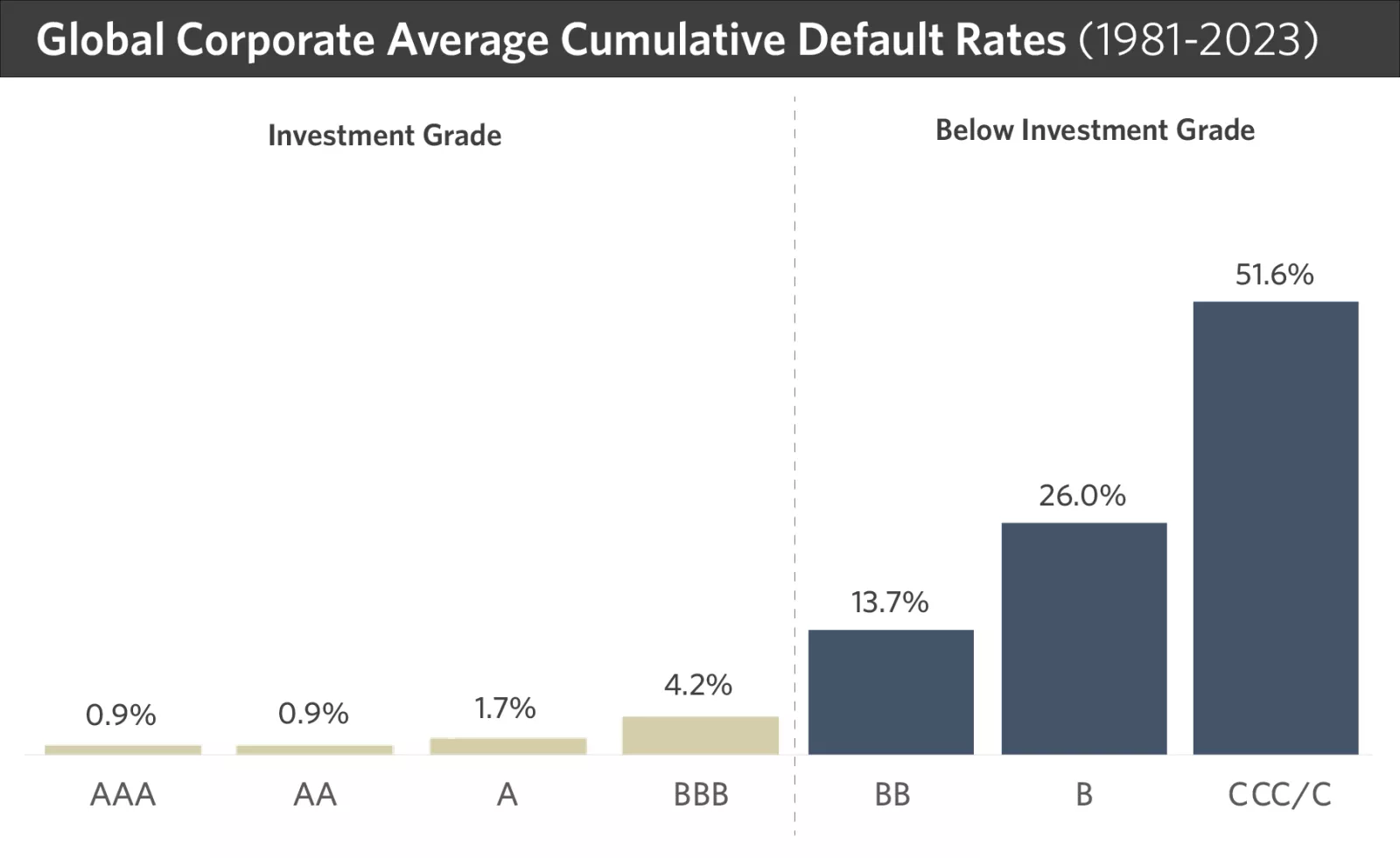

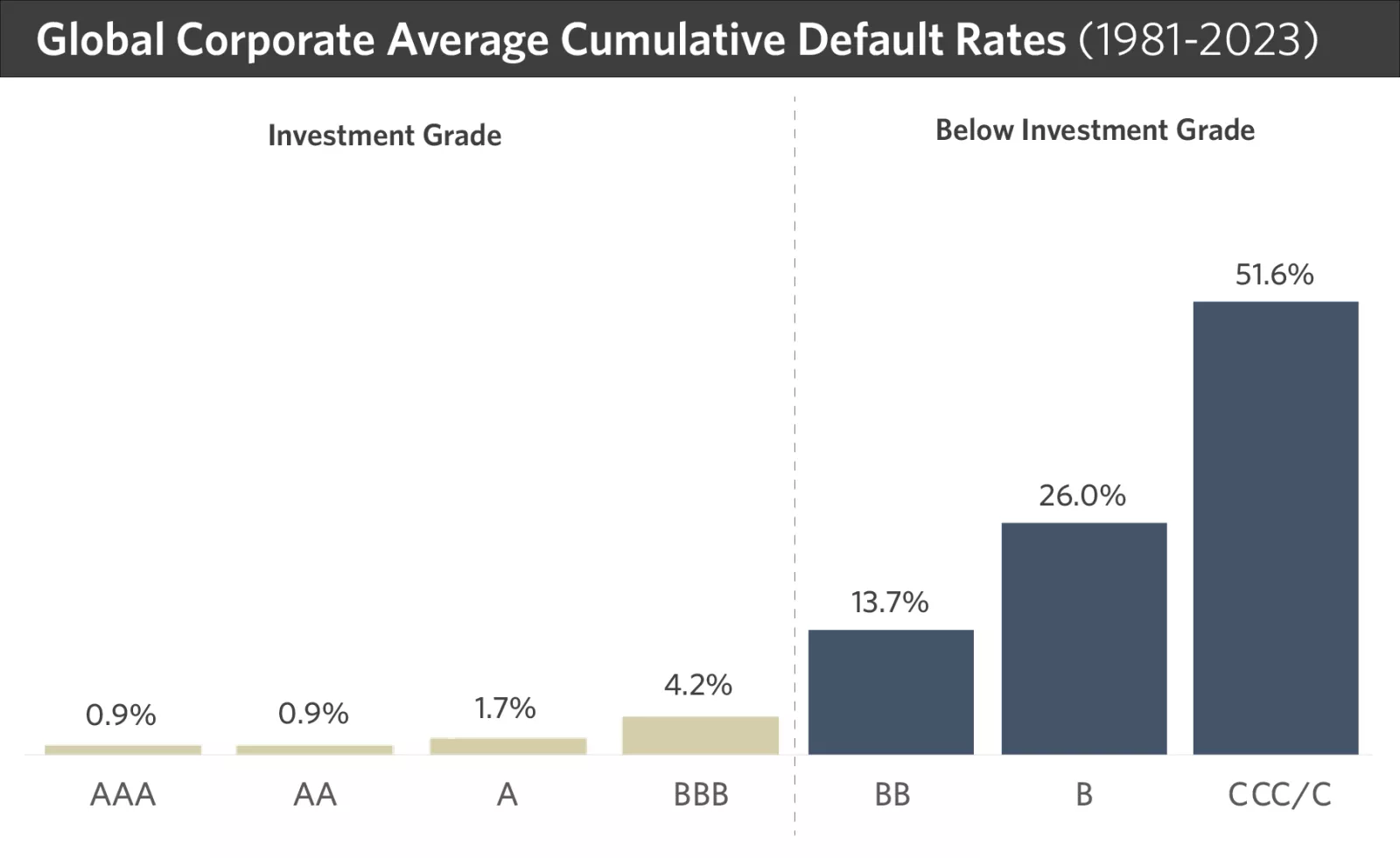

Reliable income is an important goal for most fixed-income investors. When buying bonds, don’t be tempted by lower-quality bonds paying higher rates, because of the increased risk these bonds often fail to make interest payments, as shown below.

This chart shows that higher-grade bonds have lower default risk.

This chart shows that higher-grade bonds have lower default risk.

Since higher-quality bonds have a lower default risk, we recommend 85% of your fixed-income portfolio be composed of bonds rated AAA, AA or A. Though bonds with a BBB rating are investment-grade quality, they should make up only a small portion of your portfolio.

Credit ratings can change over a bond’s life. Bonds rated AAA, AA or A have more cushion before reaching non-investment-grade status if the bond is downgraded. A downgrade from BBB to BB+ or lower puts a bond below investment grade, and the risk of failing to make timely interest and principal payments increases. A bond that has declined in credit quality may have a significantly lower market price at the time of sale. It’s important to review your fixed-income investments periodically to make sure they still align with your goals and comfort level with risk.

You should strive to diversify your fixed-income investments. A broad-based fixed-income mutual fund can generally provide fixed-income diversification and professional management, whereas a portfolio of Exchange Traded Funds (ETF's) will generally follow a specific fixed-income index.

