Family meetings: An empowering platform for family communication

Amy Theisen, CFP® • Senior Strategist, Client Needs Research

Tracey McLennan, CFP®, MFA-P™, FEA • Leader and Senior Wealth Consultant

Tim Brisibe, LLB, LLM, TEP, MFA-P™, FEA • Leader and Strategic Consultant

Family meetings can serve as a platform for positive communication and to build understanding in many areas, especially when it comes to passing on your wealth and what it means for the people you care about. If handled well, family meetings can lead to more effective communication and decision-making. They can ensure everyone is on the same page, provide opportunities for growth and development among family members and enhance relationships to bring your family closer. Family meetings can also be a forum to celebrate what makes your family truly unique.

Communication is key

Every family in Canada has its own structure, shared circumstances, memories, conflicts, beliefs and values that shape how they work and communicate to get things done. Strong family communication can help address concerns about providing support for loved ones and help establish financial security across generations.

If you’re holding family meetings as part of your estate planning process, it's important to have foundational documents, such as a Will (and potentially a Trust), powers of attorney and health care directives in place. These core documents serve as a detailed roadmap for your executor or others in situations where you are incapacitated or no longer here.

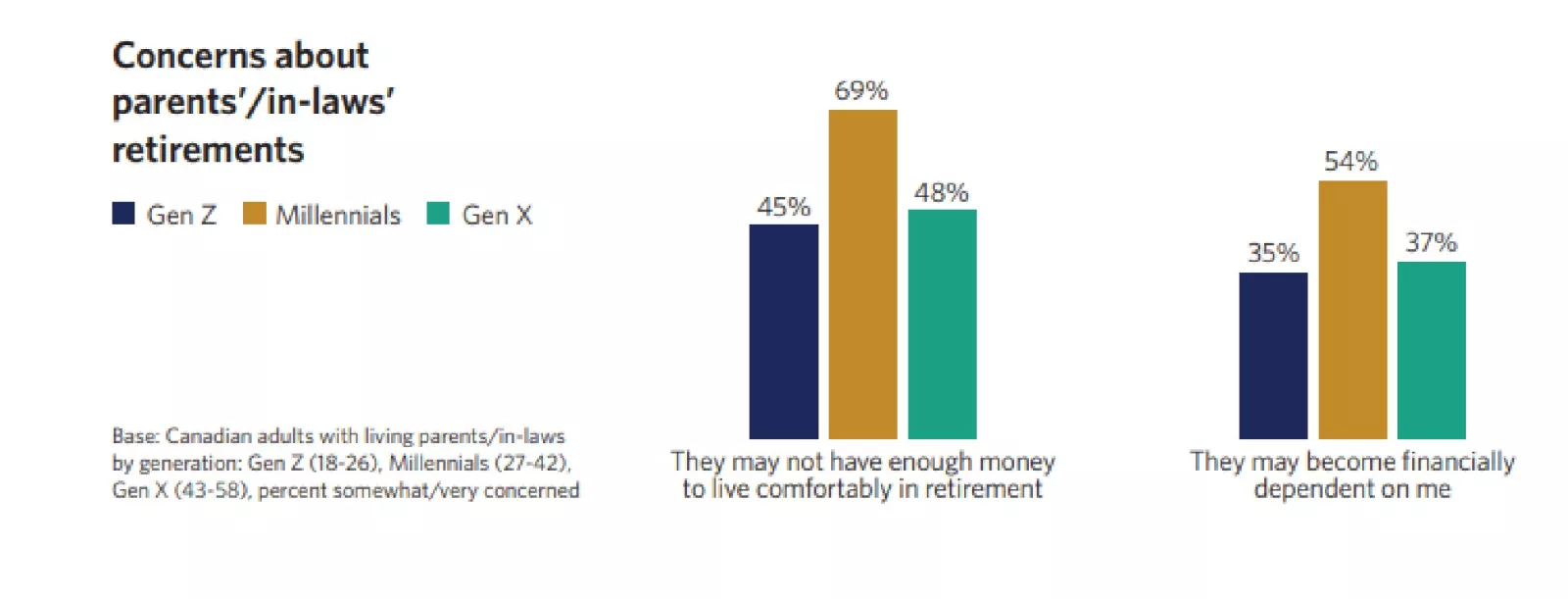

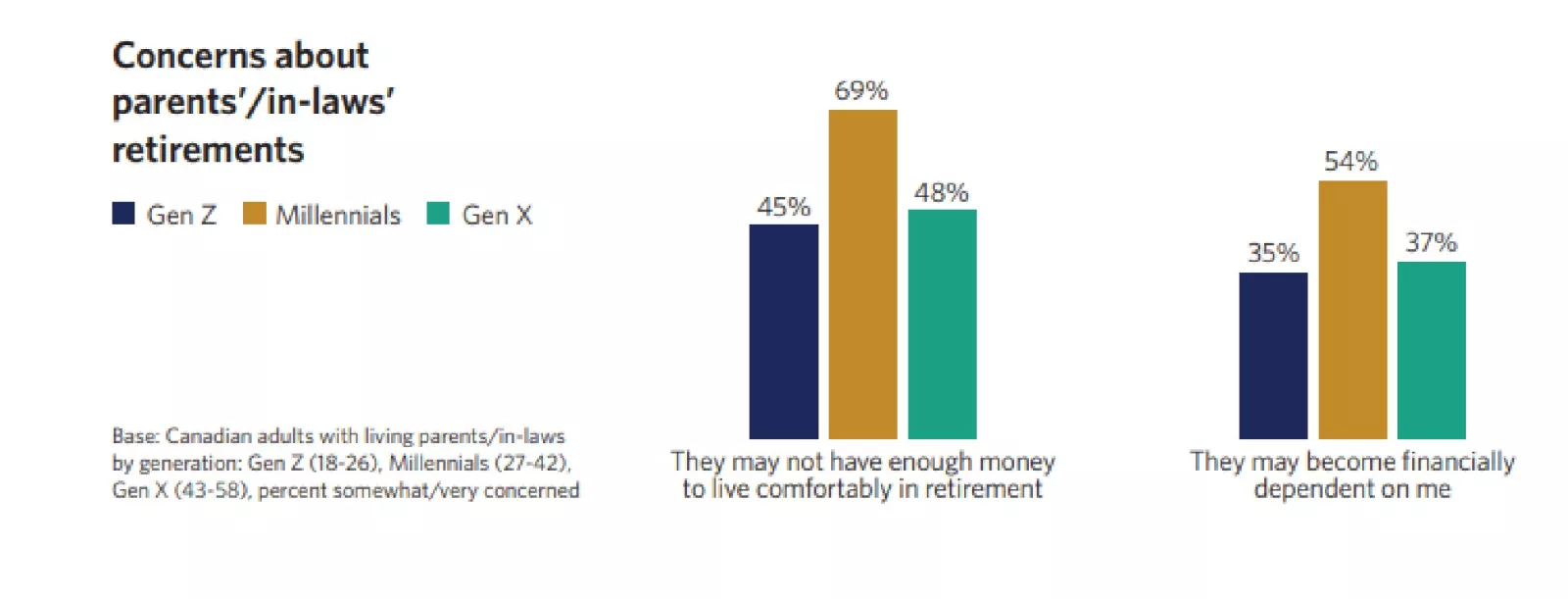

88% of retirees don’t want to be a burden on their families, while 69% of Millennials are concerned that their parents may not have enough money to live comfortably in retirement.

Edward Jones Canada/Age Wave Study, Resilient Choices: Trade-Offs, Adjustments, and Course Corrections to Thrive in Retirement, 2023.

Who would benefit from a family meeting?

Almost all families can benefit from sharing and discussing various financial matters. A common family meeting may be to discuss your gifting and estate planning intentions. You can also use the meetings to teach others how to manage finances and share your personal experiences. Keep in mind, these meetings aren’t the best time or place to talk through deep family conflicts or resolve other sensitive issues. If needed, arrange a separate gathering for those topics — especially if there are sensitivities for some family members (such as children).

