' a 7% tax-free return on your money. To compare to our eligible dividend example above, your eligible dividend would need to be $882 (8.82% pre-tax return) for you to earn an equivalent 7.00% after-tax return.

Some advantages of reducing your debt

Most Canadians carry debt in one form or another. On average, non-mortgage debt in Canada stood at $21,296 at the end of 2023 according to an Equifax Canada report.

Debt can be amassed while in school, financing a vehicle, or taking out a mortgage. Sometimes this debt comes with variable interest rates that increase and force higher monthly payments or cause you to make smaller payments towards the principal balance. It can be stressful to always make your payments on time but not see the balance decrease in any meaningful way. If you have prepayment options, you may want to make a lump sum payment on a balance – which could be a great decision – but you should first understand your reasons for doing so and how they relate to you achieving your long-term goals.

Help reduce your money-related stress

FP Canada, the governing body for Certified Financial Planners in Canada publishes a Financial Stress Index each year and the results tell us that money-related stress is on the rise. Canadians are experiencing a host of medical issues such as anxiety and depression and are losing sleep due to their financial worries. If any of this sounds familiar, prioritizing reducing your debt may have a bigger influence on your life than just the financial impact.

The publication also reveals that those who work with a financial professional tend to have less money-related stress.

Improved cash flow and financial flexibility

When you choose to reduce your debt, you're improving your cash flow and increasing your financial flexibility. Your cash flow generally improves because you now allocate less money to principal and interest charges on your debt, leaving you more money to allocate to other goals. The impact can really be felt when paying down high-interest rate debt as the savings compound.

At the same time, your financial flexibility also increases. For instance, when you pay down debt on a line of credit, you not only increase the amount of credit available to you if you need to borrow again, but you also reduce your credit utilization, which can improve your credit score. Maintaining a high credit score can help you obtain credit in the future which enables you to be more financially flexible if you need to borrow money again.

Some advantages of Investing

Choosing to reduce debt over investing might be a smart decision for your situation, but it does come with trade-offs. By not investing today, you are reducing the amount of time your money has to grow through capital appreciation, dividend, or interest income. In the example above we looked at dividends, but there is also the possibility that the original $10,000 investment will appreciate over time.

Inflation is another factor, as your purchasing power is eroded by the rising costs of goods and services, and when inflation is higher, it is eroded at a faster rate. The combination of less time in the market and inflation may force you to work longer or reduce your standard of living in retirement. For these reasons as well as various government incentives, many people opt to carry low interest rate debt while investing their savings.

The cost of waiting

Investors sometimes justify their reluctance to invest by saying:

"Now is not a good time to invest because…"

"The markets are at all-time highs."

"Stocks are too volatile."

If you look hard enough, you will always find a reason not to do something. Over the past 20 years the markets have experienced numerous periods of uncertainty. The global financial crisis, Brexit, and the coronavirus outbreak just to name a few. These moments in history spooked investors, but markets recovered, and have since moved higher.

Time is a valuable commodity and the earlier you start to invest, the more assets you will accumulate.