Diversify by issuer

Owning bonds from a variety of issuers can help reduce overall risk. Work to ensure that no single obligor – the issuer making interest and principal payments – makes up more than 10% of your total investment portfolio.

Guaranteed Investment Certificates (GICs) are short-term savings investments issued by banks, trust companies and credit unions. Since GICs are insured up to $100,000 per depositor for each institution, they are of high credit quality up to the CDIC insurance limits. However, GICs must be held until maturity. They cannot be sold or redeemed prior to maturity and may have limitations on their ability to be transferred from one account to another. This lack of liquidity reduces their overall attractiveness.

In addition, since GICs have short-term maturities, they are affected more by reinvestment risk. As a result, GICs may not be appropriate for the longterm portion of a fixed-income ladder. You don’t need to own GICs as part of a well-diversified fixed-income portfolio. However, if you choose to own them, we suggest GICs make up no more than 15% of your fixed-income portfolio.

Diversify by category

Two primary categories of bonds are government and corporate. Owning bonds across categories can help balance bond credit quality and your income needs.

- Government – Government bonds include Canadian Federal, Provincial and Municipal Bonds. Because these bonds generally possess high credit quality, including them in your portfolio is a good way to enhance the overall quality of your fixedincome holdings. Historically, they’ve given investors relatively stable returns due to their relatively low level of risk. Keep in mind that past performance is not a guarantee of future results.

- Corporate – Corporate bonds are categorized in three sectors: financial, industrial and utility. We recommend that you consider owning bonds from each sector. That way, if a particular sector experiences some challenges, you’ll own other bonds that likely aren’t affected by the same factors.

Bond sector recommendations

| Sector | Recommended range |

| Government | 40% - 60% |

| Financial | 15% - 30% |

| Industrial | 10% - 25% |

| Utility | 5% - 15% |

The primary reason most people own bonds is for the income they provide and the promise of their principal being returned at maturity, in addition to the diversification they offer to a portfolio. As stated before, a bond’s interest rate shouldn’t be the primary reason you purchase it. Consequently, even if it means accepting a slightly lower interest rate, you should ensure your bonds are appropriately diversified across sectors.

Diversify by geography

Exposure to international fixed-income investments may improve the diversification of your fixed-income portfolio. You may want to consider global bond funds that are widely diversified and primarily own developed-country bonds. However, they can add currency risk to your portfolio, making them potentially more volatile than domestic investments. If they are appropriate for your situation, we recommend they make up no more than 15% of your portfolio.

In addition, you may choose to own U.S. dollar bonds, which offer attractive rates at times and include a wider variety of corporate issuers, which may improve the diversification of your bond portfolio. U.S. dollar bonds provide income to match any U.S. expenses you expect. While you don’t need to own U.S. dollar bonds, the appropriate amount for you to own will depend upon your needs for U.S. dollar income and further diversification.

Making sure your bonds aren’t all from one province, municipality, region or corporate sector can also help you reduce risk.

If you’re looking for current income, work with your financial advisor to determine which types and amounts of bonds are appropriate for you. Diversification is key in helping ensure your portfolio can weather any market ups and downs. Keep in mind, however, that diversification does not guarantee a profit or protect against loss in a declining market.

We recommend buying bonds with the intention of holding them until they mature or are redeemed by the issuer. Bonds can provide interest payments and a return on principal. Although it can be tempting to time the market as interest rates and bond prices change, we believe you should buy bonds for the current income they provide and overall diversification to a portfolio.