Benefits of a family meeting

- Healthy communication and transparency

- Enhance family relationships

- Share information and educate

- Problem-solve together and potentially provide support

- Introduce advisors

- Address and decrease the potential for conflict

- Reinforce family values

- Opportunity to schedule meaningful activities or have fun!

Family Meeting Pre-work

As you prepare to gather your loved ones for your first formal or financial review meeting, consider what is important to you and your family – your core values. Does your family value openness, curiosity, hard work, and giving back to the community? Do you and your family have the same definition of "fair"? By understanding what motivates you and others, you can prepare to connect more deeply and communicate your wishes more clearly. It will also assist with future planning conversations and activities, like who to invite and where and how often meetings can be held.

Estate and financial review meeting

One of the most common types of family meetings is an estate and financial review meeting. Generally, the senior generation shares their estate plans and (possibly) financial preparations with their children. A key benefit of this meeting is to share the “why” behind your estate plan: what’s important to you (core values) and the reasons you made specific decisions. It is also a time to ensure those named to specific roles in your documents understand — and are comfortable with — their responsibilities.

Since you may not want to share your most detailed financial information in the first family meeting, there are four common approaches you could take, depending on your objectives. The inclusion of all meetings and the order of the meetings would be determined by the needs and communication preferences of your family.

Basic family meeting: Overview of estate documents

This approach provides a high-level review of the documents in place, and the focus is on the roles and responsibilities of those named in the documents. It helps to ensure alignment with those named to act on your behalf. This type of meeting does not include a financial discussion but may focus on sharing what is important to the family. Many choose to start with this type of meeting and use the time to introduce family members to their financial advisor, tax specialist, and attorney.

A closer look: Finances and estate documents

This approach also includes a high-level review of your financial situation. Since you will be discussing account balances, such as net worth, this may put your beneficiaries’ minds at ease, or they may have questions such as, “How will my parents pay for their health care costs? What does this mean for me? Will I receive an inheritance?” These questions are common, so it’s a good idea to be prepared with how you will respond. This meeting is also an appropriate forum to discuss how you’ll address your anticipated and unexpected needs, financial and otherwise. It can also be used to engage your family in discussions about other gifts that are important to you, such as giving to your favorite charities and encourage family participation to continue your giving back if appropriate.

Family education meeting: Learning about applicable financial structures

This meeting is an opportunity to educate family members about financial information or structures. For instance, not everyone may understand what a trust is, when to use one, or how to manage the assets of a trust. Some family members may wish to learn more on how to read financial statements, or the management of real estate assets. This meeting does not require full and transparent disclosure of the family assets or balances, but instead provides the family with the tools to steward the family assets.

A deep dive: Complete transparency discussion

This review details your estate plan and financial situation, as well as how you will distribute your assets and the estimated dollar amounts or percentages. Sharing this level of information can be beneficial, since your children may have a different point of view (no desire to inherit specific assets), or perhaps you made incorrect assumptions about your children’s and grandchildren’s needs. If you are not dividing assets equally, this could be an emotional discussion, because some may see asset distribution as a proxy for how much they are loved. Sharing your thought process gives context to your decisions and time for discussion, rather than leaving your children and grandchildren to draw their own conclusions.

REMEMBER:

Money always transfers with a message. If you are not explicit, you leave your family to determine that message.

Note: Due to the nature of estate and wealth transfer discussions, it’s important to address confidentiality and what information you don’t want to share (such as senior generations’ net worth, timing of large inheritance, etc.).

Five steps to hosting an estate or financial review family meeting

- Invite participants to attend the meeting

- Plan the meeting

- Develop and finalize the agenda

- Host the meeting

- Follow-up and next steps

1. Invite participants to attend the meeting

The first step in the process is to gain agreement for participation and invite guests.