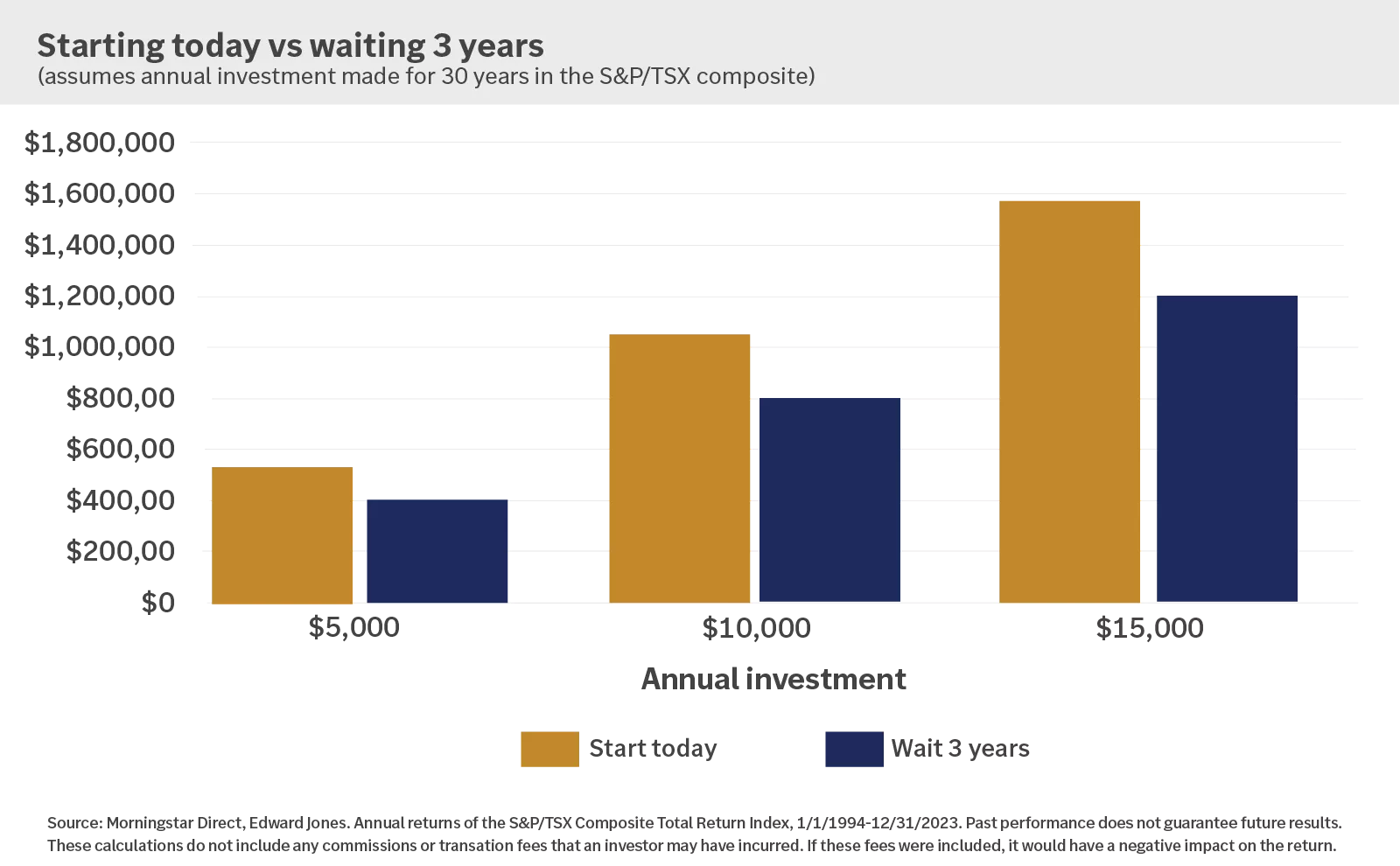

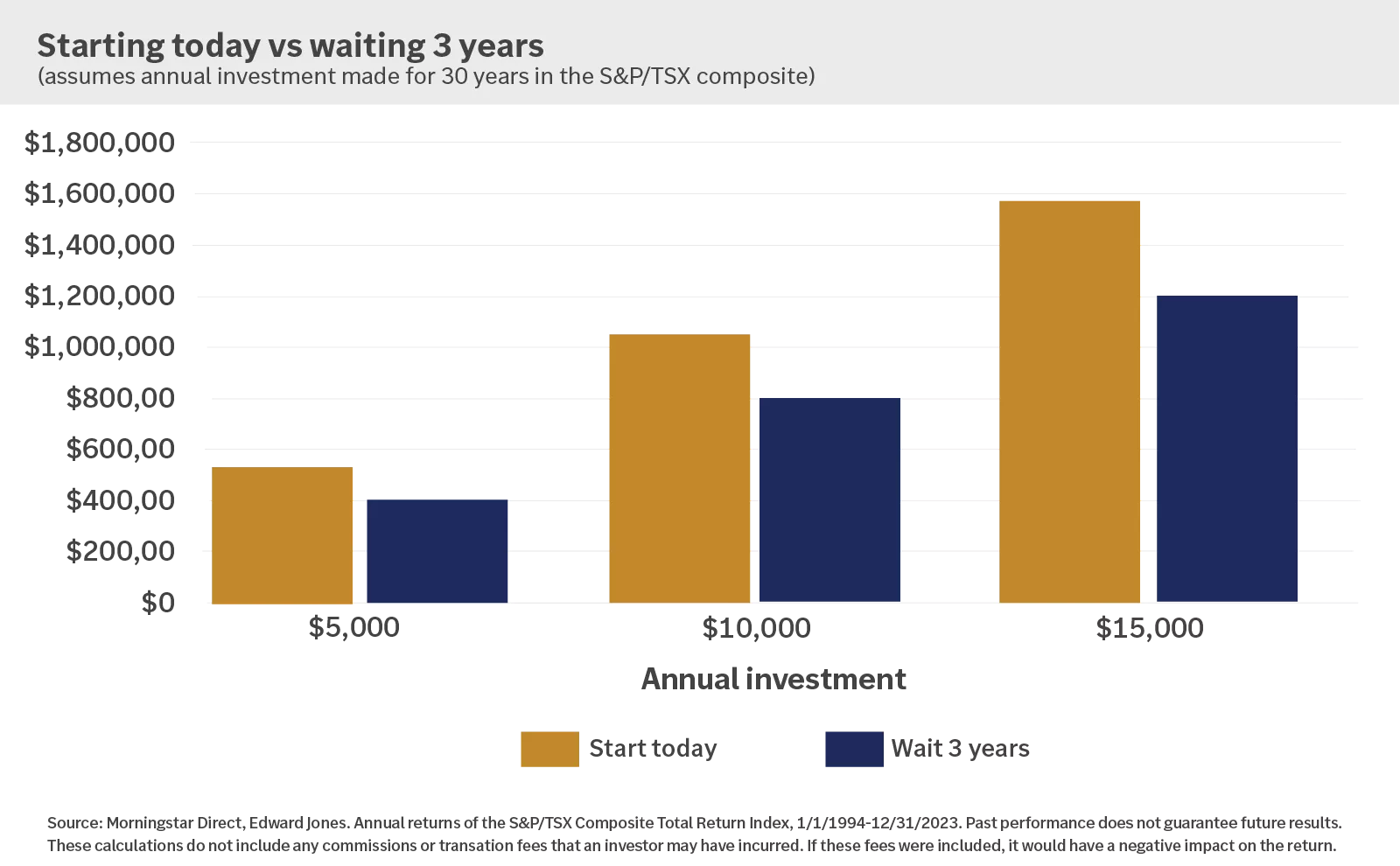

This chart shows that, over time, the cost of waiting to invest could be significant.

The chart demonstrates that generally the best time to invest is today, and that yesterday may have been even better.

This chart shows that, over time, the cost of waiting to invest could be significant.

The chart demonstrates that generally the best time to invest is today, and that yesterday may have been even better.

Government incentives

The Canadian government offer numerous financial benefits if you invest in your future.

The Registered Retirement Savings Plan (RRSP) is a registered plan designed to incentivize savings for retirement by allowing the contributor to reduce their taxable income by the amount contributed to the account. Investments within the account grow on a tax-deferred basis and are included in income when withdrawn later in life when most people are often in a lower tax bracket.

The Tax-Free Savings Account (TFSA) is a registered account designed to incentivize savings by eliminating any taxes owed on income, distributions, or capital gains earned within the account and at withdrawal.

The Tax-Free First Home Savings Account (FHSA) is a tax-free investment account designed to incentivize savings towards a first home. The account allows for a lifetime maximum of $40,000 to be contributed. Contributions are deductible, and withdrawals are tax-free if the funds are used towards the purchase of a qualifying first home.