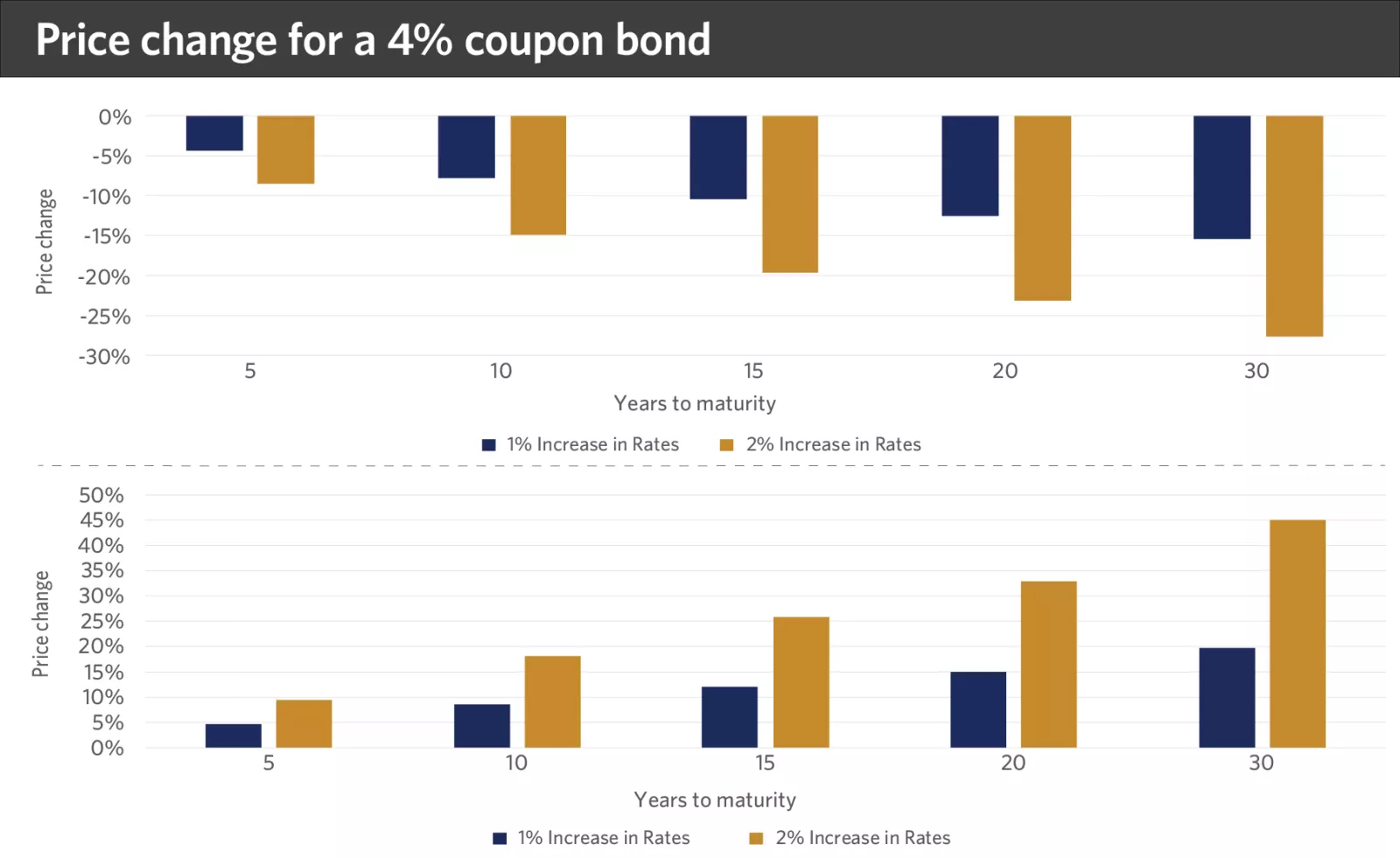

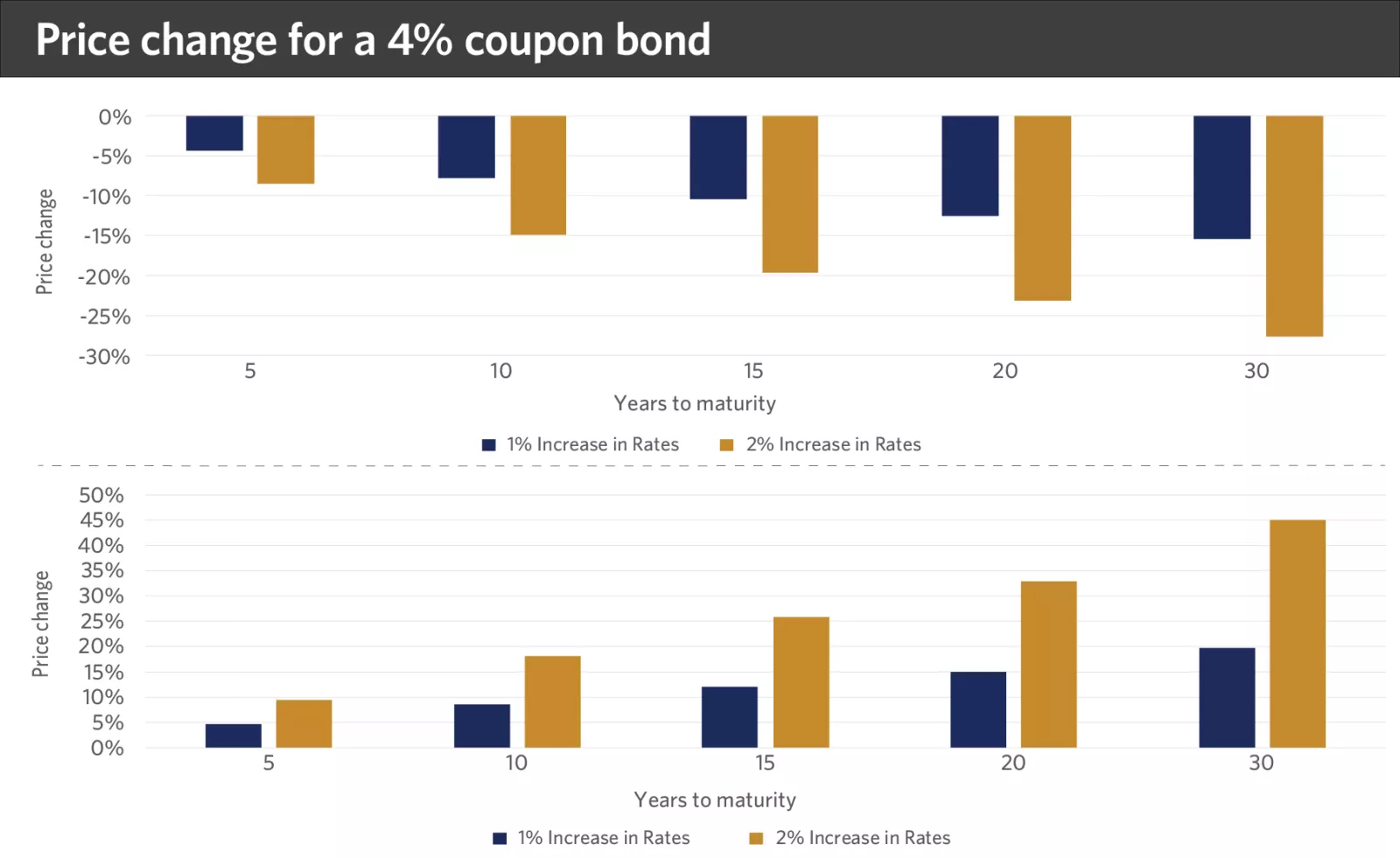

Bond prices and interest rates

Bond income is usually fixed, but interest rates can cause a bond’s market value to vary – bond prices typically fall when interest rates rise. The opposite is also true, although bonds that can be called by the issuer have limited opportunity to appreciate in price because the call acts like a ceiling, keeping prices from rising. The longer the maturity, the more sensitive bond prices are to rate changes. This relationship affects only the market value, or the approximate amount received if you sold a bond prior to maturity. The interest payments received are not affected. If you hold a bond until maturity, you can still expect to receive the original face amount.

Longer-term bond prices fluctuate more than shorter-term bonds. The example below shows how much prices of bonds with a 4% coupon would be affected by a 1% change in rates. With a 2% rate adjustment, price changes would nearly double.

This chart shows that higher-grade bonds have lower default risk.

This chart shows that higher-grade bonds have lower default risk.

Help manage risk with laddering

By investing in a variety of bonds with short-, intermediate- and long-term maturities, laddering is a long-term strategy that helps manage risk and doesn’t depend on rising or falling interest rates for success. It can also help balance the risks of price and income changes to smooth wide swings in your income and principal. Bond laddering doesn’t ensure a profit or protect against loss. Evaluate the securities within the bond ladder to ensure they align with your investment objectives, risk tolerance and financial circumstances.

Bond ladder recommendations

| Maturity type | Recommended range |

| Short term (up to 5 years) | 25% - 35% |

| Intermediate term (6 to 15 years) | 40% - 50% |

| Long term (16+ years) | 20% - 30% |

Watch the call

Some bonds are callable, meaning the issuer can redeem the bond before its maturity date. It’s more difficult to ladder with callable bonds because you don’t really know how long you’ll own them. Callable bonds typically offer a slightly higher rate to compensate for the risk of the bond being redeemed early. This risk can increase significantly if interest rates fall but is generally lower when interest rates rise. This call feature benefits the issuer, who can refinance the bond at a lower rate.

Callable bonds increase your reinvestment (or income) risk. If a bond is called and interest rates are lower, you’ll have to reinvest your money at a lower rate. When possible, limit your number of callable bonds and provide some variety in the call dates of those you own. Noncallable and make-whole call bonds* should be included in bond portfolios when appropriate to help diversify the risk associated with callable bonds.