Who’s invited: Whom to invite can be a delicate subject and there is no one right answer. As a best practice, try to be as inclusive as possible based on circumstances. It’s important to have transparency and no appearance of bias as to how invitations were extended. A best practice is to have an agreed-upon framework for attendance and apply it consistently. This is particularly important for blended families or if your preference is to include only lineal descendants.

2. Plan the meeting

When it comes to encouraging attendance, it’s important there are no surprises. Clarify who is invited (children, in-laws, grandchildren, etc.) and expectations for their participation. If there are any travel expenses, dinner, or entertainment costs for attendees, the host could offer to pay for all (or part) of the costs.

Location matters: One of the keys to a successful family meeting is for attendees to be comfortable and free to focus without distraction. Key considerations include:

- Family home: May not be a neutral site. Attendees may revert to old behaviors and established roles in the family (decision maker, oldest child, youngest, etc.).

- Vacation spot/desirable location (i.e., restaurant): Time off from work and cost could pose challenges; frequently the host pays for lodging, meals and transportation as a gift of appreciation for attendance.

- Financial advisor’s office: Do the attendees know the financial advisor? Is this a comfortable location for all?

- Virtual meeting: Attendance is easier to navigate, but there are some trade-offs, such as lack of in-person connection and opportunity for distraction.

3. Develop and finalize the agenda

Determine what information you would like to share and which advisors or facilitators you would like to include. Send the completed agenda and any relevant materials prior to the meeting (but after invitations are extended). You may also want to:

- Limit the duration to a half day or one full day — could be shorter, depending on content.

- Incorporate breaks.

- Make sure there is adequate time for thoughtful discussion.

- Determine whether you are sharing information, asking for an opinion, or deciding as a group.

- Incorporate fun or a social activity if possible.

- Invite someone to facilitate the meeting, like a Family Enterprise Advisor (FEA), a spiritual leader, or someone who is trained and skilled at facilitating sensitive meetings, if you think that would help your family navigate the meeting more successfully.

4. Host the meeting

Family meetings can be a time for reflecting and catching up, but they can also increase stress for some participants.

- Designate a scribe to capture notes.

- Establish “rules of engagement” or “meeting ground rules.”

- Stay focused, listen, adhere to the agenda and follow the meeting ground rules.

- Check in throughout the day and recap what you’ve discussed to ensure everyone is on the same page.

- Don’t overlook the opportunity for connection and enjoy each other’s company. Family meetings are an excellent way to share and create new memories.

5. Follow-up and next steps

To ensure everyone had a mutual understanding of the meeting, you’ll want to provide meeting notes to the participants in a reasonable amount of time (two to three weeks). Note specific action items, who will address the issues and the anticipated time frame.

Common family meeting ground rules:

- Be respectful

- Do not interrupt

- Focus and listen

- No phones

- Stick to the agenda

- Maintain confidentiality

- Do not speak for others

- Focus on the future

Make your own rules: While the above list is a great place to start, go ahead and tailor your meeting rules to reflect your unique family circumstances.

Family meetings

Your estate plan is dynamic and must be reviewed and updated periodically; family meetings are similar. Many families choose a periodic approach or meet annually to discuss what remains the same as well as what has changed. These meetings can be a wonderful way to strengthen relationships, enhance communication and foster relationships between children and grandchildren as they grow and mature.

Next steps

You’re not alone in planning this type of meeting. At Edward Jones, your financial advisor in partnership with our Client Consultation Group – a team of highly specialized and accredited financial planners, tax, insurance, legacy and estate professionals – can help simplify your complex financial needs. Together, they take a personal approach to help you meet your goals, answer questions, and guide you through the Family Meeting process.

The information presented is subject to change and is for educational purposes only. It should not be considered tax or legal advice. Before acting on any of the information presented in this article, it is important to seek the advice of a qualified tax and legal professional, who will be able to make recommendations tailored to your specific circumstances.

Edward Jones, it’s employees and financial advisors cannot provide tax or legal advice.