The Registered Education Savings Plan (RESP) helps Canadians save for children's education. The government will match 20% of every contribution up to a max of $2,500 per year, per beneficiary. The maximum government grant that can be earned per beneficiary is $7,200. Earnings in the plan grow tax-deferred and are taxed in the hand of the student on withdrawal.

The Registered Disability Savings Plan (RDSP) is an account for individuals under age 60 who qualify for the disability tax credit (DTC). An RDSP is designed to promote savings for those with a disability by matching contributions of up to $3,500 per year ($70,000 lifetime) as well as providing a savings bond of up to $1,000 annually for those that qualify.

Example: Should you pay off debt or invest?

Your mortgage is coming up for renewal and you'll be forced to renew at a higher interest rate than you currently have. You're wondering if you should use the money in your investment account to make a lump sum payment to reduce your mortgage balance.

Assume that at renewal the balance is $400,000 and you can secure a fixed rate of rate of 4.75% for 5 years. You have $70,000 that you could use to pay a lump sum toward your mortgage, but you don't know if you should.

Using online mortgage calculators, we can calculate that the lump sum payment would save approximately $18,411 in interest over the 5-year period. Knowing this, we can compare the potential growth of $70,000 if it was invested in a tax-free environment like a Tax-Free Savings Account or a taxable environment like a non-registered account.

In a TFSA, your investments grow tax-free and therefore you get to keep every dollar you earn on the investment. Below shows the effects of investing $70,000 at a range of potential returns:

This chart shows the effects of investing $70,000 in a tax-advantaged account at a range of potential returns.

This chart shows the effects of investing $70,000 in a tax-advantaged account at a range of potential returns.

Since the assumed gain is higher than that which you save on making the lump sum payment to your mortgage, you would be better off investing the money in most circumstances.

For a taxable account, where the investment gain is reduced by tax, the outcome is not as clear. This example assumes an average tax rate of 21%.7

This chart shows the effects of investing $70,000 in a taxable at a range of potential returns.

This chart shows the effects of investing $70,000 in a taxable at a range of potential returns.

This decision is not just about the math. The math can help clarify the impact, but it includes a lot of unknowns and therefore we are forced to make assumptions. For instance, 5 years is not long. When Edward Jones' forecast expected rates of return, it is done for a 30-year time horizon. This is to account for short-term market fluctuations. There is no guarantee that you will be able to receive an after-tax rate of return above 4.75% over the next 5 years. You may feel more comfortable reducing your mortgage balance and saving this amount in interest.

What option is best for you: Paying down debt or investing?

To determine whether it would be better for you to pay down debt or invest in the market, you need to look at your situation holistically. Start by understanding your relationship with risk and whether the debt that you currently have is 'good debt' or 'bad debt'. Next, you'll want to examine if you have too much debt.

You should consider paying down your debt first if you have:

- A low risk tolerance;

- A low risk capacity;

- A short time horizon;

- Bad debt;

- GDSR above 32% or TDSR above 40%.

Alternatively, you should consider investing if you have:

- A medium to high risk tolerance;

- A medium to high risk capacity;

- A time horizon of 5 or more years;

- No bad debt;

- GDSR below 32% or TDSR below 40%.

How we can help

Keep in mind that these are just guidelines. Your Edward Jones financial advisor can help you determine which option is best for your unique circumstances. They can help you asses the pros and cons of reducing debt vs. investing in the context of your relationship with risk. And they can help with the math to ensure you're on track to reach all your financial goals.

If you don't have a financial advisor, review the benefits of partnering with one and search for an Edward Jones financial advisor in your community.

Important information:

1 This calculation can also be performed with monthly numbers by dividing annual numbers by 12.

2 $500 x 1.38 = $690.

3 30% x $690 = $207

4 15.0198% x $690 = $130.64

5 $207 – $103.64 = $103.36

6 $396.64 / $10,000 = 3.97%

7 Assumes 21% average tax rate, total capital gains below $250,000 in a given year and based on a portfolio consisting of 40% interest, 30% dividends and 30% capital gains income for a middle-income earner.